Top FMCG Distribution Questions Answered: The Ultimate Guide for 2026

The consumer goods industry relies heavily on the FMCG distribution business. From manufacturers to distributors and sales managers, everyone in the ecosystem faces the same challenges: managing inventory, controlling retailer credit, monitoring sales teams, planning beats, and maintaining margins in a highly competitive market.

As FMCG markets become more dynamic in 2026, distributors can no longer rely on manual processes and guesswork. To help you navigate this evolving landscape, this guide answers the most frequently asked FMCG distribution questions, offering practical insights and proven strategies used by successful distributors today.

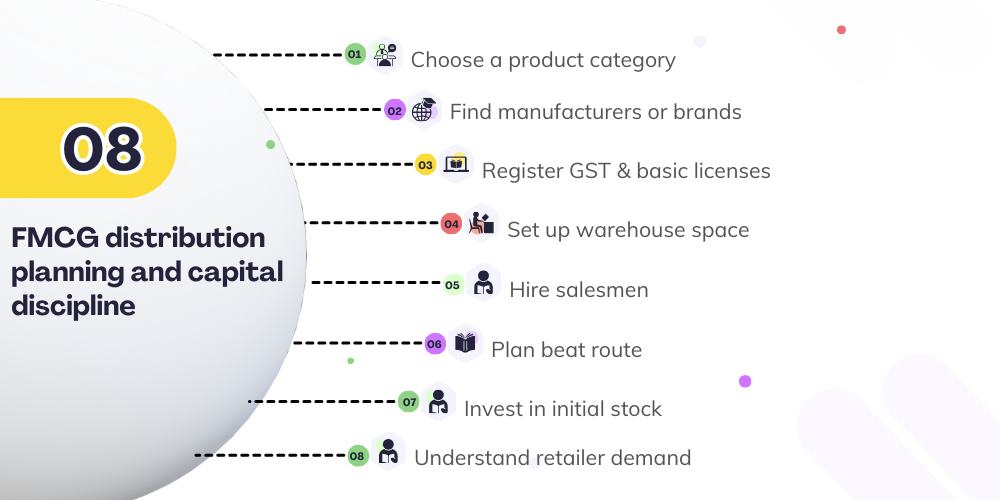

1. How do I start an FMCG distribution business?

Starting an FMCG distribution business requires careful planning and capital discipline. The first step is choosing the right product category, such as food and beverages, personal care, cosmetics, or household essentials. Once finalized, distributors typically connect with manufacturers or brands, complete GST registration and licenses, and set up basic infrastructure. Starting an FMCG distribution business requires setting up a strong operational base.

The key steps include:

-

Choose a product category : Select categories like food, beverages, personal care, or household goods based on local market demand.

-

Find manufacturers or brands : Partner with brands that offer good margins, consistent supply, and market support.

-

Register GST & basic licenses : Complete mandatory registrations to operate legally and issue tax invoices.

-

Set up warehouse space: Arrange clean and secure storage to handle inventory safely and avoid damage or expiry.

-

Hire salesmen : Build a small field sales team to visit retailers and generate daily orders.

-

Plan beat routes : Define fixed routes and visit schedules to ensure consistent retailer coverage.

-

Invest in initial stock : Purchase opening inventory based on realistic demand, not assumptions.

-

Understand retailer demand : Analyze which products move faster to avoid dead stock.

Most distributors begin with 1–2 brands, focus on execution, and expand only after achieving stable secondary sales.

2. How much investment is required to become a distributor?

The investment required depends on the brand size and product category. Approximate ranges include:

-

Entry-level FMCG brands: ₹2–5 lakhs, suitable for first-time distributors

-

Mid-size FMCG brands: ₹10–25 lakhs, with moderate market presence

-

Large national brands (HUL, ITC, Nestlé):₹40 lakhs or more, requiring strong capital backing

Actual investment varies based on territory size, credit terms, and stock requirements.

Your main expenses will be

-

Opening stock: Initial inventory you purchase from the company to start supplying retailers; this usually takes up the largest share of investment.

-

Delivery vehicle : Cost of owning or renting a van or tempo to ensure timely delivery of goods to retail outlets.

-

Sales team salaries: monthly wages, incentives, and allowances paid to salesmen who handle order collection and retailer visits.

-

Rent and warehousing: Expenses for storing products safely, including rent, utilities, and basic warehouse maintenance.

-

Working capital for retailer credit: Extra funds required to support credit given to retailers until payments are collected.

3. How do I find good FMCG brands to distribute?

Distributors can discover suitable FMCG brands through multiple reliable channels:

Contact companies directly: Reach out to FMCG manufacturers actively expanding their distribution network, especially mid-sized or regional brands seeking aggressive market penetration and long-term distributor partnerships.

Search B2B portals: Use trusted B2B platforms that list FMCG brands looking for distributors by region, category, and investment range, allowing easier comparison of opportunities.

Attend trade fairs and expos: Industry events help you evaluate product quality, pricing, packaging, and company seriousness while directly interacting with brand owners and decision-makers.

Get referrals from existing distributors: Peer recommendations often reveal brands offering realistic margins, operational support, and ethical practices that may not be aggressively advertised online.

Check local demand gaps: Identify products retailers frequently ask for but cannot source easily, indicating unmet demand and strong potential for quick market acceptance.

Choosing the right brand matters more than choosing a popular one. A good FMCG brand typically offers:

High turnover:

Products that move quickly from shelves, ensure frequent reorders, improve cash flow, and reduce inventory holding risks for distributors.

Consistent demand:

Items with steady year-round sales rather than seasonal spikes, providing predictable revenue and easier planning for stock and logistics.

Attractive trade schemes:

Discounts, margins, and incentive programs that motivate retailers to promote the brand actively and prioritize it over competing products.

Limited competition:

Fewer distributors operating in the same territory, allowing better pricing control, stronger retailer relationships, and healthier profit margins.

Strong company support:

Reliable supply chains, marketing assistance, training, and responsive sales coordination that help distributors scale operations smoothly.

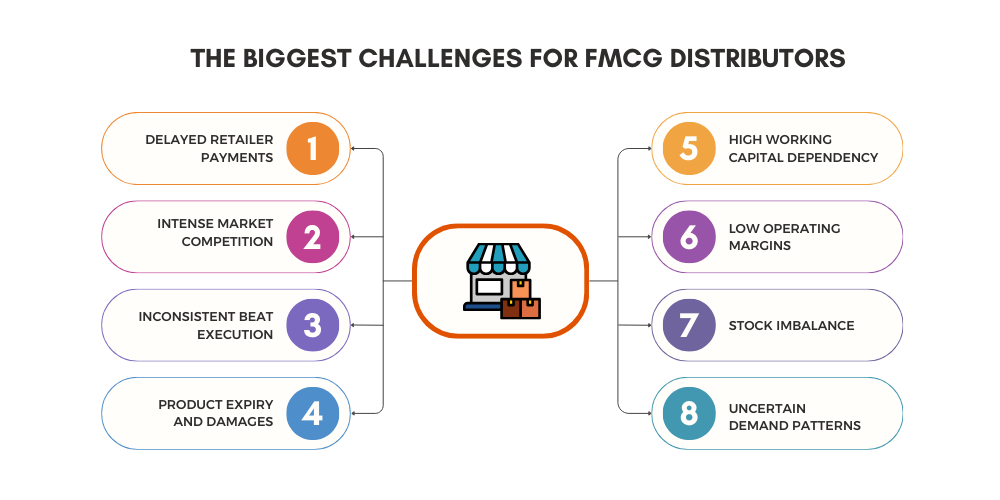

4. What are the biggest challenges for FMCG distributors?

Running an FMCG distribution business involves balancing sales growth with operational control. Distributors often face multiple challenges at the same time, especially when processes rely heavily on manual tracking and limited market visibility. The most common challenges include:

-

Delayed retailer payments:

Credit cycles frequently extend beyond planned timelines, increasing cash flow pressure and limiting the distributor’s ability to reinvest in inventory, marketing, and expansion activities. -

Intense market competition:

Multiple distributors selling similar products reduce differentiation, weaken pricing power, and force aggressive discounting to retain retailers and shelf space. -

Inconsistent beat execution:

Sales representatives may miss outlets, shorten visits, or deviate from assigned routes, leading to lost sales opportunities and poor retailer relationship management. -

Product expiry and damages:

Inefficient stock rotation, improper storage, and lack of visibility into batch-wise inventory result in avoidable losses and reduced profitability. -

High working capital dependency:

Distributors must continuously invest in inventory, logistics, and retailer credit, creating financial strain especially during demand fluctuations or delayed collections. -

Low operating margins:

Thin margins leave little room for inefficiency, making distributors highly sensitive to fuel costs, manpower expenses, returns, and operational wastage. -

Stock imbalance:

Slow-moving products accumulate while fast-moving items face shortages, causing lost sales, dissatisfied retailers, and excess capital locked in inventory. -

Uncertain demand patterns:

Seasonal variations, promotional spikes, and changing consumer behavior make accurate demand forecasting difficult, increasing the risk of overstocking or stockouts.

Although these challenges are common, they are not permanent. With structured planning, improved visibility, and the use of automation tools, distributors can overcome most operational bottlenecks.

5. What are typical FMCG distributor margins?

FMCG distributor margins vary based on the product category, brand positioning, and market competition. While margins differ, most categories fall within the following ranges:

-

Snacks and biscuits : 4–6%

High-volume products with fast movement but tighter margins. -

Beverages : 5–8%

Margins remain moderate due to strong competition and seasonal demand. -

Personal care products : 10–20%

Better margins supported by branding and repeat consumption. -

Cosmetics : 15–25%

Higher margins driven by premium pricing and lower price sensitivity. -

Household cleaning products : 6–12%

Stable margins with consistent daily demand. -

New or emerging brands: 12–30%

Higher margins are offered to encourage distributor push and market penetration.

However, margins alone do not define profitability. Faster stock rotation and higher sales volume often generate better returns than higher margins with slow movement.

6. How do distributors increase their profits?

In FMCG distribution, profitability is driven more by execution efficiency and sales volume than by margins alone. Distributors can improve profits by focusing on the following areas:

-

Adding more retail outlets: Expanding coverage increases order frequency and overall sales volume.

-

Selling a full product range: offering more SKUs per outlet improves average order value.

-

Optimizing route planning: Efficient beats reduce travel time and fuel costs while improving daily productivity.

-

Reducing stock expiry: Better stock rotation and demand planning minimize losses.

-

Pushing high-margin products: Prioritizing profitable SKUs improves overall contribution.

-

Controlling retailer credit: Timely collections strengthen cash flow and reduce financial risk.

-

Using SFA software for efficiency: Sales Force Automation improves visibility, discipline, and execution consistency.

In practice, profit comes from a combination of volume and operational efficiency not just higher margins.

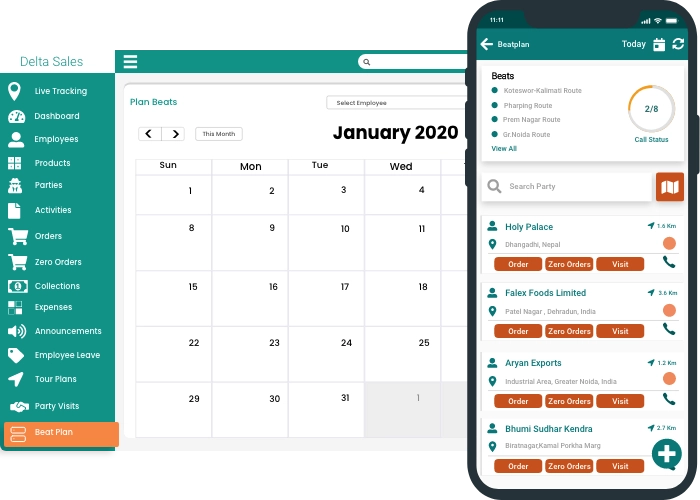

7. How does beat planning (route planning) work?

Beat planning, also known as route planning, helps sales representatives cover retail outlets in a structured and repeatable manner. Instead of random visits, outlets are visited according to a fixed plan to maximize coverage and efficiency. A typical beat planning process includes

-

Dividing areas into beats: territories are split into manageable routes based on location and outlet density.

-

Assigning fixed visit days: Each beat is allotted specific days to ensure consistent retailer engagement.

-

Defining journey cycles: Visit frequency is planned weekly or monthly depending on outlet importance.

-

Tracking outlet coverage: monitoring which shops are visited and which are missed.

-

Identifying skipped outlets: Helps correct gaps and prevent loss of sales opportunities.

-

Ensuring regular store visits: Guarantees predictable coverage and better retailer relationships.

Proper beat planning leads to higher sales productivity, lower fuel and travel costs, and better time utilization for the sales team.

8. Why do salesmen skip outlets?

Salesmen skipping outlets is a common problem in FMCG distribution, resulting in lost sales and poor market coverage. This is typically due to a combination of operational gaps and a lack of accountability. Common explanations include:

-

Overloaded or long routes: Excessive travel distance makes it difficult to cover all assigned outlets.

-

Lack of monitoring: Without supervision, route discipline often drops.

-

Retailer payment disputes: Salesmen avoid outlets with pending payments or credit issues.

-

Low motivation or personal negligence: Absence of performance pressure reduces effort.

-

No tracking system: Distributors lack visibility into actual field movement.

-

Weak incentive structure: Poorly designed incentives fail to reward consistent coverage.

To overcome this, most distributors adopt field sales apps that provide route tracking, visit verification, and real-time visibility into sales activity.

![]()

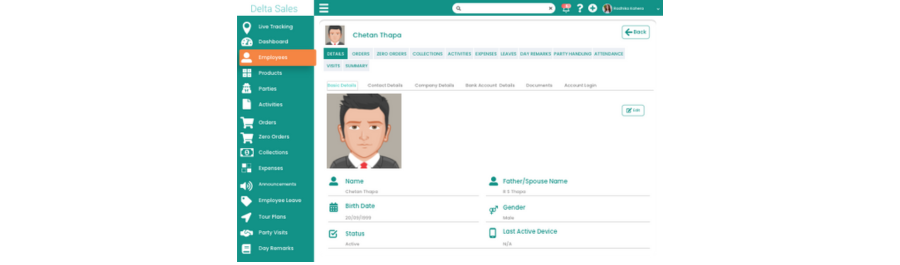

9. How do distributors manage salesmen effectively?

Effective sales team management in FMCG distribution is dependent on structure, visibility, and consistency. Distributors who adhere to a defined process can improve productivity and accountability throughout their field force. A strong sales management process typically involves:

-

Daily sales targets: Clear targets keep salesmen focused on execution every day.

-

Attendance tracking: Ensures sales representatives are active and available in the field.

-

Beat-wise outlet visits: confirms that assigned routes and outlets are covered as planned.

-

Mobile order-taking: Allows faster, error-free order booking directly from retail stores.

-

GPS tracking for accountability: provides real-time visibility into field movement and visit authenticity.

-

Performance-based incentives: motivates salesmen to meet coverage and sales goals.

-

Weekly performance reports: help managers review progress and take corrective action.

Using automation tools brings consistency, transparency, and control to sales team operations.

10. How do distributors reduce dead stock?

Dead stock in FMCG distribution usually results from poor demand planning and lack of inventory visibility. Distributors can minimize stock expiry and slow-moving inventory by following these best practices:

-

Monitor expiry dates regularly: early identification helps prevent losses before products expire.

-

Rotate near-expiry stock: Prioritize selling products that are closer to expiry through targeted outlet pushes.

-

Avoid overstocking: order only what the market can realistically absorb.

-

Track retailer demand patterns: understand which SKUs move faster across different outlets.

-

Order based on secondary sales: use actual distributor-to-retailer sales data instead of assumptions.

-

Run clearance or promotional schemes: move slow stock through discounts or bundled offers.

Using digital stock and sales reports enables distributors to plan accurately and avoid unnecessary over-purchasing.

11. Why do retailers not push certain products?

Retailers prioritize products that sell quickly, generate higher margins, and receive consistent support. When a product fails to meet these expectations, it naturally receives less shelf space and fewer recommendations from retailers. Common explanations include:

-

Low retailer margin: Products with poor margins offer little incentive to promote.

-

Slow-moving inventory: Retailers avoid pushing items that block shelf space.

-

Stronger demand for competitor brands : Well-known or faster-selling brands take priority.

-

Poor company or distributor support: Lack of follow-ups, visibility, or replacements discourages push.

-

No trade schemes or offers: without schemes, retailers have no reason to recommend the product.

-

Weak salesman promotion: If the salesman doesn’t pitch benefits, the product remains unnoticed.

Retailer push improves significantly when distributors introduce attractive trade schemes, bundle offers, and consistent sales follow-ups.

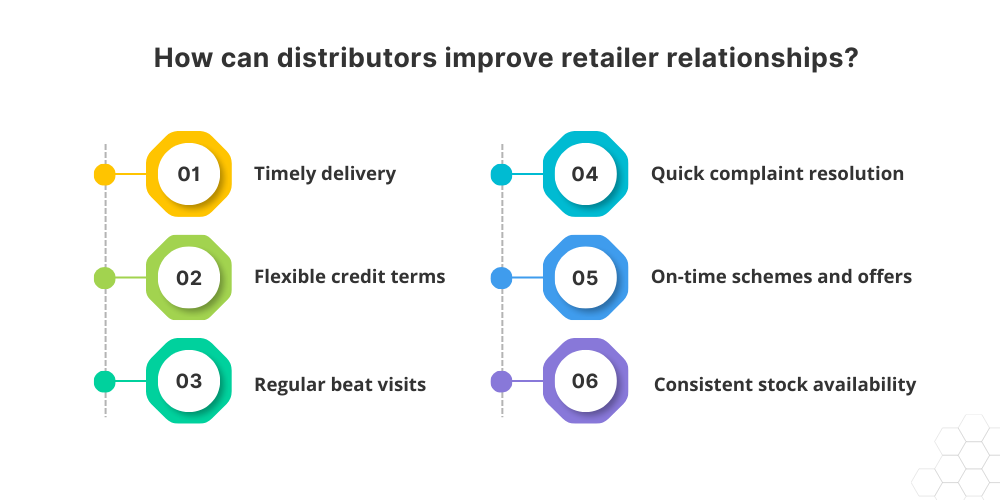

12. How can distributors improve retailer relationships?

Strong distributor–retailer relationships are built on trust, consistency, and reliability. Retailers continue to buy from distributors who make their business easier and more predictable.

Key practices include:

-

Timely delivery: Delivering orders on time builds confidence and repeat business.

-

Flexible credit terms: reasonable credit helps retailers manage cash flow.

-

Regular beat visits: Consistent store visits ensure better communication and visibility.

-

Quick complaint resolution: Fast issue handling prevents loss of retailer trust.

-

On-time schemes and offers: Retailers plan purchases around schemes; delays reduce impact.

-

Consistent stock availability: Reliable availability avoids lost sales at the store level.

Retailers prefer distributors who are responsive, dependable, and easy to work with, not just those offering low prices.

13. How do distributors manage retailer credit?

Retailer credit is one of the most critical and risky areas in FMCG distribution. Poor credit control can quickly block working capital and slow down business growth. Effective credit management includes:

-

Clear credit limits: Fix a maximum credit amount for each retailer based on sales history.

-

Credit aging tracking: Monitor how long payments have been pending (7, 15, 30+ days).

-

Partial payment rules: Collect a portion of outstanding dues before accepting new orders.

-

Incentives for early payment: Offer small discounts or schemes for timely settlements.

-

Penalties for delayed payments : Apply strict follow-ups or order holds for overdue accounts.

-

Automated payment reminders: Use digital alerts to reduce manual follow-ups.

Distributors should never offer unlimited credit without visibility and control, as it directly impacts cash flow and profitability.

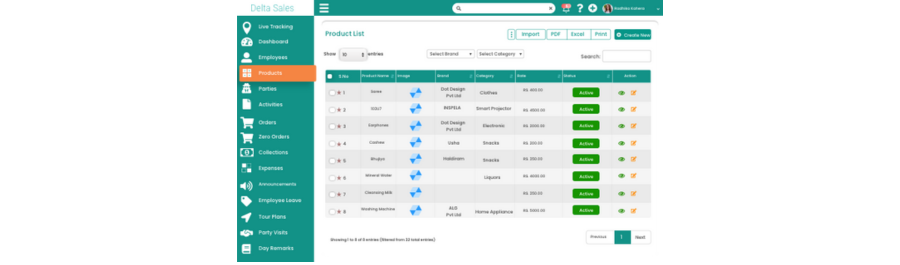

14. How does technology help FMCG distributors?

In today's competitive FMCG market, technology is no longer an option , it is required. Digital tools enable distributors to gain visibility, control costs, and improve execution throughout the distribution cycle. Key advantages include:

-

Beat planning: Digitally plan routes to ensure maximum outlet coverage and minimal travel time.

-

Salesman tracking : Monitor attendance, location, and daily activity in real time.

-

Mobile order-taking : Capture orders instantly at the store, reducing errors and delays.

-

Inventory management : Track stock levels, expiry dates, and movement across warehouses.

-

Secondary sales tracking : Measure actual sales from distributor to retailer for better forecasting.

-

Outstanding & credit reports : Get real-time visibility into retailer dues and credit aging.

-

Leakage and pilferage control : Reduce losses caused by manual processes and poor tracking.

Solutions like Delta Sales App bring all these functions together, giving distributors end-to-end operational control and data-driven decision-making.

15. What is secondary sales, and why is it important?

Secondary sales refer to the movement of products from the distributor to the retailer. Unlike primary sales (company to distributor), secondary sales show what is actually selling in the market.

Tracking secondary sales helps distributors and brands to:

-

Understand real market demand : Know which products are moving and which are not.

-

Measure product performance : Identify fast-moving and slow-moving SKUs.

-

Improve stock rotation : Align inventory with actual outlet-level sales.

-

Evaluate salesman efficiency : Track coverage, order value, and productivity.

-

Monitor retailer coverage : Ensure the right outlets are being serviced regularly.

By using accurate secondary sales data, companies and distributors can prevent stockouts, reduce dead stock, and plan inventory more effectively

16. How do distributors choose the right product mix?

Choosing the right product mix entails striking a balance between high-volume items with high profit margins. A well-planned mix allows distributors to maximize sales while minimizing inventory risk. An effective product mix should contain:

-

High-turnover items: products that sell daily and ensure consistent cash flow.

-

Seasonal products: items in demand during festivals or weather-driven seasons.

-

High-margin products: SKUs that improve overall profitability.

-

Daily essentials: staples that retailers reorder frequently.

-

Fast-moving SKUs: items with proven demand and quick stock rotation.

-

A few premium items: higher-value products for selective outlets.

-

New launches: fresh products to test market response and future growth.

The goal is to balance volume and margin to achieve sustainable and profitable distribution.

17. What KPIs should distributors track?

Tracking the right KPIs enables FMCG distributors to measure performance, control costs, and improve decision-making. Instead of tracking everything, focus on key performance indicators (KPIs) that directly impact sales efficiency and profitability:

-

Daily orders: Monitor order count and value to measure sales momentum.

-

Outlet coverage: Track how many planned outlets are actually visited.

-

Salesman productivity: Measure orders and sales per salesman per day.

-

Secondary sales: Understand real market movement at the retailer level.

-

Stock levels: Maintain optimal inventory to avoid overstocking or stockouts.

-

Expiries: Identify and reduce losses from near-expiry or damaged stock.

-

Credit aging: Monitor outstanding payments and working capital health.

-

Average order value: Increase basket size per retailer.

-

Range selling: Track how many SKUs are sold per outlet.

-

Fill rate: Measure how much of the order is fulfilled from available stock.

Consistently tracking these KPIs helps distributors increase profitability, improve execution, and reduce wastage.

18. How do distributors scale their business?

Scaling an FMCG distribution business entails expanding reach while maintaining control. Improvements in coverage, availability, and operational efficiency lead to long-term growth. The key scaling strategies are

-

Add new brands: Introduce complementary brands to increase revenue per outlet.

-

Enter new territories: expand into nearby markets with proven demand.

-

Strengthen the sales team: increase manpower to cover more outlets effectively.

-

Improve logistics: optimize delivery routes and turnaround time.

-

Use sales automation: digitize sales, tracking, and reporting for better scalability.

-

Offer better schemes : Attract retailers and increase order volumes.

-

Maintain strong retailer relationships: retention is as important as acquisition.

Business growth ultimately depends on coverage, product availability, and execution efficiency.

19. What are the biggest reasons distribution businesses fail?

The majority of FMCG distribution failures are the result of poor execution and a lack of control, rather than low demand. When core operational areas are ignored, losses quickly accumulate. Common failure causes include:

-

Poor credit control: Excessive or unchecked credit blocks working capital.

-

Stock mismanagement: Overstocking and poor demand planning lead to dead stock.

-

Wrong brand selection: Choosing brands with weak demand or support limits growth.

-

High damages and expiry: Poor stock rotation increases avoidable losses.

-

Unreliable sales team: Low productivity and skipped beats reduce market coverage.

-

Weak beat planning: Inefficient routes waste time, fuel, and sales opportunities.

-

Lack of financial discipline: Poor cash flow monitoring leads to instability.

A disciplined distributor with strong systems, planning, and controls rarely fails.

20. How can FMCG distributors stay competitive in 2026?

As FMCG markets become more crowded and margin pressure rises, distributors must prioritize speed, efficiency, and data-driven decisions to stay competitive. The most competitive distributors in 2026 will be:

-

Adopt technology early : Use digital tools for sales tracking, inventory, and reporting.

-

Reduce manual processes: minimize errors, delays, and dependency on paperwork.

-

Forecast demand accurately: plan stock using secondary sales and real market data.

-

Strengthen retailer loyalty: offer consistent service, schemes, and support.

-

Ensure fast and reliable delivery: speed is a key differentiator in modern distribution.

-

Improve operational efficiency: optimize routes, manpower, and stock movement.

-

Partner with strong brands: align with brands that invest in growth and market support.

Distributors who digitize early and operate efficiently will not just survive but lead the FMCG distribution landscape of the future.

Conclusion

The FMCG distribution landscape is rapidly changing. With increased competition, tighter margins, and higher retailer expectations, distributors must work smarter, not harder.

Distributors can improve stock control, optimize routes, increase sales, strengthen retailer trust, and implement appropriate technology by addressing key challenges. With the right systems in place, distribution is still one of the most profitable FMCG businesses.

Digitize your operations with Delta Sales App for real-time control, increased visibility, and faster growth.