From Receipts to Reports: Streamlining Expense Management in Field Sales

Managing expenses in field sales has always been a challenge. From crumpled fuel receipts to handwritten meal bills and manual spreadsheets, expense management often becomes a messy, time-consuming process. For sales reps, it’s a distraction from selling. For managers, it’s a nightmare of errors, delays, and unclear reporting.

But modern businesses are no longer willing to accept this chaos as “normal.” Today’s field sales operations demand speed, accuracy, transparency, and control. And that’s exactly where streamlined expense management comes in transforming scattered receipts into structured, actionable reports that actually help businesses grow.

Let’s explore how expense management in field sales is evolving, why it matters more than ever, and how organizations can move from manual chaos to smart, automated systems.

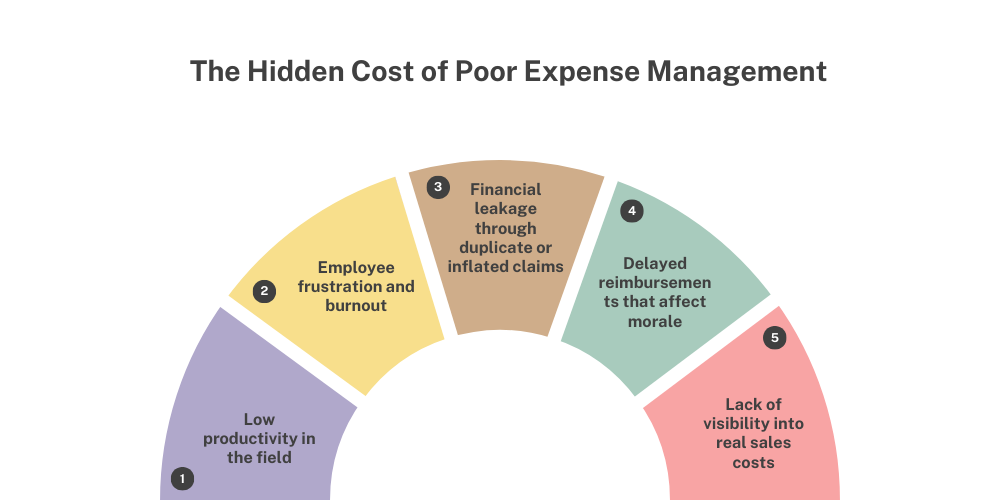

The Hidden Cost of Poor Expense Management

Poor expense management doesn’t just affect accounting, it quietly damages the entire sales ecosystem.

Sales reps waste time tracking expenses instead of building relationships. Managers struggle to validate claims and approvals. Finance teams face reconciliation issues, delayed closures, and inaccurate reporting. Over time, this creates:

-

Low productivity in the field: Sales reps spend valuable time managing receipts, filling forms, and tracking expenses instead of focusing on customer meetings, relationship building, and closing more deals.

-

Employee frustration and burnout: Manual expense processes create stress, confusion, and repeated follow-ups, leading to frustration, reduced motivation, and long-term burnout among field sales teams.

-

Financial leakage through duplicate or inflated claims: Poor controls allow duplicate entries, exaggerated expenses, and errors to slip through, causing hidden financial losses that gradually impact business profitability.

-

Delayed reimbursements that affect morale: Slow approvals and processing delays demotivate employees, reduce trust in management, and negatively impact morale, directly affecting field performance and engagement.

-

Lack of visibility into real sales costs: Disconnected expense data prevents accurate cost analysis, making it difficult for leaders to understand true sales expenses and make informed strategic decisions.

In short, unmanaged expenses create invisible losses that don’t show up immediately but slowly erode profitability and operational efficiency.

Why Field Sales Expense Tracking Is More Complex

Field sales expenses are not like office expenses. They are dynamic, unpredictable, and spread across multiple locations.

A single sales rep may incur:

-

Travel and fuel costs: Sales reps travel daily across multiple territories, making fuel and travel expenses frequent, variable, and difficult to track accurately without real-time digital recording.

-

Client meeting expenses: Costs for meals, refreshments, and meeting arrangements vary by customer and location, making manual tracking inconsistent and prone to errors and missing records.

-

Accommodation charges: Outstation visits and overnight stays generate hotel expenses that are irregular, location-based, and often poorly documented in manual reporting systems.

-

Sampling and demo costs: Product samples and demos create small but frequent expenses that are easily forgotten, misreported, or disconnected from actual sales outcomes.

-

Local logistics and delivery expenses: Local transport, courier, and delivery costs change daily, making consistent tracking difficult without structured digital systems.

Tracking these manually means relying on memory, paper, WhatsApp photos, and end-of-month reports. This not only increases the risk of errors but also disconnects expenses from actual sales activities making cost analysis almost impossible.

The Shift from Paper to Digital Expense Capture

The first big transformation in expense management is digitization. Moving from physical receipts to digital records creates clarity, structure, and accountability.

With digital capture:

-

Receipts are uploaded instantly: Sales reps capture receipts immediately through mobile devices, reducing loss, delays, and dependency on physical documents for later reporting or verification.

-

Expenses are logged in real time: Real-time logging ensures accurate records, faster approvals, and better control over daily spending without waiting for weekly or monthly reporting cycles.

-

Data is structured, not scattered: Digital systems organize expense data into categories and formats, making it searchable, reportable, and usable for analysis and decision-making.

-

Loss of receipts becomes irrelevant: Digital uploads eliminate dependency on paper, preventing data loss, missing proofs, and disputes caused by misplaced physical receipts.

-

Transparency improves across teams: All stakeholders can view expenses clearly, improving trust, accountability, visibility, and collaboration between sales, managers, finance, and operations teams.

This shift turns expense tracking from a reactive process into a proactive system that supports daily operations instead of slowing them down.

Real-Time Expense Logging: A Game Changer for Field Teams

Real-time expense logging changes everything. Instead of waiting for weekly or monthly reports, expenses are recorded at the moment they occur. This creates:

-

Accurate records: Expenses recorded instantly reduce memory-based errors, duplicate entries, and missing information, creating reliable, trustworthy financial records for both sales and finance teams.

-

Better budget control: Real-time tracking helps managers monitor spending patterns continuously, control overspending early, and manage budgets proactively instead of reacting after reports are submitted.

-

Faster approvals: Instant submission enables quicker verification and approval workflows, reducing delays, backlog, and dependency on manual follow-ups or paperwork.

-

Immediate visibility for managers: Managers can see live expense activity across teams, enabling faster decisions, better supervision, and real-time operational control.

-

Reduced disputes and corrections: Clear, time-stamped records minimize misunderstandings, incorrect claims, and approval conflicts between sales reps, managers, and finance teams.

It also allows businesses to connect expenses directly to activities like store visits, meetings, and orders turning raw data into meaningful insights.

Approval Workflows That Actually Work

Traditional approval systems are slow, hierarchical, and often confusing. Papers move between departments. Emails get lost. Approvals get delayed.

Modern expense systems use structured workflows:

-

Auto-routing to the right manager: Expense claims are automatically sent to the correct approver based on roles and hierarchy, eliminating confusion, misrouting, and unnecessary approval delays.

-

Rule-based approvals: Predefined rules decide approval paths, reducing manual decisions, speeding up processing, and ensuring consistent treatment of all expense claims.

-

Policy checks in real time: The system validates expenses instantly against company policies, preventing violations before submission instead of detecting issues later.

-

Instant notifications: Real-time alerts keep managers and employees informed, reducing follow-ups, missed approvals, and unnecessary communication delays.

-

Clear audit trails: Every action is recorded with timestamps and user details, creating transparent, traceable records for compliance, audits, and accountability.

This creates faster reimbursements, better compliance, and stronger trust between teams and management.

Policy Compliance Without Policing

One of the biggest challenges in expense management is enforcing company policies without turning into a policing system.

Smart systems embed policies into workflows:

-

Category limits: Spending limits are automatically applied to expense categories, preventing over-claiming while guiding sales reps to stay within approved business spending boundaries.

-

Daily allowances: Predefined daily limits control routine expenses, ensuring fair usage, cost discipline, and consistency without manual enforcement or constant supervision.

-

Approval thresholds: Higher-value expenses are automatically escalated for additional approvals, maintaining financial control without slowing down routine, low-value claims.

-

Location-based rules: Expense policies adjust based on territory or city, allowing fair allowances while maintaining consistent compliance across different regions.

-

Role-based permissions: Access and approval rights are defined by roles, ensuring accountability, security, and proper control without unnecessary managerial intervention.

This ensures compliance automatically without confrontation, confusion, or conflict. Sales reps know what’s allowed. Managers don’t need to micromanage. Finance teams don’t need to chase errors.

From Data to Decisions: The Power of Expense Analytics

When expense data is structured, it becomes a strategic asset.

Businesses can analyze:

-

Cost per visit: Analyzing expenses per customer visit helps businesses understand travel efficiency, optimize routes, and reduce unnecessary spending while maintaining sales effectiveness.

-

Cost per order: Tracking expense per order reveals true sales acquisition costs, helping organizations improve profitability and pricing strategies.

-

Cost per territory: Territory-wise expense analysis highlights high-cost and high-return regions, enabling smarter resource allocation and territory planning.

-

Cost per salesperson: Expense tracking per rep helps measure efficiency, performance, and ROI, supporting fair incentives and performance-based management decisions.

-

ROI on field activities: Comparing expenses with sales outcomes shows which activities deliver real value, helping teams focus on high-impact actions.

This transforms expense management from bookkeeping into decision-making intelligence. Leaders can optimize routes, budgets, incentives, and resource allocation based on real insights—not assumptions.

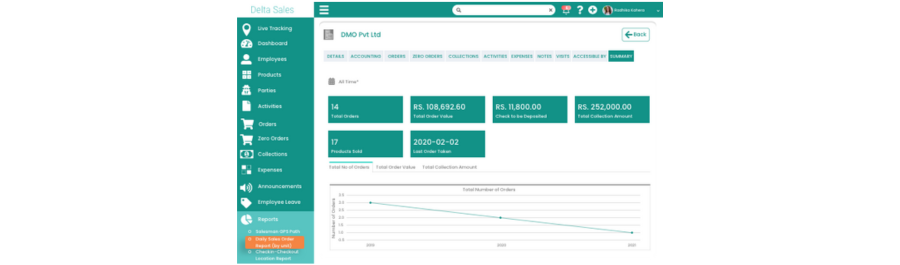

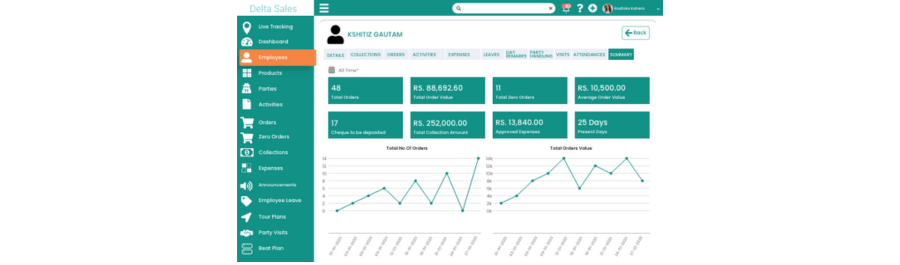

Integration with Sales and Operations

Expense management shouldn’t live in isolation. It should connect with the entire sales ecosystem.

When expenses integrate with:

-

Sales activities: Linking expenses to sales tasks helps track spending related to specific deals, improving cost control and sales efficiency.

-

Orders and invoices: Connecting expenses with orders and invoices ensures accurate financial reconciliation and visibility into the true cost of sales.

-

Customer visits: Integrating expense data with visit records provides insights into visit-related costs, enabling better planning and resource allocation.

-

Route planning: Expense tracking tied to routes helps optimize travel costs, reduce inefficiencies, and improve overall field operations.

-

Performance tracking: Combining expenses with performance metrics allows evaluation of cost-effectiveness, helping managers reward productivity and control budgets.

Organizations gain a 360-degree view of field operations. This alignment turns expense data into operational intelligence rather than isolated financial records.

This is where solutions like field sales management software, sales force automation tools, mobile CRM for sales teams, field employee tracking systems, retail execution platforms, route optimization software, order management apps, and expense reporting systems naturally become part of a connected digital ecosystem streamlining operations without complexity.

Faster Reimbursements, Higher Morale

Delayed reimbursements are one of the biggest morale killers in field sales.

When expense systems are automated:

-

Claims are processed faster: Automation speeds up expense claim handling, reducing waiting times and ensuring employees receive reimbursements promptly.

-

Approvals happen in real time: Instant approval workflows eliminate bottlenecks, allowing quicker verification and payment without unnecessary delays.

-

Errors are minimized: Automated checks reduce manual mistakes, preventing costly rejections and repeated corrections in expense submissions.

-

Trust increases: Transparent, reliable processes build confidence between sales reps, managers, and finance teams, strengthening workplace relationships.

-

Employee satisfaction improves: Faster reimbursements and smoother processes boost morale, motivation, and loyalty among field sales staff.

Happy sales reps perform better. And better performance directly impacts revenue growth.

Security, Transparency, and Audit Readiness

Modern expense management also strengthens governance.

Digital systems provide:

-

Secure data storage: Digital expense systems store data safely with encryption and backups, protecting sensitive financial information from loss, theft, or unauthorized access.

-

Clear audit trails: Every transaction and approval is logged with timestamps and user details, creating transparent, traceable records for accountability and review.

-

Tamper-proof records: Immutable records prevent unauthorized changes, ensuring the integrity and reliability of expense data throughout its lifecycle.

-

Compliance-ready reporting: Automated reports align with regulatory and company policies, simplifying compliance and reducing the risk of violations or penalties.

-

Easy audits and reconciliations: Structured, accessible data speeds up audits and financial reconciliations, reducing time, effort, and errors during reviews.

This protects organizations from internal risks while improving financial discipline.

Building a Scalable Expense Framework

As businesses grow, manual processes collapse under scale. What works for 5 reps fails for 50. What works for 50 fails for 500.

Scalable expense management systems are:

-

Cloud-based: Cloud systems allow centralized access, real-time updates, and easy scalability, ensuring expense data remains accessible and consistent across growing teams and multiple locations.

-

Mobile-first: Mobile-first design enables field reps to log expenses anytime, anywhere, ensuring adoption, accuracy, and real-time data capture in dynamic field environments.

-

Policy-driven: Built-in policies automate compliance, standardize spending behavior, and maintain financial discipline without manual monitoring or enforcement.

-

Analytics-enabled: Advanced analytics convert expense data into insights for forecasting, budgeting, and strategic planning across expanding operations.

-

Workflow-automated: Automated workflows handle submissions, approvals, and reimbursements efficiently, reducing delays and operational workload as the organization scales.

This allows organizations to grow without operational friction.

Conclusion

From lost receipts to real-time reports, the journey of expense management in field sales reflects a larger transformation from manual operations to intelligent systems.

Streamlined expense management improves productivity, transparency, compliance, and decision-making. It empowers sales teams, simplifies management, and strengthens financial control. More importantly, it turns expenses from a problem into a strategic advantage.

This is where modern platforms like Delta Sales App play a critical role bringing together expense tracking, field sales operations, reporting, and management into a single connected system that helps businesses move from chaos to control, and from paperwork to performance.

Because in today’s competitive world, growth doesn’t come from working harder, it comes from working smarter.

Ready to Transform Your Field Sales Expense Management?

Stop letting manual processes slow your team down. Discover how streamlined, real-time expense tracking can boost productivity, reduce errors, and accelerate reimbursements.

Try a demo of the Delta Sales App today and see how easy expense management can be!