Top FMCG Industry Questions Answered: The Complete Guide for 2026

The FMCG (Fast-Moving Consumer Goods) industry is one of the most dynamic, competitive, and fast-growing sectors worldwide. In 2026, it is shaped by digital transformation, changing consumer preferences, sustainability, and tech-enabled supply chains. Entrepreneurs, distributors, and professionals entering this space often ask similar questions about operations, growth, margins, technology, and trends.

This guide answers the most common questions with clarity, actionable insights, and expert perspective.

1. What is the FMCG industry and how does it work?

The Fast-Moving Consumer Goods sector involves goods bought often by purchasers at modest costs, like shelf-stable edibles, drinks, toiletries, household cleaners, and non-prescription remedies. These are staple items, resulting in substantial need, rapid usage, and regular restocking. The arena features worldwide heavyweights such as Unilever, Nestlé, and Coca-Cola, in addition to area-specific and smaller firms.

The Fast-Moving Consumer Goods sector functions via a high-volume, slim-margin structure, depending on quick stock movement and broad sales channels. Goods progress from producers to master agents, then to wholesalers, shops, and finally, the end-user. Achievement hinges on streamlined logistics, maintaining stock levels, promotional efforts, cost-setting, and brand recognition. By 2026, machine learning for predicting demand, optimizing delivery paths, and online sales systems boost performance and lessen shortages.

2. Why is FMCG considered a high-volume, low-margin business?

The FMCG (Fast-Moving Consumer Goods) sector thrives by moving vast volumes of inexpensive items to achieve significant income, given the slim profit made on each sale. This business structure succeeds due to steady consumer need and quick product rotation, enabling firms to grow operations efficiently while staying visible in the marketplace.

Core factors:

Minimal Unit Cost & Regular Buying: Basic necessities such as food and personal care items are cheap and purchased frequently, resulting in tight per-item earnings.

Robust Consumer Need: The nature of daily essentials guarantees steady purchasing and fast stock depletion.

Fierce Rivalry: Numerous comparable offerings compel businesses to keep pricing low to secure a larger portion of sales.

Streamlined Distribution Network: Effective logistics and mechanized processes are vital for swiftly handling large quantities and trimming expenses.

Promotional & Packaging Outlay: Significant spending on advertising and presentation builds customer allegiance, further reducing net profits.

Even though the profit per item is small, selling millions of units ensures significant overall revenue and steady profitability.

3. What are examples of FMCG companies?

Companies in the Fast-Moving Consumer Goods (FMCG) sector produce items people utilize daily and buy again often. This covers things like edibles, drinks, grooming essentials, personal hygiene products, and household cleaners. The industry sees intense rivalry, prompting firms to emphasize broad market reach, powerful brand recognition, and novel product development to maintain their edge.

Leading worldwide corporations feature Unilever, Nestlé, P&G, Coca-Cola, PepsiCo, Mondelez, L'Oréal, Kimberly-Clark, and Danone, all providing a vast array of well-liked goods that command significant retail space and consumer preference.

Worldwide FMCG Leaders & Famous Labels:

Unilever: Dove, Lipton, Knorr, Ben & Jerry’s

Nestlé: Nescafé, KitKat, Maggi, Nespresso

P&G: Gillette, Pampers, Tide, Head & Shoulders

Coca-Cola: Coca-Cola, Fanta, Sprite, Minute Maid

PepsiCo: Pepsi, Lay’s, Gatorade, Quaker

Mondelez: Oreo, Cadbury, Ritz

L’Oréal: L’Oréal Paris, Garnier, Maybelline

Kimberly-Clark: Huggies, Kleenex, Kotex

Danone: Activia, Evian, Alpro

Prominent Indian FMCG Entities:

Hindustan Unilever (HUL), Dabur, ITC, Britannia, Marico, Godrej Consumer Products, Colgate-Palmolive India

These organizations form the core of the FMCG landscape, integrating robust product offerings, advancements, and vast supply chains to satisfy the continually increasing demands of buyers everywhere.

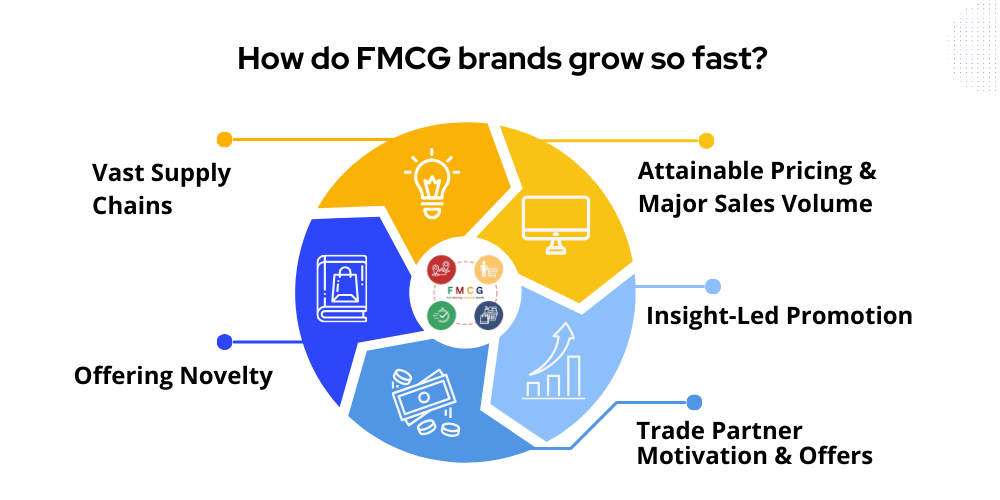

4. How do FMCG brands grow so fast?

Fast-moving consumer goods companies drive swift expansion by integrating broad availability, market-appropriate pricing, novel offerings, and impactful advertising. Within this fiercely contested landscape, the capacity to swiftly adjust to shifting shopper tastes and use technology like AI-powered metrics, online sales platforms, and digital outreach is vital for efficient scaling.

Core approaches involve:

Vast Supply Chains: Making sure goods are present across the greatest number of physical stores and digital venues.

Attainable Pricing & Major Sales Volume: Offering budget-friendly items in significant amounts to capture the widest customer base.

Offering Novelty: Consistently introducing fresh items or enhancing current ones to satisfy evolving shopper needs.

Insight-Led Promotion: Employing customer understanding and integrated channel efforts to connect with the desired demographic successfully.

Trade Partner Motivation & Offers: Prompting retailers to feature their goods prominently via special arrangements, price reductions, and push activities.

Through the synergy of these methods, FMCG enterprises can grow quickly while sustaining robust customer allegiance and market footing.

5. What are the latest trends in the FMCG industry?

By keeping pace with these developments, companies in the fast-moving consumer goods sector can offer products that support better health, provide ease of access, and reflect ethical considerations, all while remaining competitive and technologically advanced in a market that changes quickly.

As we look toward 2026, the FMCG environment is being shaped by advances in digital tools, a greater emphasis on health, and heightened ecological awareness. Firms are employing elements such as artificial intelligence, data intelligence, e-commerce, and direct consumer touchpoints to foresee demands, customize offers, and optimize their supply chains. Increased automation and networked hardware are improving efficiency throughout production and product delivery.

Consumers increasingly favor products that are whole, unadulterated, and provide distinct wellness advantages, alongside convenient choices like ready-to-eat meals and recurring delivery services. Furthermore, there's a noticeable move towards premium items, as buyers are willing to invest more for top-tier quality and unique purchase journeys. Planet stewardship is also a crucial driver, with eco-friendly packaging, responsibly sourced components, and transparent operations influencing buying decisions.

By staying attuned to these movements, firms in the fast-moving consumer goods realm can deliver offerings that promote healthier lifestyles, deliver convenience, and align with ethical values, all while maintaining an edge and technological relevance in a rapidly evolving marketplace.

6. What is the average margin in FMCG distribution?

Distributor earnings within the Fast-Moving Consumer Goods (FMCG) sector are usually narrow yet capable of expansion, frequently sitting between 5% and 12%, occasionally reaching as high as 15% for specialized or recently launched goods. Commonly sought-after products often carry reduced margins due to retailer eagerness to carry them, whereas up-and-coming labels provide greater margins to encourage stocking. Total profitability is derived from sales volume, streamlined processes, and astute handling of the supply chain.

Margin Overview:

Standard FMCG: 5% – 12%

Reduced Range: 3% – 10% (very popular, well-known brands)

Enhanced Range: Up to 15% (novel introductions or specialized items)

FMCG distribution profitability is shaped by factors like consumer appetite, brand recognition, the product type, and overheads. Items with strong demand permit smaller profit percentages, whereas newer or specialized brands necessitate greater inducement. Superior or specialty segments typically generate improved margins compared to conventional FMCG merchandise. Operational expenditures such as transportation, personnel wages, and administrative overhead also reduce the final take, underscoring the importance of efficiency for achieving success.

7. How do manufacturing companies decide distributor margins?

Producers determine reseller markups by weighing expenses, market forces, brand equity, and the distributor's contribution, aiming for healthy profits yet staying competitive. These percentages differ based on the specific offering, prevailing market climate, and the chosen distribution approach. Goods needing expert handling or considerable assistance frequently see larger markups, whereas well-known, heavily sought-after names might accept smaller ones.

Additional elements affecting this include sales quantities, individual order size, extra services provided, and variations in overheads and market potential across different locales. Solid collaborations and bargaining can also result in more adaptable agreements.

Typically, reseller markups sit near 20%, though across various sectors and goods, this can span from 5% up to 40%.

8. Why are FMCG margins so low?

Profitability in the FMCG (Fast-Moving Consumer Goods) sector is typically modest due to its reliance on substantial sales volume, small per-item earnings, fierce rivalry, cost-conscious shoppers, and significant running expenses. Success for these firms hinges on swiftly moving inexpensive staples to generate adequate overall returns.

Main contributing factors:

-

Vigorous market rivalry leads to recurring price conflicts and extensive promotional activities.

-

Consumers highly attuned to pricing readily shift to more economical options, restricting the ability to raise prices.

-

Profits stem from large sales figures, not expanded profit margins.

-

Increasing expenses for basic inputs, crating, transport, and power compress potential earnings.

-

Intricate supply channels and the demand for rapid delivery increase operational expenditures.

-

Retailer expectations and weak consumer allegiance necessitate considerable marketing investment.

In summary, FMCG success depends more on achieving scale, operational effectiveness, and robust supply chain oversight than on securing high profit margins.

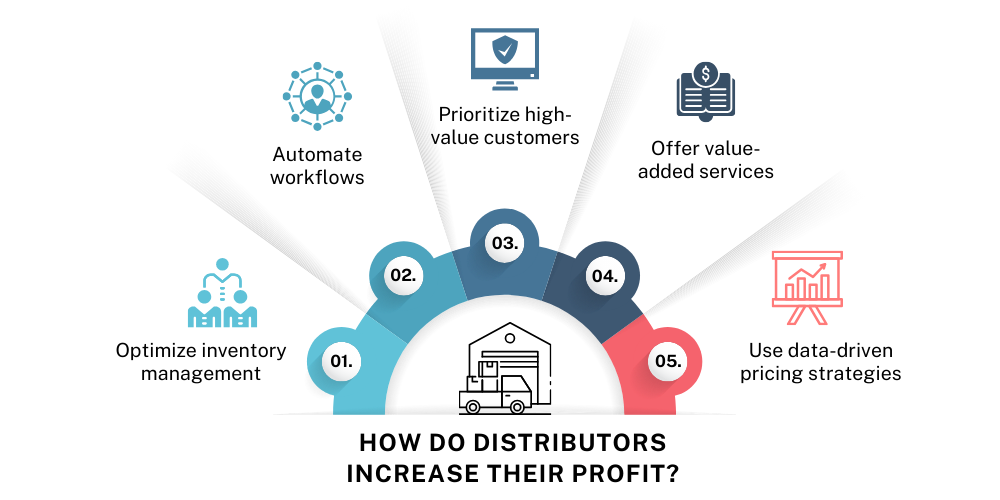

9. How do distributors increase their profit?

To boost their bottom line, distributors can refine their operational methods. Smart inventory handling, automating workflows, and precise anticipation of needs aid in cutting down on waste and guaranteeing products are ready when required. Smoothing out the movement of goods and concentrating on top-tier customers further cuts down on expenses, enabling distributors to function with greater effectiveness.

Regarding income generation, distributors can grow sales by offering extra beneficial services, setting prices based on solid information, and spotting chances to sell more. Thoughtful actions such as creating their own product lines or locking in unique agreements can lift profit margins. Cultivating robust connections with both suppliers and buyers also builds lasting commitment and worth over time, setting up a durable route to greater earnings in the fast-paced FMCG sector.

10. How does the FMCG supply chain work?

The Fast-Moving Consumer Goods (FMCG) supply chain transports high-quantity, narrow-profit items from elemental components through to end-users, prioritizing swiftness, proficiency, and economy. This encompasses acquiring, producing, storing, shipping, and selling, all underpinned by live updates regarding orders, stock levels, and monetary aspects. Businesses employ tactics such as predicting market needs, carrying minimal stock (Just-in-Time), direct transfer between transport modes (cross-docking), and advanced machine learning predictions to cut down on losses and guarantee constant product access.

Core Phases of the FMCG Supply Chain:

-

Procurement of Inputs: Guaranteeing the standard and prompt arrival of necessary components or substances.

-

Production: Aligning large output capacities with brief product shelf lives.

-

Storage & Stock Control: Employing methods like Vendor Managed Inventory (VMI) or cross-docking to lower storage expenses and accelerate fulfillment.

-

Transportation & Movement: Effectively channeling goods via intermediaries, retail outlets, and direct customer routes.

-

Point of Sale & Usage: Sustaining uninterrupted product presence on physical shelves and digital sites while enhancing the total flow system.

11. What is the difference between primary and secondary sales?

In the FMCG industry, understanding primary sales and secondary sales is crucial for tracking product movement and revenue. Primary sales reflect the goods sold by the company to distributors, while secondary sales represent the products sold by distributors to retailers. Monitoring both helps companies forecast demand, manage inventory, and optimize supply chain efficiency.

|

Primary Sales |

Secondary Sales |

|

Sales from the company to distributors |

Sales from distributors to retailers |

|

Generates revenue for the company |

Indicates actual market demand at retailer level |

|

Helps plan production and distribution |

Helps assess consumer demand and market trends |

|

Influences production schedules and inventory management |

Guides marketing and promotional strategies |

Monitoring both types ensures efficient supply chain management, accurate demand forecasting, and seamless product availability by clearly understanding the difference between primary and secondary sales.

12. What is tertiary sales in FMCG?

In the fast-moving consumer goods sector, tertiary sales signify the concluding step in a product's path, where merchandise flows from sellers like food stores, large retailers, chemistries, and various other points of sale straight into the hands of ultimate customers. Distinct from primary sales (manufacturer to wholesaler) or secondary sales (wholesaler to shop), tertiary sales mark the genuine utilization of the item in the marketplace. This phase furnishes organizations with crucial understanding regarding shopper actions, how well a product is received, and current market needs, establishing it as an essential measure for judging total company success.

Monitoring tertiary sales empowers FMCG firms to grasp shopper leanings, pinpoint frequently sought-after items, and modify advertising and manufacturing plans to suit. Furthermore, it aids in precise demand projection, streamlining stock levels, and designing marketing drives. Through examining tertiary sales, brands can synchronize their distribution network with actual usage trends, guarantee items are accessible precisely when and where they are needed, and ultimately elevate sales effectiveness and customer contentment.

13. How do FMCG companies manage product returns and damages?

FMCG companies face frequent product returns and damages due to expiration, transportation mishaps, or retailer/consumer complaints. To manage this efficiently, companies implement strict inventory control, batch tracking, and expiry audits, ensuring products nearing expiration are rotated or returned before becoming unsellable. Buyback policies and damage allowances are common, allowing retailers to return defective or unsold stock without financial loss. Digital tools, like inventory management software and field sales apps, help track product movement, monitor stock quality, and record returns systematically. These measures reduce losses, improve cash flow, and maintain strong retailer relationships.

Key strategies FMCG companies use include:

-

Conducting expiry stock audits to remove near-expiry items proactively.

-

Batch tracking for quality control and easier recall management.

-

Offering buyback or replacement policies for damaged goods.

-

Leveraging digital inventory and reporting tools to monitor returns.

Efficient return management not only minimizes financial loss but also enhances brand trust and ensures continuous product availability for consumers.

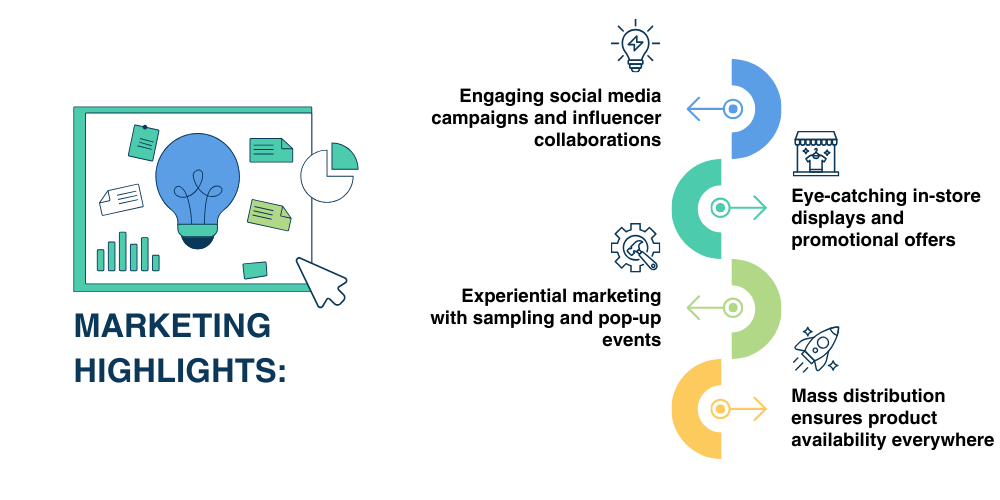

14. How do FMCG companies promote their products?

FMCG companies combine digital, in-store, and traditional marketing to boost reach and sales. Online, they leverage social media, influencers, targeted ads, e-commerce, and D2C channels, using technologies like AR/VR, gamification, and data analytics to engage consumers.

In retail, trade marketing focuses on attractive packaging, POS materials, promotions, and retailer incentives to drive purchases. TV, radio, sampling, pop-ups, and brand partnerships further expand visibility, creating a seamless strategy that builds awareness, loyalty, and sales.

Marketing Highlights:

-

Engaging social media campaigns and influencer collaborations

-

Eye-catching in-store displays and promotional offers

-

Experiential marketing with sampling and pop-up events

-

Mass distribution ensures product availability everywhere

Ultimately, mass distribution across supermarkets, local stores, and online channels ensures availability, while careful brand positioning highlights unique product benefits, quality, and value, creating a seamless and effective marketing ecosystem.

15. What is trade marketing?

Sales-driving tactics for fast-moving consumer goods firms often center on trade marketing, which aims to boost sales via retail channels and distributors instead of directly addressing shoppers. The core goal is making sure items are adequately supplied, noticeable, and appealingly displayed where purchases happen, thus encouraging retailers to feature them. By matching promotional activities with what matters most to retailers, brands can improve product access, prominence on shelves, and eventually, overall revenue.

This method involves actions like point-of-sale displays, product arrangement, staff education, and rewards for retailers, all intended to reinforce connections with channel partners. Smart trade marketing helps brands stay competitive by motivating retailers to give their products preference, boosting how easily consumers can find them, and securing steady market consumption. It is vital for converting marketing spend into measurable sales success in the dynamic FMCG industry.

16. What is an FMCG planogram?

A fast-moving consumer goods (FMCG) planogram serves as a tactical roadmap for retail shelving, detailing the precise product layout needed to capture shopper focus and drive sales upward. It guarantees uniform, visually appealing setups across various outlets, instructing retailers on positioning, front-facing, and how much shelf area each item receives. A skillfully developed planogram enables brands to feature popular goods, stimulate unplanned buying, and preserve a unified brand look across all points of sale.

These shelf arrangements are developed by integrating understanding of shopper actions, category review, and sales figures, taking into account dimensions, packaging, and current marketing efforts. For FMCG businesses, they represent more than just diagrams; they are potent instruments that improve how things are set up in the store, optimize presence, and tactically sway consumer choices, transforming every shelf area into a display designed for conversions.

17. What is an FMCG brand activation?

FMCG brand activation is a marketing approach aimed at linking brands straight to shoppers, crafting lasting impressions that fuel involvement and transactions. This encompasses undertakings such as demonstrations within retail spaces, item giveaways, special offers, competitions, organized gatherings, and online initiatives to prompt trying out the merchandise, lift recognition of the brand, and create buzz surrounding the item.

The objective extends beyond simply advertising an item; it's about fostering enduring shopper connections, reinforcing memory of the brand, and enhancing faithfulness. Successful brand activation transforms regular consumers into keen promoters for the brand, leading to both immediate revenue increases, sustained expansion, and favorable talk-about marketing.

18. How do FMCG companies use technology for sales and distribution?

Fast-moving consumer goods firms leverage tech to simplify selling, delivery, and their material flow processes, allowing for quicker judgments, increased productivity, and stronger customer connection. Through the adoption of digital resources, they gain enhanced insight, lower expenditures, and match selling activities to what shoppers want.

Important Tech & Uses:

-

Field sales staff utilize handheld applications for immediate order taking, managing client details, and smoothing out everyday work effectively.

-

Artificial intelligence forecasts requirements, fine-tunes transport paths, and examines sales figures to boost choices on pricing and stock levels.

-

Cloud hosting for Distribution Management Systems consolidates orders, stock levels, and sales monitoring, offering live updates and automated invoicing.

-

Web, non-connected, and direct-to-consumer avenues are linked together to broaden availability, interact with shoppers, and push focused sales.

-

Intelligence-powered supply networks track goods in transit, adapt to shifts in the marketplace, and maintain seamless functioning.

19. What is an SFA (Sales Force Automation) app?

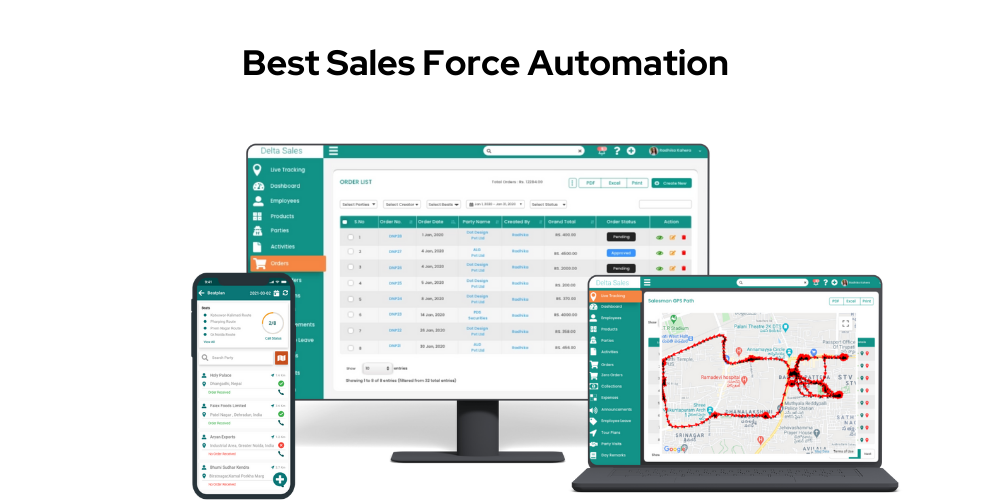

A Sales Force Automation (SFA) application is a digital solution designed to help organizations automate and simplify their sales procedures, especially those involving sales personnel out in the field. It enables firms to skillfully handle prospects, monitor customer touchpoints, finalize transactions, and arrange necessary activities. Core functionalities usually involve managing client details, charting optimal travel paths, location monitoring, handling purchases, setting prompts for tasks, and analyzing results.

Through cutting down on tedious manual effort, SFA tools increase the output of sales staff, lower mistakes, and deepen connections with customers. Additionally, they furnish immediate understanding for improved strategic choices. Solutions such as the Delta Sales App empower Fast-Moving Consumer Goods (FMCG) companies and others to keep tabs on their traveling teams, perfect their routes, manage procured goods, and assess sales results, all accessible via a portable gadget.

Conclusion

The FMCG industry in 2026 demands speed, efficiency, and data-driven execution. Businesses that optimize margins, strengthen distribution, and adopt smart sales and inventory technology will stay competitive and drive sustainable growth.

As market complexity increases, visibility across primary to tertiary sales becomes essential. Companies that act faster on real-time insights will outperform slower, manual competitors.

Explore Delta Sales App Today and take control of your FMCG growth journey.