Why Integration Between Sales and Accounting Software Is a Game-Changer

In today’s fast-paced business environment, efficiency and accuracy are critical to staying competitive. Companies, especially those with dynamic sales teams and complex financial operations, are constantly looking for ways to streamline their processes. One of the most impactful advancements has been the integration between sales and accounting software. This integration is not just a technical upgrade it is a true game-changer that transforms how businesses operate, drive revenue, and manage finances.

In this blog, we’ll explore why this integration matters, what benefits it brings, and how it can reshape your business operations.

What Does Integration Between Sales and Accounting Software Mean?

Simply put, integration refers to the connection and communication between sales software (used for managing leads, customer interactions, orders, and sales pipelines) and accounting software (used to track finances, expenses, invoices, and payments). When these systems talk to each other seamlessly, data flows automatically, reducing the need for manual entry and improving accuracy.

For instance, when a sales rep closes a deal, the order details automatically appear in the accounting system for billing and financial tracking. This reduces delays and errors that usually occur with manual data transfer.

Why Was Integration So Difficult Before?

Traditionally, sales and accounting teams worked in silos. Salespeople would record orders and send paperwork or spreadsheets to accounting, which then had to manually input data into their financial systems. This process was prone to errors, delays, and miscommunications.

Without integration:

-

Sales teams lacked real-time visibility into payment status: Sales reps couldn’t track if customers had paid, leading to uncertainty and difficulties in managing follow-ups or closing deals efficiently.

-

Accounting teams struggled with delayed invoicing and cash flow tracking: Manual data entry caused invoicing delays and made it hard for finance to monitor cash flow and manage finances accurately.

-

Reporting became fragmented, making it hard for management to get a clear picture: Without unified data, generating comprehensive reports was challenging, limiting leadership’s ability to make informed decisions.

This disconnect slowed business processes and led to missed opportunities.

Benefits of Integrating Sales and Accounting Software

-

Improved Data Accuracy and Reduced Manual Errors

When sales and accounting software are integrated, the need for manual data entry is drastically reduced. This minimizes human error such as incorrect invoice amounts, missed orders, or duplicated entries that can lead to financial discrepancies or customer dissatisfaction.

-

Faster Billing and Cash Flow Management

One of the biggest benefits of integration is speeding up the billing process. Once a sale is confirmed, invoices can be automatically generated and sent to customers. This reduces the time between sale and payment, which improves cash flow critical for any business's survival and growth.

Real-time reporting syncing of sales data with accounting systems also allows finance teams to monitor outstanding payments and follow up promptly, reducing overdue invoices and improving collections.

-

Enhanced Sales and Financial Reporting

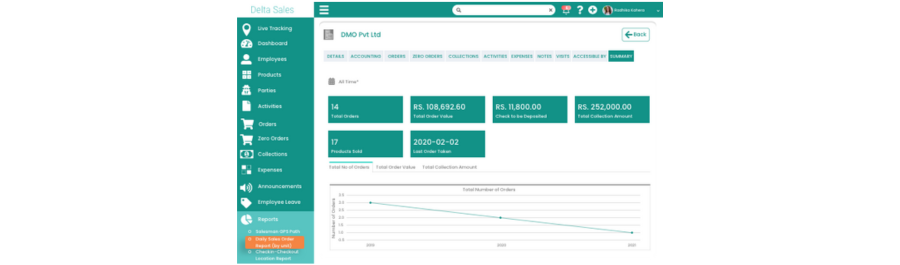

When sales and accounting systems work together, businesses can generate comprehensive reports combining sales performance with financial metrics. This unified data helps in better forecasting, budgeting, and decision-making.

For example, managers can see not only how many deals were closed but also the revenue recognized, expenses incurred, and profit margins all in one dashboard.

-

Better Collaboration Between Sales and Finance Teams

Integration bridges the gap between sales and accounting departments. When both teams have access to the same accurate data, collaboration improves significantly. Sales reps can check payment statuses and outstanding invoices without constantly contacting finance, and accountants can verify sales details without needing to chase down information.

Such collaboration leads to faster problem resolution and smoother workflows.

-

Streamlined Expense Management

Field sales management teams often incur expenses that need to be tracked and reimbursed. Integration allows sales reps to submit expense reports directly through their sales software, which then automatically syncs with the accounting system. This ensures expenses are categorized correctly, approved faster, and reflected in financial statements without delay.

How Integration Supports Scalability and Growth

As businesses grow, manual processes that once worked become inefficient bottlenecks. The volume of sales transactions and financial data increases, making errors and delays more costly.

Integrating sales and accounting software sets a foundation for scalability by automating routine tasks and ensuring data accuracy. It allows teams to focus on strategic activities like customer engagement and financial planning rather than repetitive manual work.

Moreover, real-time insights from integrated systems empower leadership to make informed decisions quickly whether that’s investing in new sales initiatives or optimizing operational costs.

Key Features to Look for in Integration

Not all integrations are created equal. To truly leverage the benefits, businesses should look for:

-

Real-Time Syncing: Data should update instantly between sales and accounting systems to reflect the latest transactions.

-

User-Friendly Interface: Both sales and finance teams should find it easy to navigate and access relevant information.

-

Comprehensive Reporting: The ability to generate detailed, customizable reports combining sales and financial data.

-

Expense Management: Seamless tracking and approval of sales team expenses integrated into the accounting workflow.

-

Security and Compliance: Ensuring sensitive financial and customer data are protected according to industry standards.

Common Challenges in Integration and How to Overcome Them

Even though integration brings many benefits, there can be hurdles:

-

Data Compatibility: Different software may use different data formats, causing syncing issues.

-

Implementation Time: Setting up integrations can take time and require IT support.

-

User Adoption: Teams must learn new workflows and trust the integrated system.

To overcome these challenges:

-

Choose software solutions known for their compatibility and robust APIs.

-

Plan the integration process carefully, involving both sales and finance teams.

-

Provide training and support to ensure smooth adoption.

Many businesses find that the long-term gains far outweigh the initial efforts.

Real-World Impact of Sales and Accounting Software Integration

Companies across industries are already reaping the benefits:

-

Faster deal closures and billing cycles

Integration automates data flow, speeding up sales processing and invoicing, which helps close deals faster and accelerates cash collection.

-

Reduced administrative overhead

Automation cuts down manual tasks like data entry and paperwork, freeing teams to focus on higher-value activities instead of routine admin work.

-

Enhanced visibility into sales performance and financial health

Unified data provides real-time insights into sales results and financial status, helping management make smarter, faster business decisions.

-

Improved customer satisfaction due to accurate invoicing and timely payments

Accurate, automated invoicing reduces billing errors and delays, leading to smoother transactions and happier customers.

![]()

In sectors where field sales are prominent, real-time field sales employee location tracking and expense management combined with accounting integration enhance team productivity and cost control.

Conclusion

Integrating sales and accounting software is more than just a tech upgrade, it's a strategic move that can revolutionize your business operations. It leads to higher data accuracy, faster cash flow, better reporting, and improved collaboration between teams.

If your sales and finance processes still operate in isolation, it’s time to consider integrating them. Doing so will not only reduce errors and save time but also provide the insights and agility necessary for sustained growth.

For businesses looking for a robust solution that brings these capabilities together, Delta Sales App offers powerful tools that support seamless sales and accounting workflows. With features like real-time syncing, expense management, and detailed reporting, it’s designed to empower sales teams and finance departments alike.

Ready to transform your sales and accounting processes?

Experience how seamless integration can boost accuracy, speed up billing, and improve collaboration all in one powerful platform.

Book a Free Demo of Delta Sales App Today and see the game-changing difference for your business!