Why Most FMCG Brands Stall at ₹25 Crore And What the Ones Crossing ₹100 Crore Do Differently

The FMCG sector in India is one of the most competitive and execution-driven industries. Every year, thousands of new brands enter the market with strong ambition, innovative products, and aggressive growth goals. Yet, despite promising starts, a large percentage of these brands plateau around the ₹20–25 crore revenue mark. Only a small fraction successfully break through and scale beyond ₹100 crore.

The difference between these two categories is rarely product quality or marketing budget alone. It lies in execution discipline, operational structure, and data-driven decision-making. Brands that scale build systems early; brands that stall rely on intuition for too long.

Let’s examine why many FMCG brands hit the ₹25 crore ceiling and what separates those that successfully move to the ₹100 crore league.

Why Reaching ₹25 Crore Is Easier Than Ever

Building an FMCG or CPG brand today is far more accessible than it was a decade ago. Structural shifts across manufacturing, distribution, and marketing have significantly lowered entry barriers, enabling new brands to enter the market and grow faster than before.

Several factors have made early-stage scaling easier:

-

Contract manufacturing minimizes upfront capital investment and accelerates production readiness

-

Packaging suppliers, logistics providers, and supply chain partners are widely available and cost-efficient

-

Digital marketing enables rapid brand discovery and consumer engagement at a relatively low cost

-

Distributors are increasingly open to onboarding emerging brands in search of new growth opportunities

As a result, many young FMCG brands now reach ₹10–25 crore in annual revenue more quickly than ever before.

In the early growth phase, expansion is typically driven by a focused and hands-on approach:

-

Sales are heavily founder-led, with direct involvement in key business decisions

-

Operations are concentrated in a limited but high-potential geography

-

A small number of strong-performing SKUs drive the majority of revenue

-

Close, relationship-driven collaboration exists with distributors

This stage is characterized by speed and flexibility. The founder maintains direct visibility into operations, knows distributors personally, and can resolve issues quickly. Sales teams communicate informally through calls and messaging, and inventory decisions are often based on intuition rather than structured data. Problems are identified early and addressed rapidly.

This approach is highly effective in the initial stages, but only up to a certain scale.

Why Most FMCG Brands Get Stuck at ₹25 Crore

Hitting ₹25 crore is often the first major milestone for emerging FMCG brands. It signals initial market acceptance, product-market fit, and traction in retail. However, crossing this barrier is where most brands falter. Several factors contribute to this plateau:

Limited Distribution Reach – Many brands focus on urban centers or specific cities. While this helps control costs initially, it limits exposure to larger markets, capping potential revenue.

Inconsistent Retail Execution – Small brands often lack structured field teams or processes to ensure their products are properly stocked, displayed, and promoted across retailers. Poor execution leads to missed sales opportunities and weak brand presence.

Reactive Decision-Making – Decisions based on gut feel rather than data result in missed opportunities for demand forecasting, production planning, and sales optimization. Without visibility into what’s happening at the retail level, scaling becomes guesswork.

Without execution-level visibility, production and distribution decisions become guesswork. Inventory piles up in distributor warehouses while real market demand remains unclear.

Identifying the Invisible Bottlenecks

Breaking the ₹25 crore barrier is less about increasing ad spend or launching new SKUs. It’s about addressing hidden operational and market bottlenecks that silently throttle growth.

As brands scale, small inefficiencies compound quietly. A salesperson skipping just five outlets daily becomes 3,000 missed visits per month. A slow-moving SKU in one region can block ₹5–10 lakhs of working capital. One weak distributor can reduce visibility across hundreds of stores. These issues rarely appear in monthly revenue immediately, but together they flatten growth.

Distribution Gaps

Distribution is the backbone of FMCG success. Many emerging brands rely on a handful of distributors or focus on a limited geography. This creates gaps:

-

Retailers in Tier-2 and Tier-3 towns may never see the product.

-

Stock-outs and delayed replenishments frustrate retailers and consumers alike.

-

Brands fail to gain the critical mass required for large-scale growth.

Over time, these gaps translate into lost market presence and stalled expansion.

Field Execution Challenges

Even if a product reaches retail outlets, execution at the store level is critical. Field sales teams often face challenges such as:

-

Inefficient route planning leading to fewer store visits

-

Inconsistent merchandising and product display

-

Lack of real-time accountability, resulting in missed orders and weak retail relationships

These operational inefficiencies are invisible in dashboards but directly impact revenue. At scale, this often results in territory confusion, overlapping sales efforts, and unclear ownership of retail performance.

Poor Visibility of Retail & Consumer Data

Data is the differentiator between brands that plateau and those that scale. Emerging brands often:

-

Rely on delayed sales reports

-

Lack insights into which SKUs perform best by region

-

Cannot track competitor activity or market trends in real time

Many founders know dispatch numbers but not sell-through. Stock quietly accumulates at distributor warehouses while production continues—creating false signals of demand. Without execution visibility, decisions remain reactive and growth slows.

What ₹100 Crore Brands Do Differently

Brands that scale beyond ₹100 crore do not just sell more, they operate smarter. Their approach is systematic, strategic, and highly disciplined.

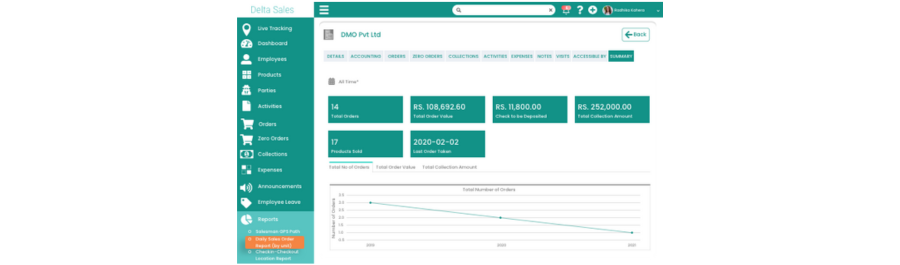

Predictive Analytics & Market Insights

Data-driven decision-making is central to scaling:

-

Brands track retail sales, inventory, and customer preferences in real time

-

Predictive analytics helps forecast demand, optimize production, and reduce wastage

-

Insights into regional trends allow for localized marketing and SKU strategies

Many high-growth brands also reduce SKU noise, focusing on core products nationally while managing select SKUs regionally. This simplifies operations and improves inventory rotation.

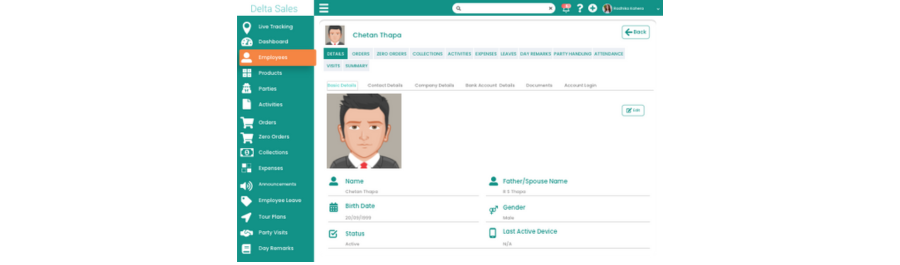

Operational Excellence & Sales Discipline

High-growth FMCG brands build robust systems:

-

Structured distribution networks covering urban and semi-urban markets

-

Well-trained field teams with defined KPIs and incentives

-

Efficient supply chain management to prevent stock-outs and delays

More importantly, they shift from sales-driven thinking to territory management. Instead of asking, “How much did this region sell?”, they analyze outlet coverage, beat completion, SKU movement, and sales productivity. Each territory becomes a measurable business unit with defined ownership.

Innovative Marketing & Trade Promotions

Marketing isn’t limited to advertising. High-growth brands:

-

Use trade promotions to incentivize distributors and retailers

-

Launch campaigns targeting key regions based on data-driven insights

-

Invest in brand-building activities that resonate with consumers

They also segment outlets strategically, prioritizing high-value retailers and aligning sales effort with outlet potential, boosting productivity significantly.

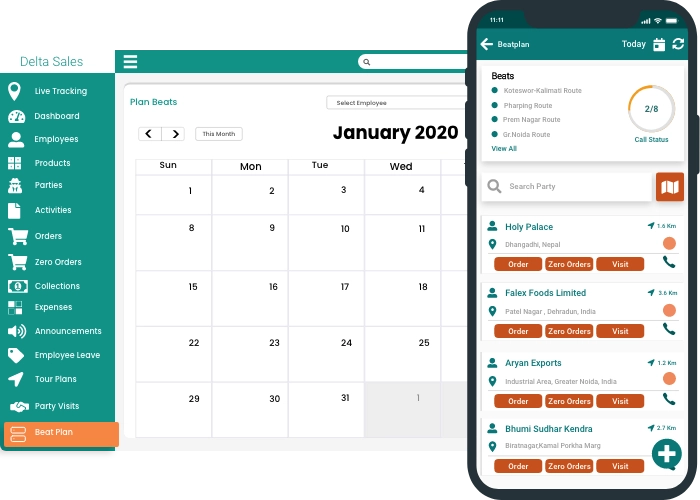

Structured Field Execution

Consistent execution at the retail level is a defining trait of high-performing FMCG brands. They build disciplined field management systems to ensure productivity and accountability.

Key practices include:

-

Route optimization and structured beat planning to maximize outlet coverage

-

Outlet segmentation based on business potential and priority

-

Real-time tracking of sales activity and field performance

-

Continuous monitoring of field productivity and visit discipline

-

Clearly defined merchandising and in-store execution standards

This structured execution improves sales efficiency, reduces missed opportunities, and strengthens retailer relationships, all of which contribute directly to sustained growth.

Innovative Marketing & Trade Promotions

For scaling brands, marketing extends beyond advertising and integrates closely with sales and distribution execution.

They:

-

Use targeted trade promotions to incentivize distributors and retailers

-

Launch region-specific campaigns based on data-driven insights

-

Invest in brand-building initiatives that resonate with consumer behavior and preferences

Additionally, they segment outlets strategically, prioritizing high-value retailers and aligning sales efforts with outlet potential. This significantly improves productivity and ensures marketing investments deliver measurable business impact.

Steps to Break the ₹25 Crore Barrier

Emerging FMCG brands can learn from the high-growth playbook. Here’s a practical roadmap:

-

Expand Distribution Strategically: Map your target geography, prioritize high-potential regions, and partner with reliable distributors, ensuring wide coverage, consistent product availability, strong relationships, and measurable performance for sustainable growth.

-

Strengthen Field Execution: Implement route optimization, define clear territory ownership, and maintain merchandising standards, while monitoring outlet coverage, field productivity, and in-store execution to boost retailer relationships and brand visibility.

-

Leverage Technology & Data: Gain real-time insights into sales, inventory, and field execution, using analytics for demand forecasting, reducing stock-outs, optimizing production, and making informed decisions to prevent operational blind spots.

-

Adopt a Structured Marketing Approach: Align trade promotions, retail campaigns, and consumer engagement with market realities, targeting high-value regions, tailoring messaging to local trends, and integrating marketing with sales for measurable impact.

-

Monitor KPIs & Iterate: Track execution metrics daily, not just monthly, including territory performance, distributor efficiency, and SKU movement, identify gaps quickly, adjust strategies, and continuously optimize operations for predictable growth.

Conclusion

Scaling from ₹25 crore to ₹100 crore isn’t luck, it’s about systems, disciplined execution, and data-driven decisions. Real growth comes from empowering field teams, optimizing distribution, and gaining real-time visibility into retail operations. Brands that systemize early reduce bottlenecks, increase sales efficiency, and make smarter, faster decisions.

Ready to grow faster? Use Delta Sales App to empower your field teams, track execution in real time, and turn your FMCG growth plans into reality. Take control of your distribution, boost productivity, and unlock predictable growth today.