The Ultimate 70-Question FMCG FAQ Guide-1 With Detailed Answers

One of the most competitive, high-volume, and execution-driven industries in the world market is the fast-moving consumer goods (FMCG) sector. Success in FMCG now depends on real-time visibility, sales efficiency, data-driven decision-making, and exceptional field execution rather than just robust products and broad distribution.

This guide answers 70 most commonly asked FMCG questions, covering everything from FMCG basics and distribution models to sales automation, inventory control, credit management, and future trends. Whether you are scaling a brand or optimizing your distribution network, this handbook serves as a practical FMCG knowledge base.

1. What is FMCG?

FMCG (Fast-Moving Consumer Goods) refers to everyday consumer products that sell quickly, are affordably priced, and are purchased frequently. These products are essential to daily life and generate revenue through high sales volume rather than high margins.

In the FMCG business model, success is driven by speed, availability, and execution efficiency, not just by product innovation. Even the best product fails if it is not consistently available at retail outlets.

Key Characteristics of FMCG:

Low unit price: Designed for mass-market affordability

High sales volume: Profitability comes from scale, not margin

Frequent purchase cycle: Daily, weekly, or monthly consumption

Wide distribution reach: Products must be available across thousands of outlets

Fast inventory turnover: Stock moves rapidly through the supply chain

2. Why is the FMCG industry called “fast-moving”?

The FMCG sector is known as "fast-moving" because goods are produced and consumed quickly, frequently in a very short amount of time. These goods need to be constantly restocked because they are quickly consumed.

FMCG products don't require lengthy purchasing decisions, in contrast to durable goods. Customers purchase them due to convenience, necessity, and habit.

What Makes FMCG Products Fast-Moving:

High daily consumption: Items like food, soap, and beverages are used daily

Short shelf life: Especially in food, dairy, and beverages

Frequent retail replenishment: Retailers reorder stock multiple times a month

Impulse-driven purchases: Minimal decision-making involved

Because of this speed, FMCG companies must ensure:

Timely salesman visits

Accurate route and beat planning

Real-time stock and sales visibility

3. What are examples of FMCG products?

FMCG products include a wide range of daily-use consumer goods that are essential, affordable, and frequently purchased. These products require strong shelf presence and consistent replenishment.

Major FMCG Product Categories:

Food & Beverages: Snacks, biscuits, tea, coffee, soft drinks, packaged food

Personal Care: Soap, toothpaste, shampoo, cosmetics

Household Care: Detergents, dishwashing liquids, surface cleaners

Staples: Rice, oil, flour, pulses

Each category involves:

High SKU counts

Large outlet networks

Frequent distributor-to-retailer movement

Managing this complexity requires structured sales processes and real-time field visibility, which is why FMCG brands use platforms like DeltaSales App for outlet management and sales tracking.

4. What is the difference between FMCG and CPG?

Although often used interchangeably, FMCG and CPG are not the same.

Understanding the Difference:

CPG (Consumer Packaged Goods):

Includes all packaged consumer products

Covers both fast- and slow-moving items

FMCG:

A subset of CPG

Focuses on high-frequency, fast-selling essentials

Requires faster sales cycles and tighter execution

For example:

Shampoo → FMCG

Microwave oven → CPG but not FMCG

Because FMCG products sell faster and more frequently, they demand stronger sales automation, tighter distribution control, and faster decision-making.

5. How big is the FMCG market?

The FMCG industry is one of the largest, most stable, and most resilient sectors globally, valued in the trillions of dollars. Unlike cyclical industries, FMCG continues to grow even during economic slowdowns because it caters to essential daily needs such as food, personal care, and household products.

The steady growth of the FMCG market is driven by structural and long-term factors, rather than short-term trends. These drivers ensure consistent demand, repeat purchases, and expansion opportunities across both urban and rural ma+rkets.

Key Drivers of FMCG Market Growth:

Population growth

An increasing population directly expands the FMCG consumer base, leading to higher demand for daily-use products such as food, personal care, and household essentials across all income levels.

Urbanization and rural expansion

Urbanization increases demand for branded and convenience-focused FMCG products, while rural expansion opens new high-volume markets, making wider distribution and deeper outlet coverage essential.

Rising disposable income

Higher disposable income encourages consumers to shift from unbranded to branded products, try premium variants, and increase overall FMCG spending, boosting category and value growth.

Increased demand for packaged goods

Consumers prefer packaged FMCG products due to better hygiene, quality consistency, and longer shelf life, driving faster growth in packaged food, beverages, and household items.

Growth of traditional and modern retail

Expansion of kirana stores and modern retail formats improves product accessibility, increases sales points, and supports higher FMCG consumption across urban and semi-urban markets.

In developing markets, FMCG growth is primarily driven by distribution expansion, making field sales efficiency and distributor performance tracking crucial for sustainable scaling.

6. Which FMCG products sell the most?

The best-selling FMCG products are those that fulfill daily needs and hygiene requirements.

Highest-Selling FMCG Categories:

Food & beverages: Highest consumption frequency

Household cleaning products: Regular replacement cycle

Personal care essentials: Strong repeat purchases

These products succeed because they:

Are used frequently

Have low switching costs

Depend heavily on retail availability

Ensuring these products are always available at outlets requires continuous sales coverage and real-time stock visibility.

7. Why do FMCG products have low margins?

FMCG products operate on thin profit margins per unit due to intense competition and price sensitivity.

Reasons for Low FMCG Margins:

Highly competitive pricing

Multiple substitute brands

Retailer negotiation pressure

Heavy promotions and schemes

To remain profitable, FMCG companies focus on:

High-volume sales

Operational efficiency

Optimized sales routes

Reduced leakage and inefficiencies

Even small gains in productivity enabled through sales automation tools can significantly improve profitability at scale.

8. What makes the FMCG sector competitive?

The FMCG sector is extremely competitive due to low entry barriers, high product similarity, and consumers having numerous choices at every price point.

Factors Driving FMCG Competition:

Numerous brands offering similar products

Many FMCG brands sell nearly identical products, giving consumers multiple alternatives for the same need.Strong price sensitivity

Small price differences can quickly shift consumer preference from one brand to another.High advertising spend

Brands invest heavily in marketing to maintain visibility and recall in crowded markets.Retailer influence on shelf placement

Retailers control shelf space and product visibility, directly impacting sales performance.Low brand switching cost

Consumers can easily switch brands without risk or high effort.

How do winning FMCG brands stay ahead?

Wider distribution reach

Products are available across more outlets, increasing chances of purchase.Superior field execution

Sales teams ensure regular visits, stock availability, and in-store presence.Faster data-driven decisions

Real-time sales data helps brands react quickly to market changes.Stronger retailer relationships

Trust and consistent support improve shelf placement and brand preference.Technology advantage

Sales automation and field tracking tools help FMCG brands execute better and scale faster.

9. How do FMCG companies maintain customer loyalty?

Customer loyalty in FMCG is built through consistency, trust, and availability, not one-time experiences.

Loyalty-Building Factors in FMCG

Consistent product quality

Delivering the same quality every time builds consumer trust and encourages repeat purchases in highly competitive FMCG categories.Strong brand recall

High brand visibility through packaging, advertising, and in-store presence helps consumers recognize and choose the brand instantly.Attractive packaging

Eye-catching, functional packaging improves shelf appeal and influences buying decisions at the point of sale.Promotional offers and schemes

Discounts, bundles, and trade schemes motivate trial purchases and reinforce brand preference among price-sensitive consumers.Reliable availability at retail outlets

Consistent product availability prevents brand switching and ensures consumers can buy the brand whenever they need it.

Behind the scenes, loyalty depends on execution discipline, including regular outlet visits, stock monitoring, and distributor coordination.

10. What influences FMCG consumer behavior?

FMCG consumer behavior is driven by convenience, habit, and trust, rather than extensive evaluation.

Key Factors Influencing FMCG Buying Decisions

Price and affordability

Consumers prefer FMCG products that offer value for money, making competitive pricing critical in price-sensitive markets.Brand familiarity

Trusted and well-known FMCG brands are chosen more often due to perceived quality, reliability, and past experience.Product availability nearby

FMCG purchases are driven by convenience; products that are easily available at nearby retail outlets sell faster.Promotions and discounts

Price-offs, bundle offers, and in-store promotions strongly influence impulse buying and brand switching.Packaging appeal

Attractive and informative packaging improves shelf visibility and helps brands stand out at the point of sale.Ease of access

Products that are easy to find, pick, and purchase increase buying frequency and reduce consumer effort.

Among all factors, availability is the most critical ;if a product is not on the shelf, the consumer immediately switches brands. This makes sales coverage and outlet visibility central to FMCG success.

11. How do FMCG companies design pricing?

FMCG companies design pricing by balancing cost efficiency, competitive positioning, and market affordability. Since FMCG products sell in high volumes with low margins, even small pricing differences can significantly impact sales velocity and market share.

Key Elements of FMCG Pricing Strategy:

Cost structure: Raw materials, manufacturing, packaging, logistics, and distribution costs

Competitive pricing: Benchmarking against similar FMCG brands in the same category

Distributor margin: Ensuring attractive margins to motivate distributor push

Retailer margin: Securing shelf space and visibility at retail outlets

Consumer price sensitivity: Understanding demand elasticity in target markets

Market positioning: Economy, mass, or premium pricing strategy

To manage pricing effectively, FMCG brands rely on SKU-wise sales data, outlet-level performance, and real-time sales reports, which can be monitored using DeltaSales App pricing and sales analytics.

12. What is an SKU?

An SKU (Stock Keeping Unit) is a unique identifier assigned to each specific product variant based on size, flavor, packaging, or formulation. In FMCG, even minor variations create separate SKUs.

Why SKUs Are Critical in FMCG Operations:

Enable SKU-wise sales tracking

Tracking sales at the SKU level helps FMCG companies measure individual product performance using real-time sales dashboards and reports.Improve inventory and replenishment planning

SKU-level visibility allows accurate stock planning, reorder management, and stock-out prevention, supported by inventory and distributor tracking.Support accurate demand forecasting

Historical SKU sales data and seasonal trends improve demand forecasting accuracy, usinganalytics and reporting tools.Identify top-performing and slow-moving variants

SKU-wise performance analysis helps identify fast-moving and slow-moving SKUs, enabling better portfolio optimization and sales strategy adjustments.

For example, a 200 ml beverage and a 500 ml beverage are different SKUs with different demand patterns. DeltaSales App helps FMCG companies track SKU-level sales performance across distributors and retailers in real time.

13. Why do FMCG companies launch new products?

FMCG companies launch new products to capture new consumer needs, respond to market trends, and stay competitive in crowded categories. Innovation is essential to sustain growth and protect market share.

Key Reasons for New Product Launches:

Enter new price points or consumer segments

Address evolving tastes, health, or lifestyle trends

Increase shelf presence and brand visibility

Counter competitor innovations

Drive incremental revenue growth

Successful launches depend on field sales execution, outlet coverage, and distributor readiness, all of which can be tracked using field activity tracking.

14. What is product cannibalization?

Product cannibalization occurs when a newly launched FMCG product reduces the sales of an existing product from the same brand, instead of generating new demand.

Common Causes of Cannibalization:

Similar pricing between old and new products: When prices are close, consumers shift from the old product to the new one.

Overlapping target consumers: Both products appeal to the same customer group, reducing net sales growth.

Weak product differentiation: Lack of clear differences makes the new product a substitute, not an addition.

Poor portfolio planning: Launching products without clear roles leads to internal sales competition.

Controlled cannibalization may be strategic (e.g., shifting consumers to premium variants), but uncontrolled cannibalization hurts profitability.

15. Why is packaging important in FMCG?

Packaging is a critical success factor in FMCG because it directly influences product protection, brand perception, and purchase decisions at the retail shelf.

Importance of Packaging in FMCG:

Protects product quality and shelf life

Communicates brand value and product information

Enhances shelf visibility and differentiation

Encourages impulse buying

Improves convenience and usability

Even the best product fails without effective packaging. FMCG brands track in-store execution and retailer feedback using outlet visit and merchandising tracking features.

16. Why do FMCG companies spend so much on marketing?

FMCG companies invest heavily in marketing to build brand recall, influence buying decisions, and maintain visibility in highly competitive markets.

Objectives of FMCG Marketing Spend:

Increase brand awareness

Support new product launches

Drive trial and repeat purchases

Reinforce brand trust

Gain retailer confidence

Marketing effectiveness improves when linked with actual sales performance and outlet-level data, which can be analyzed using promotion tracking and sales analytics.

17. How is demand forecasted in FMCG?

Demand forecasting in FMCG involves predicting future sales to ensure optimal production, inventory control, and distribution planning.

Inputs Used in FMCG Demand Forecasting:

Historical sales data: Past sales figures help predict future demand and buying patterns.

Seasonal demand patterns: Certain FMCG products sell more during specific seasons or festivals.

Market and consumption trends: Changing consumer preferences influence which products gain or lose demand.

Promotion and scheme impact: Discounts and offers temporarily increase sales volumes.

Distributor and retailer order behavior: Ordering patterns indicate real demand and stocking requirements.

18. What is the FMCG product lifecycle?

The FMCG product lifecycle describes how a product performs over time, guiding pricing, marketing, and distribution decisions.

Stages of the FMCG Product Lifecycle:

Introduction: Low sales, high marketing and trade investment

Growth: Rapid sales expansion and distribution widening

Maturity: Stable demand with intense competition

Decline: Falling sales and reduced profitability

19. How do FMCG companies ensure product quality?

Product quality is vital in FMCG because even minor quality issues can damage brand trust and customer loyalty.

Quality Assurance Practices in FMCG:

Quality control checks at every production stage

Supplier audits and raw material testing

Compliance with manufacturing standards

Regular internal and external audits

Batch-level traceability and documentation

Field feedback and retailer complaints can be logged and tracked using DeltaSales App retailer interaction and feedback modules.

20. What certifications are required for FMCG products?

Certifications ensure regulatory compliance, food safety, and quality assurance, and vary by product category and region.

Common FMCG Certifications:

FSSAI: Mandatory for food and beverages

ISO: Quality management systems

HACCP: Food safety and hazard control

GMP: Good manufacturing practices

21. What is FMCG distribution?

FMCG distribution is the structured system that ensures fast-moving consumer goods move efficiently from the manufacturer to the end consumer. Because FMCG products have high purchase frequency and low shelf tolerance, distribution focuses on speed, reach, and continuous availability.

An effective FMCG distribution network ensures products are stocked across thousands of retail outlets without interruption. Weak distribution leads to stock-outs, lost sales, and reduced brand trust. For this reason, distribution is considered a core competitive advantage in the FMCG industry.

22. What is the typical distribution chain?

The typical FMCG distribution chain is designed to balance scale, cost, and last-mile efficiency. It usually follows this structure:

Company → Super Stockist → Distributor → Retailer → Consumer.

Bulk storage, regional supply, local delivery, and final sale all have distinct functions. FMCG businesses can enter deep markets with this tiered approach while still keeping cost effectiveness and operational control.

23. Who is a super stockist?

A super stockist is a sizable wholesale partner that FMCG companies designate to oversee bulk inventory for a broad geographic area. Super stockists purchase products directly from the business and distribute them to several distributors.

In high-volume markets where direct company-to-distributor supply would be ineffective, their function is crucial. Super stockists facilitate quicker distributor replenishment, stabilize inventory availability, and shorten lead times.

24. What is the role of a distributor?

At the local level, distributors are in charge of carrying out FMCG sales and distribution. Stocking products, selling to retailers, delivering goods, collecting payments, and ensuring steady market coverage are their main responsibilities.

Additionally, distributors oversee local market execution, retailer relationships, and sales routes. In the designated territory, their performance has a direct effect on brand availability, visibility, and revenue generation.

25. How do distributors earn money?

Distributors earn income mainly through trade margins offered on each product sold. In addition to margins, they may receive monthly schemes, performance bonuses, and volume-based incentives.

Distributor profitability depends on sales volume, cost control, delivery efficiency, and working capital management. Higher coverage and faster inventory rotation typically lead to better earnings.

26. What are typical distributor margins?

Distributor margins in FMCG generally range between 4% and 25%, depending on product category, brand strength, and market competition.

Staple food products usually have lower margins but high volume, while personal care and specialty products offer higher margins. Companies must design margin structures that keep distributors motivated while remaining commercially viable.

27. Why do companies appoint multiple distributors?

FMCG companies appoint multiple distributors to expand market reach, improve service levels, and reduce operational risk. Multiple distributors allow faster delivery, better territorial focus, and reduced dependency on a single partner.

This approach is especially important in large, diverse markets where consumer demand and retail density vary significantly.

28. How do distributors expand their network?

Distributors expand their network by increasing outlet coverage, adding new sales routes, expanding SKU availability, and improving service consistency.

Growth also comes from entering new localities, onboarding additional retailers, and increasing order frequency at existing outlets. Structured expansion helps distributors grow sustainably while supporting brand penetration.

29. What logistics challenges do distributors face?

FMCG distributors face multiple logistics challenges that directly impact delivery efficiency, cost control, and retailer satisfaction. Common challenges include:

Stock damage during transportation

Poor handling, long transit times, and inadequate packaging often lead to product damage and losses.Delivery delays

Traffic congestion, inefficient route planning, and last-minute order changes delay retailer servicing.Rising fuel and transportation costs

Increasing fuel prices significantly affect distributor margins and delivery economics.Inaccurate demand forecasting

Poor forecasting leads to overstocking or stock-outs, disrupting supply continuity.Limited visibility into stock movement

Lack of real-time tracking makes it difficult to manage inventory and deliveries efficiently.

Addressing these challenges requires structured logistics planning, optimized routing, and better coordination across the distribution network.

30. How important is geography?

Geography is extremely important in FMCG distribution because distance directly affects delivery time, transportation costs, and service frequency. Urban markets require fast and frequent deliveries, while rural markets demand wider coverage with optimized routes.

Understanding geographic conditions helps FMCG companies and distributors design efficient distribution strategies and ensure consistent product availability across all regions.

31. What does an FMCG salesman do?

An FMCG salesman is responsible for executing sales activities at the retail level and ensuring consistent product availability in the market.

Key responsibilities include:

Retailer visits : Servicing assigned outlets regularly

Order collection : Booking orders based on stock and demand

New product push: Introducing and promoting new SKUs

Payment collection: Ensuring timely collections

Coverage expansion: Adding new outlets to the beat

Field productivity improves when these activities are supported by sales force automation (SFA) tools and real-time field reporting systems like those used in DeltaSales App.

32. How do companies monitor field teams?

FMCG companies monitor field teams to ensure discipline, coverage, and productivity.

Common monitoring methods include:

SFA apps: Track daily sales activities digitally

GPS tracking: Verify market visits and movement

Beat plans : Ensure planned outlet coverage

Daily reports : Analyze performance and gaps

Digital field tracking platforms, such as provide real-time visibility and reduce manual reporting errors.

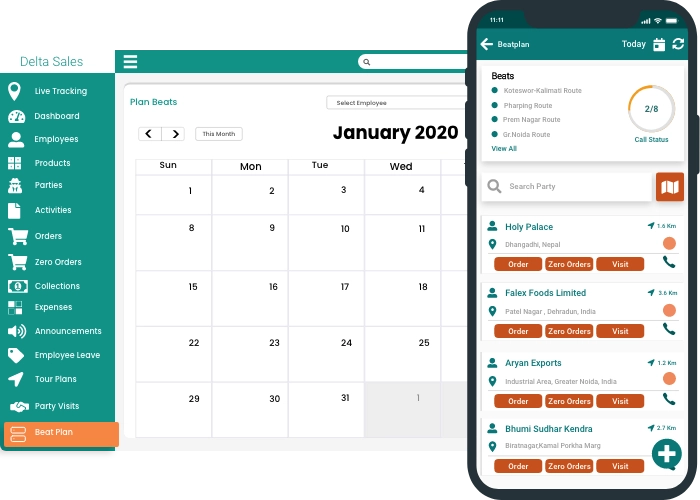

33. What is beat planning?

Beat planning is a structured daily route plan that defines which retailers a salesman must visit on a given day.

Why beat planning matters:

Ensures outlet coverage: No store is missed

Reduces travel time : Optimized routes

Improves productivity: More productive calls per day

Modern FMCG companies rely on digital beat planning and route optimization tools to manage large sales teams efficiently.

34. Why do salesmen skip outlets?

The main reasons salespeople skip outlets are low motivation, ineffective beat planning, and inadequate field monitoring. Missed visits are frequently caused by lengthy or impractical routes, inadequate supervision, and low retailer demand. Outlet skipping increases in frequency without adequate tracking and accountability, which lowers market coverage and sales consistency.

Common reasons include:

Poor tracking: No real-time supervision

Long or overloaded beats: Unrealistic daily routes

Low retailer demand: Reduced motivation

Lack of supervision: Weak accountability

GPS-enabled SFA systems help reduce outlet skipping by improving transparency and accountability.

35. How do companies ensure coverage?

By enforcing organized beat plans, routinely monitoring field activity, and tracking attendance, businesses guarantee coverage. Missed stores can be avoided and market reach can be increased with clear routes, daily goals, and visibility into outlet visits.

Companies ensure coverage through:

Strict beat plans: Defined daily routes

Digital attendance logs: Track working hours

Live field tracking: Verify outlet visits

Coverage tracking through field sales management software improves market reach and reduces missed sales opportunities.

36. How are FMCG salesmen incentivized?

Sales targets, commissions based on performance, and rewards based on SKUs or ranges are used to motivate FMCG salespeople. Incentive programs that are well-designed encourage increased output and reliable field performance.

Common incentive structures include:

Sales targets: Volume or value-based goals

Slab-based commissions: Higher sales, higher earnings

Range selling rewards: Incentives for selling more SKUs

37. What is digital order-taking?

Digital order-taking is the process of capturing retailer orders through mobile applications instead of paper, improving speed, accuracy, and real-time visibility of sales data.

Key benefits include:

Faster order processing: Reduced errors

Real-time order sync : Instant visibility

Accurate SKU-level data: Better forecasting

38. What KPIs should be tracked?

Tracking the right KPIs helps FMCG companies evaluate salesman performance objectively.

Key FMCG sales KPIs include:

Coverage – Outlets visited vs planned

Order value – Average bill value

Range selling – SKUs sold per outlet

Productivity – Orders per day

Call rate – Calls made vs effective calls

Strike rate – Orders booked vs visits

KPI dashboards in sales analytics platforms help managers take data-driven decisions.

39. Why do some salesmen outperform others?

Top-performing salesmen differ in mindset and execution quality.

Key success factors include:

Discipline : Consistent route execution

Territory knowledge: Understanding local demand

Retailer relationships: Trust-based selling

Strong habits: Regular follow-ups and reporting

Performance visibility through field sales tracking systems reinforces good selling behaviors.

40. How to improve salesman productivity?

Improving productivity requires a mix of process, technology, and training.

Effective productivity improvement methods include:

Automation: Reduce manual tasks

Sales training: Improve product knowledge

Route optimization: Minimize travel time

Real-time tracking : Improve accountability

Field productivity increases significantly when FMCG teams use integrated SFA and sales performance tools

41. Why do retailers prefer certain distributors?

Distributors who facilitate and increase the profitability of their business are preferred by retailers. Reliability and relationship quality are more important than brand promises because retailers have narrow profit margins and quick turnover.

Key reasons retailers favor specific distributors include

Fast delivery: Ensures shelves never stay empty

Good credit terms: Reduces cash flow pressure

Consistent supply: Builds trust and repeat ordering

Friendly salesman: Improves communication and problem resolution

Distributors who combine service efficiency with strong field execution earn long-term retailer loyalty and higher order frequency.

42. What are retailer margins?

Retailer margins are the percentage of profit retailers earn on selling FMCG products. These margins typically range between 10% and 25%, depending on the product category, brand strength, and competition.

Staples and essentials: Lower margins, higher volume

Personal care and impulse items: Higher margins

New or less-known brands: often higher margins to attract retailers

Margin structure directly influences which brands retailers actively promote at the point of sale.

43. What is a planogram?

A planogram is a graphic representation of how merchandise should be placed on store shelves to optimize visibility and sales. Product placement is determined by factors such as size, category, brand priority, and consumer purchasing patterns.

Benefits of using planograms include:

Improved shelf visibility : Products are easier to notice

Better brand blocking: Stronger visual impact

Higher impulse purchases: Especially for FMCG items

44. What is a retail audit?

A retail audit is a systematic check conducted at retail outlets to evaluate brand performance and in-store execution. It helps companies understand ground reality beyond sales numbers.

A retail audit typically checks:

Product availability : Are SKUs in stock?

Shelf visibility: Is the product properly displayed?

Competitor presence : What alternatives are visible?

Retail audits support better merchandising decisions, distribution corrections, and competitive strategy planning.

45. How is shelf placement decided?

Shelf placement is decided through a mix of commercial negotiation and market power. Since shelf space is limited, brands compete aggressively for eye-level and high-traffic positions.

Key factors influencing shelf placement:

Trade payments or fees: Paid shelf rentals or incentives

Negotiation strength : Distributor–retailer relationships

Brand strength : Consumer pull and recognition

Sales velocity : Faster-selling products get better space

Strong brands with high turnover naturally command premium shelf positions.

46. What are retailer schemes?

Retailer schemes are trade promotions offered to retailers to encourage stocking, displaying, or active selling of products. These schemes improve short-term sales momentum and shelf visibility.

Common retailer schemes include:

Extra margin or discounts : better profitability

Free goods : Buy-more-get-more offers

Display incentives : Rewards for better visibility

Retailer schemes are a critical tool for driving distribution expansion and new product adoption.

47. Why do retailers refuse products?

When retailers perceive low profitability or high risk, they reject FMCG products. Slow-moving items obstruct cash flow, and shelf space is valuable.

Common reasons for refusal include:

Low margin: Not worth the effort

Slow-moving products : Risk of dead stock

Strong competitor dominance : limited chance of sale

Past bad experience : Supply or service issues

Understanding retailer objections helps brands refine pricing, schemes, and distribution strategy.

48. What is range selling?

Range selling is the practice of selling multiple SKUs or variants of a brand to a retailer instead of just one product. It increases brand presence and total sales per outlet.

Benefits of range selling include:

Higher order value : More items per invoice

Better shelf presence : Increased brand visibility

Lower competition impact : The brand occupies more space

Sales teams that focus on range selling achieve stronger outlet-level performance.

49. What is fill rate?

The percentage of retailer orders that are fully fulfilled without stock-outs is known as the fill rate. It is a crucial measure of distributor and supply chain effectiveness.

High fill rate : Reliable supply and satisfied retailers

Low fill rate : Lost sales and reduced trust

Improving fill rate requires accurate forecasting, inventory planning, and efficient delivery execution.

50. How do companies reduce retailer complaints?

Long-term market stability and distributor credibility depend on lowering retailer complaints. The majority of complaints are not about the quality of the product, but rather about poor service.

Effective ways to reduce complaints include:

Faster service response : Quick issue resolution

Replacement of damaged goods : Builds confidence

Consistent availability : Prevents lost sales

Companies that prioritize retailer satisfaction enjoy stronger relationships, better shelf space, and higher repeat orders.

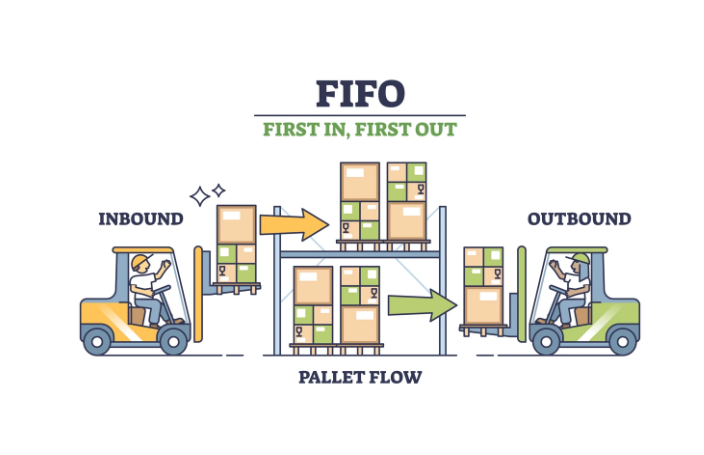

51. How do distributors manage inventory?

Distributors control inventory to prevent excess stock and expiry losses while guaranteeing a steady supply. Working capital, storage capacity, and sales demand are all balanced by efficient inventory management.

Common inventory management practices include:

- FIFO method: Selling older stock first

- Regular stock audits: Verifying physical vs book stock

- Order planning: Aligning purchases with sales velocity

- Expiry tracking: Monitoring near-expiry SKUs

Structured inventory processes reduce stock-outs, dead stock, and capital blockage.

52. What causes dead stock?

Dead stock is inventory that has not moved in a long time and ties up capital. It has a direct impact on distributor profitability.

Major causes of dead stock include:

- Over-purchasing: Buying beyond actual demand

- Weak market demand: Low consumer acceptance

- Poor forecasting : Incorrect demand estimation

Dead stock increases storage costs and often results in heavy discounting or write-offs.

53. What is stock rotation?

Stock rotation is the practice of selling older inventory before newer stock. It is critical in FMCG due to the short shelf life and expiry-sensitive products.

Why stock rotation matters:

- Reduces expiry losses: Prevents outdated stock

- Maintains product quality: Fresh stock reaches retailers

- Improves inventory turnover: Faster stock movement

Effective rotation protects margins and retailer trust.

54. Why does expiry increase?

Expiry rates rise when inventory is not properly monitored or rotated. This is a common issue in the distribution of FMCG products.

Key reasons for high expiry include:

Slow-moving SKUs : Low consumer demand

Lack of FIFO discipline: New stock sold first

No regular monitoring : Expiry dates ignored

Expiry-related losses can significantly erode distributor and company profitability.

55. How to reduce damages?

Product damage during storage and handling leads to financial losses and retailer dissatisfaction.

Ways to reduce damages include:

Good storage conditions: Clean, dry, ventilated warehouses

Proper stacking: Avoiding pressure and collapse

Careful handling : During loading and unloading

Damage control improves stock quality and reduces replacement costs.

56. What is FIFO?

FIFO stands for First In, First Out, an inventory management method where the oldest stock is sold or dispatched first.

FIFO benefits include:

Lower expiry risk : Older stock clears faster

Accurate stock valuation: Reflects real inventory age

Better inventory discipline : Systematic stock flow

FIFO is essential for all expiry-driven FMCG categories.

57. How do stockists calculate replenishment?

Stockists calculate replenishment to maintain optimal stock levels while avoiding overbuying. Data informs replenishment decisions.

Replenishment is based on:

Secondary sales: Actual sales to retailers

Closing stock: Current inventory position

Lead time : Time taken for new stock to arrive

Accurate replenishment prevents stock-outs while controlling working capital.

58. What is a warehouse audit?

A warehouse audit is a thorough examination of inventory accuracy, storage conditions, and operational procedures.

A warehouse audit checks:

Stock accuracy: Physical vs recorded stock

Storage conditions: Hygiene and safety

Process compliance: FIFO, stacking, labeling

Regular audits reduce leakage, damage, and inventory mismatch.

59. What causes stock mismatch?

Stock mismatch happens when physical stock does not match system records, resulting in losses and reporting errors.

Common causes include:

Manual data entry errors: Incorrect recording

Leakage or pilferage : Unauthorized stock movement

Poor tracking systems : Lack of real-time updates

Accurate tracking and disciplined processes are essential to control mismatch.

60. How are product recalls handled?

Product recalls are initiated when a product fails to meet quality or regulatory standards. They must be addressed quickly and methodically.

The typical recall process includes

Immediate communication: Inform distributors and retailers

Product collection : Remove affected stock from the market

Segregation and destruction: as per legal guidelines

Efficient recall handling protects consumer safety and brand reputation.

61. What are primary sales?

Primary sales are sales made by the company to its distributors. This is the first level of revenue recognition for FMCG companies, and it indicates how much stock is moved into the distribution network.

Distributors' stocking capacity, schemes, and market expansion plans all have an impact on primary sales. However, they do not always accurately reflect real consumer demand, necessitating more detailed sales tracking.

62. What are secondary sales?

Secondary sales are sales made by distributors to retailers. This level of sales reflects actual market movement and is a more accurate indicator of demand.

Secondary sales data helps companies understand outlet-level performance, distributor efficiency, and SKU movement. Features like secondary sales tracking, outlet-wise reporting, and distributor performance dashboards play a key role in analyzing this layer.

63. What are tertiary sales?

Tertiary sales are those made by retailers directly to consumers. This is the final stage of consumption, which reflects actual consumer demand.

Pricing, shelf visibility, promotions, and availability all have an impact on tertiary sales. While tertiary sales trends are more difficult to track directly, retail audits and market studies can help estimate them.

64. Why track secondary sales?

Tracking secondary sales provides actionable insights into real market demand and supply efficiency.

Key benefits of secondary sales tracking include:

Better demand forecasting: Aligns supply with actual consumption

Stock-out reduction: Identifies low-availability areas early

Distributor performance visibility: Measures execution quality

Real-time secondary sales visibility enables smarter planning and reduces dependency on primary sales alone.

65. What is PJP?

PJP stands for Permanent Journey Plan, a fixed weekly or monthly route plan assigned to field sales representatives. It defines which outlets must be visited on specific days.

Why PJP is important:

Ensures consistent outlet visits: No store is missed

Improves time management: Structured daily routes

Increases coverage efficiency : Balanced workload

Digital PJP execution supported by beat planning and route adherence tracking improves field discipline and productivity.

66. What is outlet coverage?

Outlet coverage is the number of retail outlets visited by a salesperson within a given territory and time period. It is an essential metric for assessing market reach and execution quality.

Increased outlet coverage enhances brand availability, visibility, and sales opportunities. Geo-tagged visits and outlet mapping features help to track coverage and improve reporting accuracy.

67. What affects order frequency?

Order frequency determines how often retailers place orders and directly impacts sales consistency.

Key factors affecting order frequency include:

Market demand : Consumer pull for the product

Schemes and offers: Temporary purchase incentives

Seasonality: Festive or climate-driven demand

Salesman visit consistency: Regular engagement builds trust

Tracking visit frequency and order patterns helps optimize sales cycles.

68. What is a productivity report?

A productivity report evaluates the effectiveness of a salesperson's daily activities. It enables managers to compare output to effort.

A typical productivity report includes:

Outlets visited: Coverage achieved

Orders booked: Selling effectiveness

Order value: Revenue contribution

Time spent in market: Field efficiency

Automated productivity reports generated from field activity tracking and sales analytics features enable data-driven performance reviews.

69. How do schemes impact sales?

Schemes are short-term trade promotions designed to influence buying behavior and improve sales momentum.

Schemes impact sales by:

Increasing order quantity : Bulk purchases by retailers

Pushing slow-moving SKUs : Clearing aged inventory

Improving shelf visibility: Higher stock presence

Scheme effectiveness can be measured through pre- and post-scheme sales analysis.

70. How is market share measured?

Market share compares a brand's sales to the total category sales in a market. It reflects competitive strength and brand positioning.

Market share is measured using:

Sales data analysis (primary & secondary sales trends):

Studying company-to-distributor and distributor-to-retailer sales helps understand demand movement, distributor performance, and whether products are actually selling in the market.Retail audits (shelf presence & competitor visibility):

Regular store checks show how well products are displayed, whether shelves are stocked, and how competitors are positioned compared to your brand.Category-level comparisons (brand vs. market performance):

Comparing a brand’s sales with total category sales reveals market share, growth gaps, and competitive strength within the FMCG category.

Accurate market share assessment supports strategic decisions on pricing, promotions, and distribution expansion.

Conclusion

The FMCG industry values speed, availability, discipline, and execution excellence. From understanding fundamental FMCG concepts to mastering distribution, sales force management, inventory control, credit discipline, and growth strategy, success is determined by how well theory is translated into practical application on a daily basis.

Visibility, control, and data-driven decisions are now the driving forces behind growth, not just effort. Manual processes, delayed reporting, and guesswork result in leaks that modern FMCG companies cannot afford.

Adopting the right sales automation platform is critical for strengthening distributor performance, improving retail execution, reducing operational leakage, and confidently scaling your FMCG business.

The DeltaSales App provides FMCG companies and distributors with real-time visibility into field sales, outlet coverage, secondary sales, and team performance, without adding complexity to daily operations.