How FMCG Giants Like HUL and Nestlé Tackle Field Sales Challenges?

In the fast-paced world of Fast-Moving Consumer Goods (FMCG), visibility and control on the ground aren't just helpful—they're essential. Household names like Hindustan Unilever (HUL), Nestlé, and P&G dominate retail shelves not just because of great products or branding, but because of field sales excellence.

Behind the scenes, these giants run vast sales networks, execute tight beat plans, monitor retail activity in real-time, and constantly tweak performance. And while they’ve invested millions in building such systems, there’s good news: many of their practices are now accessible to growing FMCG brands through modern tech.

Let’s explore how the biggest players tackle field sales challenges—and how you can too.

🧩 The Core Challenges of FMCG Field Sales

Field sales in FMCG is like orchestrating a live concert across thousands of small stages. Whether you're a global giant or a regional player, the operational hurdles are largely the same:

1. Managing a Dispersed Sales Team

Sales reps are constantly on the move—across towns, cities, and rural belts. Ensuring they stick to their routes and hit their daily targets is easier said than done.

2. Lack of Real-Time Visibility

Traditional systems don’t tell you:

Which outlet your rep is currently visiting

What orders are being placed

Where execution gaps exist

This black box problem reduces control and delays interventions.

3. Manual Order Taking

In many cases, field reps still jot down orders manually. This leads to:

Delayed order processing

Miscommunication

Inventory planning issues

4. Inconsistent Beat Plan Execution

Without digital monitoring, reps often skip outlets or rearrange their daily plan based on convenience, not priority. This causes gaps in retail coverage and missed sales.

5. Secondary Sales & Van Tracking Difficulties

Van sales and secondary distribution in rural areas remain underreported. Manual data updates often lack accuracy, making territory-wise performance analysis hard.

In short: Even the best brands grapple with complexity. What separates them is how they’ve optimized their approach.

🏆 How Giants Like HUL and Nestlé Navigate These Challenges

Let’s unpack what global leaders actually do differently—and what systems are behind their unbeatable execution.

🔹 Hindustan Unilever (HUL): The Beat Plan Masters

HUL’s salesforce is one of the most sophisticated in India, especially in terms of beat planning and outlet segmentation.

They:

Define every rep’s route with precision (urban & rural)

Prioritize high-value outlets

Track deviations in beat plans using proprietary apps

Align incentives to field discipline

What You Can Learn:

Create fixed, GPS-based beat routes

Monitor schedule adherence through mobile tech

Segment outlets (A/B/C) based on order potential

🔹 Nestlé: The Rural Distribution Leader

Nestlé India is known for last-mile rural penetration, especially for products like Maggi, Cerelac, and Nescafé.

Their tactics include:

Partnering with local micro-distributors

Using van sales units for deep rural

Monitoring secondary sales in real-time

What You Can Learn:

Adopt van sales tracking via mobile apps

Monitor secondary stock depletion

Use lightweight systems to train and track local distributors

🔹 P&G: Data-Driven Incentive Engine

Procter & Gamble is highly analytical about rep performance. They invest in dashboards that show:

SKU-wise sales trends

Retailer coverage heatmaps

Incentive mapping based on data

What You Can Learn:

Use dashboards to reward performance

Analyze product-level data across territories

Identify underperforming SKUs or reps before targets slip

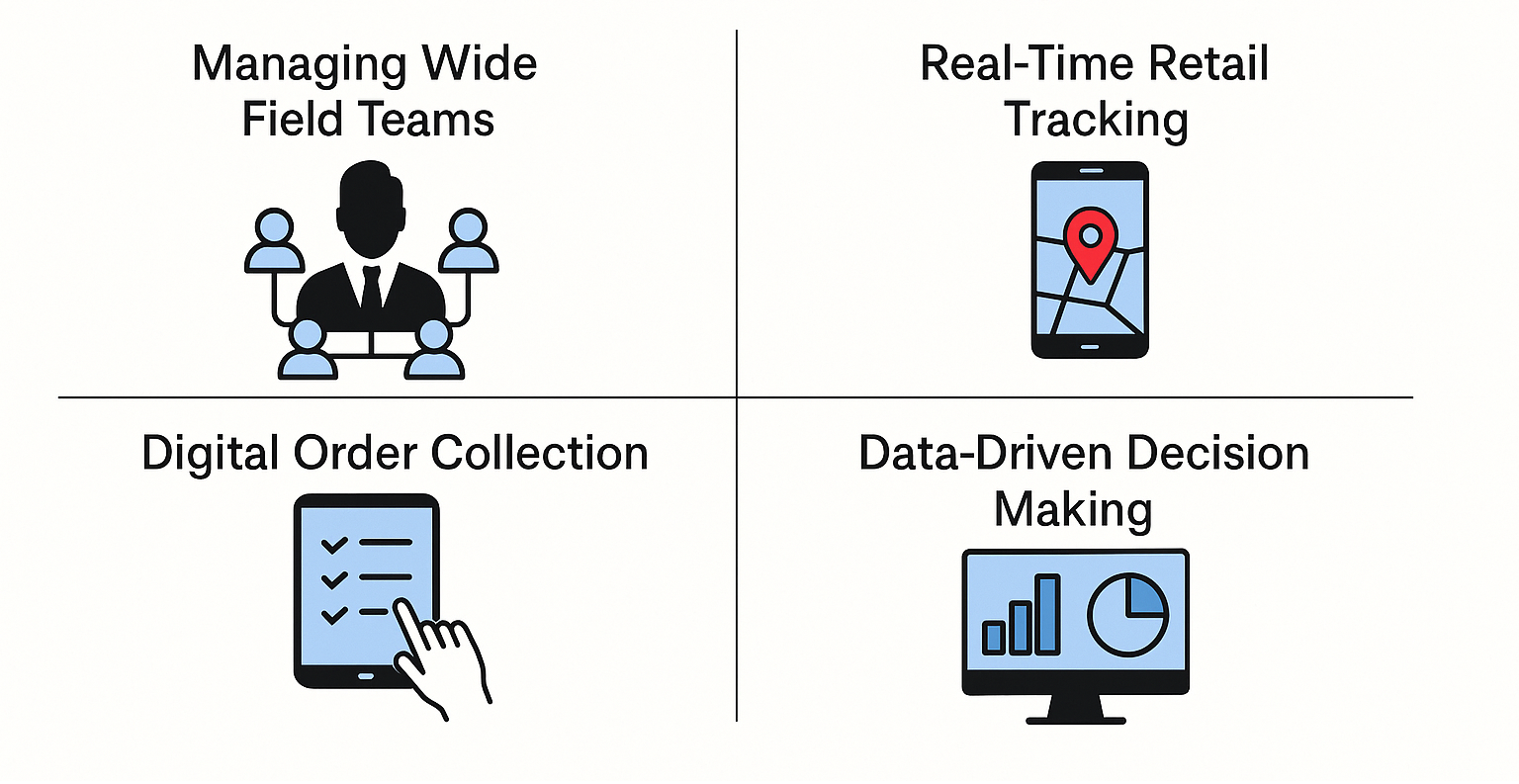

⚙️ The Technology Shift: How You Can Replicate These Strategies

You don’t need a billion-dollar war chest to achieve this kind of control. With modern sales automation platforms, regional FMCG brands can now plug into the same tactics at a fraction of the cost.

✅ Live Field Tracking

Know exactly:

Which outlet your rep visited

Time spent per visit

Location check-ins with GPS

This improves productivity and discipline while reducing sales leakages.

✅ Digital Order Collection

Ditch the notebooks. Reps can:

Punch orders via mobile

Upload instantly to the backend

Access past order history for upselling

Faster orders mean faster delivery and higher order frequency.

✅ Beat Plan Automation

Pre-load daily routes. If reps deviate or skip outlets, get:

Instant alerts

Route change logs

Missed outlet flags

This boosts outlet coverage and ensures no customer is left out.

✅ Real-Time Dashboards

Access:

Region-wise sales heatmaps

Rep-wise target vs achievement

Product-wise sell-through

Managers no longer wait for weekly updates. They act on today’s numbers, today.

🔍 Case Insight: Big-Brand Moves You Can Replicate

💡 Example 1: Nestlé’s Rural Push

Nestlé trained over 20,000 micro-distributors and synced them to a digital reporting platform. The result?

40% higher secondary sales in untapped villages

Better forecasting of demand in low-density areas

💡 Example 2: HUL’s Shakti Initiative

They turned thousands of rural women into sales agents and equipped them with mobile ordering apps.

Created reach in over 100,000 villages

Reduced cost of rural distribution

You can replicate this by empowering small distributors and tracking their activity digitally.

📈 Why This Matters for Growing FMCG Brands

You may not be Nestlé or HUL — but you're trying to solve the same problem:

👉 "How do I control my salesforce better, move more product, and improve outlet reach?"

With platforms like Delta Sales App, these answers become accessible.

Plug-and-play setup — no custom build required

Flexible pricing — pay as you grow

Easy onboarding — reps learn it in hours, not weeks

📚 Real Results for Regional Players

Local FMCG brands that adopted digital tools saw:

25–30% increase in order frequency

Reduced rep idling time by 40%

Faster order-to-dispatch cycles

Better visibility into non-performing outlets

When execution becomes data-driven, so does growth.

🔑 Final Takeaway: Systems > Size

The real difference between you and an FMCG giant isn’t budget — it’s systems.

They track, measure, and respond instantly.

They’ve systematized field sales.

They win because they execute better, not just because they’re big.

Now, you can too.

💬 Ready to Operate Like the Giants?

If you're building a consumer brand and want to:

Improve outlet reach

Track reps in real-time

Collect more orders

Beat your sales targets

Then sales automation is your next big move.

👉 Book a Free Demo of Delta Sales App

See how regional FMCG brands are scaling like never before — no tech team needed.

Explore more

👉Beat and Route Plan in FMCG Sales

👉Mastering SWOT Analysis for FMCG Success

See What Users Say About Us!

Start your digital transformation with Delta Sales App.