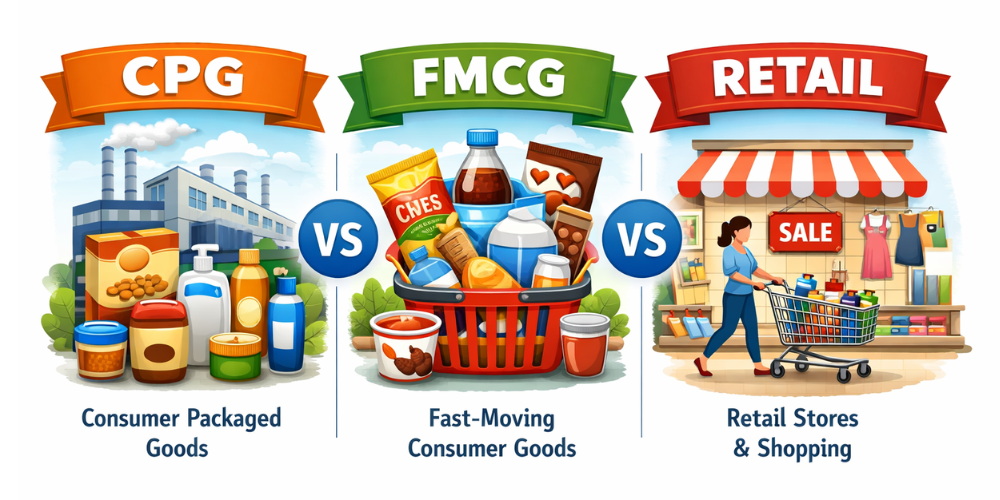

CPG vs FMCG vs Retail: Key Differences, Trends & Market Insights

Understanding the distinction between CPG, FMCG, and retail in today's hypercompetitive consumer economy is no longer optional; it is required. These three terms describe how products are manufactured, distributed, sold, and ultimately experienced by consumers. However, many growing businesses struggle because they view them as interchangeable models.

As business strategist Michael Porter once said, “The essence of strategy is choosing what not to do.” Choosing the right execution model requires clarity, which begins here.

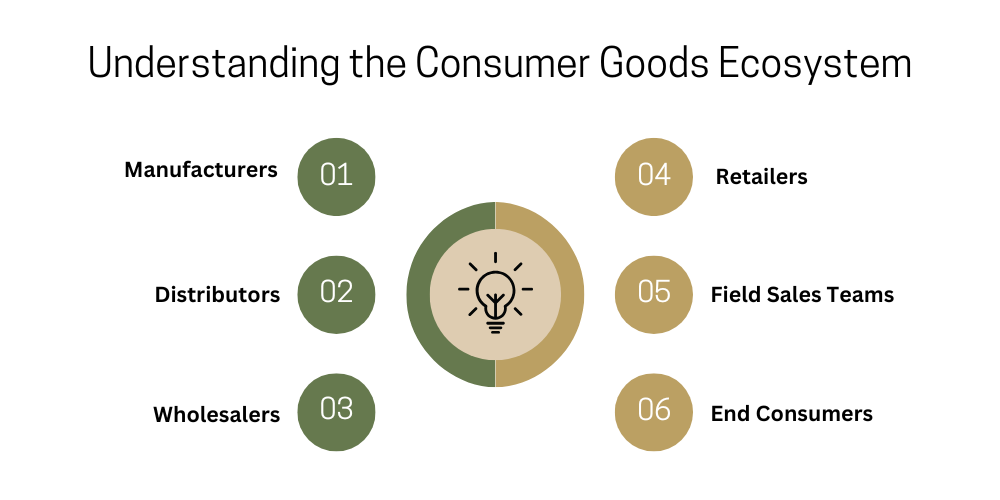

Understanding the Consumer Goods Ecosystem

The consumer goods ecosystem is a multilayered value chain. At one end, brands are driving demand. On the other end, retailers fulfill it. In the middle are distribution, execution, and a web of field operations that determine success or failure.

This ecosystem becomes even more complex in emerging and high-growth markets, where:

-

Distribution networks are fragmented

-

Field sales teams operate remotely

-

Retail outlets vary widely in size and sophistication

Understanding CPG, FMCG, and retail enables businesses to develop execution strategies that are tailored to real-world conditions rather than ideal scenarios.

What Is CPG (Consumer Packaged Goods)?

Consumer Packaged Goods (CPG) are products that consumers purchase regularly but not necessarily daily. These include packaged foods, beverages, personal care products, cleaning supplies, and over-the-counter items. CPG companies focus heavily on brand building and demand generation. However, their success depends just as much on how well products are distributed and executed at the ground level.

Key Characteristics of CPG

- Longer product lifecycle compared to FMCG

Unlike fast-moving consumer goods, which are replenished almost daily, CPG products typically have a longer shelf life and a slower repurchase cycle. This means that brands must plan inventory, promotions, and distribution with a medium- to long-term perspective rather than focusing solely on quick turnover.

- Strong focus on branding and demand creation

CPG companies make significant investments in marketing, packaging, and brand positioning to influence consumer purchasing decisions. Because multiple similar products compete for the same shelf space, brand recognition and trust are critical in driving demand before the consumer even enters the store.

- Sold through distributors, wholesalers, and retailers

Most consumer packaged goods brands do not sell directly to consumers. Instead, they use a multi-tier distribution network that includes distributors, wholesalers, and retail stores. While this model allows for broad market coverage, it also presents challenges in maintaining visibility and control throughout the sales chain.

- Heavy reliance on field sales and channel execution

Field sales teams are the foundation of CPG execution. They ensure product availability, manage retailer relationships, track shelf placement, and gather market feedback. Even the best brand strategies can fail at the last mile if they are not executed consistently in the field.

Distribution reach, shelf presence, and sales visibility are central to CPG companies' operations. A great product alone is insufficient; execution at the final mile is what determines success. Indeed, industry studies indicate that more than 70% of purchase decisions are influenced at the point of sale.

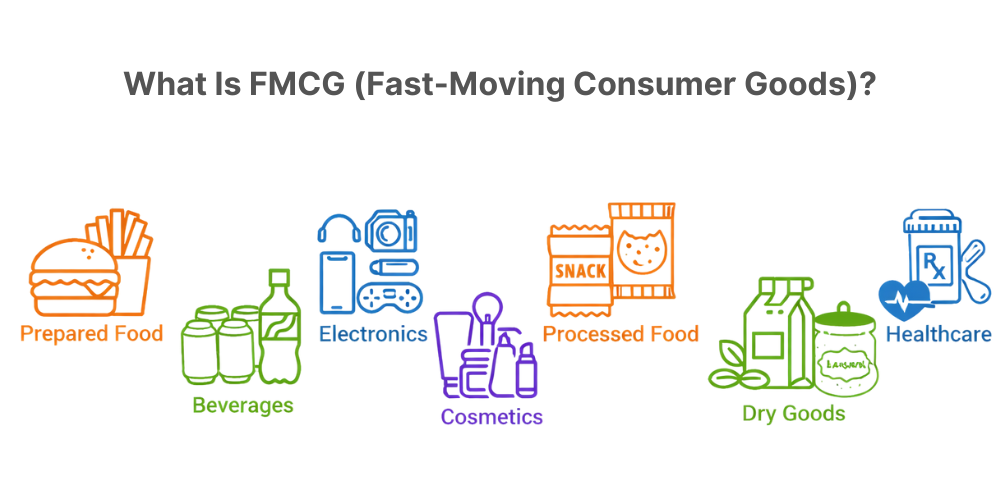

What Is FMCG (Fast-Moving Consumer Goods)?

Fast-Moving Consumer Goods (FMCG) are everyday items that are purchased frequently, consumed quickly, and replaced at a rapid rate. FMCG is a subset of CPG with one distinguishing characteristic: speed. These are low-cost products with high sales velocity and frequent repurchase cycles like snacks, soft drinks, soaps, toothpaste, and other necessities.

Key Characteristics of FMCG

-

High-volume, low-margin products

FMCG products are widely distributed but generate low profit per unit. This means that profitability is determined by scale and consistency rather than premium pricing, so continuous sales flow is critical for maintaining margin.

-

Rapid inventory turnover

Inventory in FMCG businesses moves quickly, often within days or weeks. This rapid movement necessitates close coordination among manufacturers, distributors, and retailers to ensure that products are replenished before shelves run out.

-

Strong dependence on beat planning and store coverage

FMCG success is heavily reliant on structured beat plans that ensure field sales representatives visit the correct stores at the appropriate frequency. Missed visits can disrupt the entire sales cycle, particularly in high-traffic locations.

-

Constant pressure to avoid stock-outs

Because FMCG products are daily necessities, consumers quickly switch brands when they are unavailable. Even short-term stockouts can lead to permanent customer loss and decreased market share.

What Is Retail?

Retail represents the final and most consumer-facing stage of the value chain: the point where products meet the end customer and purchasing decisions are made. It is the space where brand promises are either fulfilled or broken. Retailers include:

-

Kirana stores

-

Supermarkets

-

Modern trade chains

-

E-commerce platforms

Key Characteristics of Retail

-

Focus on store operations and customer experience

Retail success is heavily dependent on how efficiently stores are run and how customers perceive the purchasing process. Clean layouts, product availability, clear pricing, and simple checkout processes all have an impact on whether customers make a purchase or switch to a competitor.

-

Managing assortment, pricing, and promotions

Retailers must carefully balance product assortment to meet customer demand while remaining price sensitive and promotionally effective. Too many options can overwhelm customers, while poor pricing or ineffective promotions can reduce profit margins and sales volume.

-

Coordinating with multiple CPG and FMCG brands

Retailers collaborate with a number of different brands and distributors, each with their own supply cycles, promotional calendars, and expectations. Managing these relationships necessitates coordination, timely communication, and consistent performance on the shop floor.

-

Handling real-time inventory challenges

Inventory availability is one of the most difficult challenges in retail. Overstocking ties up capital and shelf space, whereas stock-outs have a direct impact on sales and customer trust. Retailers must constantly monitor inventory levels and rely on upstream partners for timely replenishment.

Retail success is dependent on product availability, visual merchandising, and timely replenishment, all of which are heavily reliant on upstream execution by brands and distributors.

CPG vs FMCG vs Retail: A Quick Comparison

|

Aspect |

CPG |

FMCG |

Retail |

|

Product Type |

Packaged goods |

Daily-use essentials |

Point of sale |

|

Sales Velocity |

Moderate |

Very high |

Transaction-based |

|

Key Challenge |

Distribution & visibility |

Speed & availability |

Inventory & margins |

|

Execution Focus |

Field sales effectiveness |

Beat adherence & replenishment |

Store operations |

While all three models work within the consumer goods ecosystem, their priorities are different. CPG focuses on brand development and distribution reach, FMCG on speed and availability, and retail on store operations and customer experience. Understanding these distinctions enables businesses to plan strategy, optimize field execution, and select the appropriate tools to ensure sales success.

Market Trends Shaping CPG, FMCG & Retail in 2026

The consumer goods ecosystem is evolving rapidly. Some trends shaping the landscape include:

1. Execution Is Becoming Data-Driven

According to industry research, companies that use real-time field sales dashboards achieve up to 25% faster issue resolution and 20% higher retail execution compliance than those that rely on spreadsheets and manual reports. Modern tools enable managers to track store visits, stock levels, and sales activity in real time, transforming field data into actionable insights.

Businesses can now swiftly find gaps in store coverage, allocate products optimally, and make quicker, more informed decisions that have a direct impact on revenue thanks to this change. Effective data harvesting gives businesses a distinct competitive edge over slower, manual systems by increasing compliance, increasing field sales efficiency, and turning insights into workable strategies.

2. Field Sales Teams Are More Distributed

Over 60% of FMCG field teams now operate in semi-urban or rural markets, creating a critical need for GPS-based tracking, task monitoring, and performance visibility. Managing these dispersed teams using conventional techniques becomes more difficult as brands penetrate deeper regions, raising the possibility of lost revenue opportunities, inconsistent reporting, and missed visits.

Businesses require technological solutions that offer GPS tracking, real-time task monitoring, and performance visibility in order to overcome these obstacles. These platforms bridge the gap between strategic planning and on-the-ground retail execution by ensuring that field teams reach the appropriate stores, carry out planned activities effectively, and report accurately. These days, a major factor in increasing sales and brand awareness is the effective management of remote teams.

3. Retailers Expect Faster Replenishment

Retailers now expect quicker and more dependable product replenishment, which is a third important trend. Stock-outs and delayed deliveries are no longer acceptable due to decreasing shelf space, growing competition, and rising customer expectations. Retailers expect timely shipments. accurate inventory management, and proactive communication from both brands and distributors.

Companies that fail to meet these expectations risk lost sales, weakened brand credibility, and missed market opportunities. Conversely, businesses that streamline supply chains, improve last-mile execution, and enhance responsiveness strengthen retailer relationships, maintain shelf presence, and ultimately increase both customer satisfaction and revenue.

Why Execution Is the Common Thread Across All Three

One idea applies to all businesses, whether they are part of a retail network, an FMCG distributor, or a CPG brand: "If you don't measure, you can't improve." Execution is the vital link that ties strategy to outcomes throughout the consumer goods ecosystem. Without adequate field sales tracking, precise store coverage, and prompt reporting, even the best product, brand, or marketing campaign may fall short.

Execution failures usually stem from:

-

Poor visibility into field activities

Managers lose control over the last mile when they are unable to see which stores have been visited, what products are stocked, or how sales representatives are doing. Decisions are postponed, coverage gaps are overlooked, and revenue-generating opportunities are lost.

-

Inconsistent store coverage

Field teams might visit too infrequently, omit some outlets, or carry out promotions improperly. Even one missed store visit can result in lost sales, a diminished brand presence, and disgruntled retailers in high-velocity markets like FMCG.

-

Delayed reporting

Delayed reporting keeps managers in the dark, forcing decisions based on outdated data. In CPG, FMCG, and retail, this can lead to missed sales, stock-outs, and poor store coverage. With real-time field sales tracking and reporting tools, businesses can access immediate insights, respond faster, and ensure consistent retail execution across all outlets.

-

Lack of coordination between sales, distribution, and retail teams

Without a unified system, various stakeholders may work in silos, resulting in misaligned priorities, duplicated effort, or operational inefficiencies. Ensuring seamless coordination across the value chain is critical for retail execution success.

And this is exactly where modern sales and workforce execution platforms come into play.

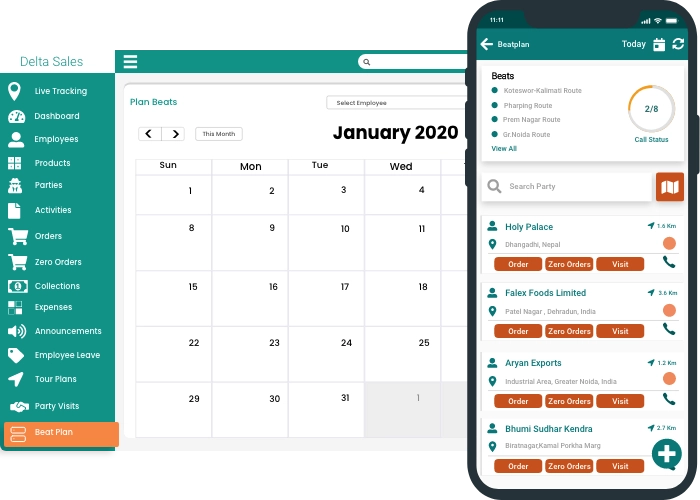

How DeltaSalesApp Fits Naturally into This Ecosystem

DeltaSalesApp was created to address the real-world challenges of CPG, FMCG, and retail operations, where success is determined not by boardroom strategies but by flawless execution on the ground. For brands and distributors, it serves as a unified platform that connects field teams, retail outlets, and management, ensuring that all plans are carried out efficiently and consistently.

For CPG & FMCG Brands

DeltaSalesApp helps:

-

Track field sales visits in real time

DeltaSalesApp allows brands and distributors field sales tracking in real time, giving managers full visibility into daily field activities. Companies can ensure that store coverage and retail execution meet planned standards by tracking which stores were visited, how long each visit lasted, and what tasks were completed. Real-time tracking not only reduces the likelihood of missed visits, but it also enables managers to intervene quickly when performance gaps are identified, ensuring consistent execution across all outlets.

-

Optimize beat plans and store coverage

With DeltaSalesApp, organizations can optimize beat plans and store coverage by analyzing performance data, store locations, and visit frequency. The platform helps field teams plan efficient routes that maximize reach while minimizing travel time, ensuring no store is overlooked. Optimized beat planning improves field sales productivity, strengthens retailer relationships, and ensures that promotional and merchandising activities are executed consistently, which is critical for CPG, FMCG, and retail success.

-

Monitor order booking and productivity

DeltaSalesApp enables businesses to track order booking and team productivity in real time, giving managers insight into how effectively sales representatives capture orders and meet targets. By tracking both the quantity and timing of orders, the platform ensures that inventory is allocated efficiently and sales cycles are uninterrupted. This capability not only improves secondary sales execution, but it also provides actionable data to help improve field operations and revenue growth.

-

Gain visibility into secondary sales execution

DeltaSalesApp offers complete visibility into secondary sales execution, allowing brands to see what happens after primary orders, such as stock movement from distributors to retailers. This transparency aids in identifying supply chain gaps, preventing stockouts, and ensuring maximum product availability at the point of sale. With accurate secondary sales data, businesses can make data-driven decisions about promotions, replenishment, and territory management, ensuring that every store visit has a measurable business impact.

For Distributors & Retail Networks

It enables:

-

Better coordination between sales reps and outlets

DeltaSalesApp improves coordination between sales representatives and retail outlets, ensuring that each store receives the proper attention at the appropriate time. By centralizing communication, task assignments, and updates, the platform eliminates the confusion and misalignment that frequently occur when multiple teams operate in different locations. Improved coordination allows distributors and retailers to collaborate seamlessly, resulting in more effective retail execution, consistent product placement, and stronger retailer relationships.

-

Faster issue resolution at the store level

DeltaSalesApp allows you to quickly identify and resolve store-level issues like stockouts, misplaced promotions, and delayed deliveries. Real-time reporting and field sales tracking enable managers to identify problems as they occur, rather than waiting for delayed reports. This rapid response reduces revenue loss, boosts retailer trust, and ensures that last-mile execution runs smoothly and efficiently throughout the supply chain.

-

Improved inventory movement and replenishment cycles

DeltaSalesApp provides complete visibility into inventory movement and replenishment cycles, allowing distributors and retailers to maintain optimal stock levels. By tracking stock in real time, the platform avoids overstocking and stock-outs, ensuring that products are available when customers are ready to buy. This results in more efficient supply chain management, faster product replenishment, and stronger secondary sales, ultimately increasing revenue and operational efficiency.

Instead of using separate tools for attendance, task tracking, order management, and reporting, DeltaSalesApp consolidates everything into a single unified platform, making execution simpler, faster, and more accountable.

From Strategy to Execution Excellence

Image recommendation here : A conceptual illustration of strategy → execution → results

Even the best strategies often fail due to a lack of execution visibility, rather than poor planning. As the saying goes, "Vision without execution is hallucination." In the fast-paced world of CPG, FMCG, and retail, plans alone cannot guarantee results; what happens on the ground determines success. DeltaSalesApp closes this critical gap by converting daily field activities into actionable insights, giving managers real-time information on field sales tracking, store coverage, order booking, and last-mile execution. Businesses that convert raw field data into clear, actionable information can respond to issues faster, optimize resource allocation, and scale operations more efficiently. This ability to monitor and improve retail execution in real time ensures that strategic plans yield measurable results, increased revenue, and stronger retailer-consumer relationships.

Conclusion

Understanding CPG, FMCG, and retail is more than just terminology; it's about aligning operations with reality. Brands that succeed will invest in execution visibility, provide field teams with the necessary tools, and strengthen their retailer relationships. Each execution tool provides value in its own way. However, for businesses looking for an all-in-one platform designed for real-world consumer goods operations, DeltaSalesApp offers a balanced, scalable, and execution-first solution.

Take control of your field execution today and ensure that each store visit generates revenue, efficiency, and growth. Experience Delta Sales App and transform your sales execution into something spectacular!