The Ultimate 30-Question FMCG FAQ Guide-2 With Detailed Answers

One of the most competitive, fast-paced, and execution-driven industries in the global market is the fast-moving consumer goods (FMCG) sector. Success today depends on real-time visibility, sales efficiency, data-driven decision-making, and disciplined field execution - not just strong products and wide distribution.

This guide answers the 30 most essential FMCG questions, covering everything from sales force automation and distribution management to inventory control, credit policies, and growth strategies. Whether you are managing a distribution network, optimizing your sales team, or planning to scale your brand, this handbook serves as a practical FMCG knowledge base for professionals seeking operational excellence and measurable results.

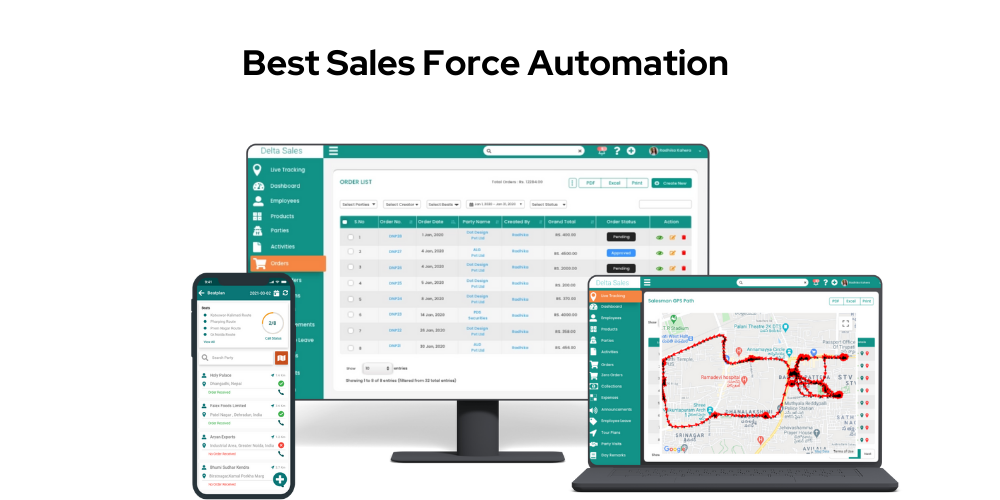

1. What is an SFA app?

An SFA (Sales Force Automation) app is a digital tool designed to manage, track, and optimize the daily activities of FMCG sales teams. It replaces manual reporting with real-time data capture from the field.

Key functions of an SFA app include:

-

Order management: Captures retailer orders digitally, reducing errors and delays

-

Field activity tracking: Records daily visits, coverage, and productivity

-

Sales reporting: Generates instant performance reports for managers

-

Beat and route planning: Ensures disciplined market execution

SFA apps are now essential for companies managing large field forces across multiple territories.

2. Why do distributors need a sales app?

Distributors operate at the center of FMCG execution, handling inventory, sales, and retailer relationships. A sales app improves operational visibility and control.

Benefits of using a distributor sales app:

-

Reduced sales leakage: Eliminates fake or unrecorded orders

-

Better market visibility: Real-time secondary sales data

-

Improved outlet coverage: Tracks which retailers are visited

-

Performance monitoring: Measures salesman productivity and order value

This level of automation helps distributors scale without losing control.

3. How does GPS help?

GPS technology plays a critical role in field force monitoring and compliance.

GPS-enabled features help by:

-

Tracking salesman location: Confirms market presence

-

Ensuring route compliance: Checks if planned beats are followed

-

Validating outlet visits: Confirms actual retailer interaction

-

Reducing false reporting: Prevents backdated or fake entries

![]()

GPS brings accountability and transparency to FMCG field sales operations.

4. What is digital order-taking?

Digital order-taking means capturing retailer orders directly on a mobile device instead of paper.

Why it matters in FMCG:

-

Real-time order sync: Orders reach distributors instantly

-

Faster delivery cycles: Reduced processing delays

-

Zero manual errors: Eliminates handwriting and data-entry mistakes

-

Instant inventory visibility: Avoids over-promising stock

Digital order-taking directly improves service levels and retailer satisfaction.

5. How does technology reduce fake orders?

Fake or inflated orders are a common problem in manual systems. Technology minimizes this through built-in verification layers.

Key controls include:

-

Geo-tagged orders: Orders can be placed only at retailer locations

-

Time-stamped entries: Prevents backdated submissions

-

Automated reporting: No manual manipulation of sales data

-

Visit verification: Confirms salesman presence during order capture

These checks ensure data authenticity across the sales chain.

6. What is retailer mapping?

Retailer mapping involves digitally plotting all outlets on a geographic map to improve planning and execution.

Benefits of retailer mapping:

-

Optimized beat planning: Logical routes reduce travel time

-

Better territory coverage: Identifies missed or uncovered outlets

-

Accurate market sizing: Helps plan distributor expansion

-

Improved visit discipline: Ensures no outlet is ignored

Retailer mapping is foundational for scalable FMCG distribution.

7. What is geo-fencing?

Geo-fencing creates a virtual boundary around a retailer’s physical location.

How it improves sales control:

-

Restricts order-taking: Only allows orders within retailer premises

-

Stops remote order entry: Prevents sitting-at-home reporting

-

Improves data accuracy: Confirms actual market execution

Geo-fencing strengthens trust in field sales data.

8. How are secondary sales tracked?

Secondary sales tracking records daily sales from distributors to retailers.

Technology enables this by:

-

Logging retailer-wise orders daily:

Capturing daily orders outlet by outlet helps track actual market movement, ensures accurate billing, and improves visibility into which retailers are actively purchasing. -

Providing SKU-level visibility:

Viewing sales by individual SKU makes it easier to identify fast-moving products, slow movers, and gaps in assortment at the retailer level. -

Tracking salesman contribution to sales:

Measuring sales generated by each salesman helps evaluate productivity, territory performance, and accountability in the field. -

Enabling demand forecasting:

Consistent and accurate sales data supports better demand planning, helping companies avoid stockouts, overstocking, and expiry losses.

Accurate secondary sales data is critical for inventory planning and stock replenishment.

9. How do digital reports reduce leakage?

Digital reports replace manual registers and Excel sheets, which are prone to manipulation.

Key advantages of digital reporting:

-

Real-time dashboards: No delay in data access

-

Single source of truth: Everyone views the same numbers

-

Automated calculations: Eliminates human bias

-

Audit-ready data: Easier compliance and checks

Transparency directly reduces revenue leakage.

10. Why is technology essential in 2025?

In 2025, FMCG success depends on speed, precision, and execution quality.

Technology is no longer optional because:

-

Competition is intense: Faster brands win shelf space

-

Margins are thin: Leakage control is critical

-

Markets are fragmented: Manual tracking doesn’t scale

-

Retailer expectations are higher: Faster service is mandatory

Sales automation, real-time tracking, and data-driven decision-making are now core pillars of FMCG growth.

11. Why do retailers take credit?

Retailers often operate on thin cash buffers and rely on credit to keep shelves stocked and sales running.

Common reasons retailers ask for credit:

-

Cash flow gaps: Daily expenses exceed immediate cash collections

-

Higher inventory needs: Stocking more SKUs to improve sales

-

Seasonal demand: Festivals or peak seasons require extra stock

Credit helps retailers grow sales but increases financial risk for distributors.

12. What is credit aging?

Credit aging tracks how long a retailer has delayed payment after the invoice date.

Why credit aging matters:

-

Identifies risky retailers: Long overdue payments signal trouble

-

Improves cash flow planning: Helps prioritize collections

-

Controls bad debt: Early action reduces loss

Credit aging is usually categorized into 0–15, 16–30, 31–60, and 60+ day buckets.

13. How do companies control credit risk?

FMCG companies manage credit risk through policy, discipline, and tracking.

Key control measures include:

-

Defined credit limits: Prevents over-exposure

-

Approval workflows: Extra checks for high-value credit

-

Payment reminders: Follow-ups before dues escalate

-

Digital tracking: Real-time visibility of outstanding amounts

Structured credit control protects margins and working capital.

14. Why do retailers delay payment?

Payment delays are often operational rather than intentional.

Common causes include:

-

Slow-moving inventory: Stock not converting to cash

-

Low sales velocity: Reduced footfall or demand

-

Weak distributor relationship: Less urgency to pay

-

Temporary cash crunch: Expenses exceed collections

Understanding the reason helps decide whether to support or restrict credit.

15. What is a credit limit?

A credit limit is the maximum outstanding amount a retailer is allowed at any time.

How credit limits are decided:

-

Sales history: Average monthly purchases

-

Payment behavior: Past delays or defaults

-

Shop potential: Location, footfall, category mix

Credit limits balance sales growth with financial safety.

16. How do distributors manage working capital?

Working capital management ensures smooth daily operations.

Best practices include:

-

Cash-based purchasing: Reduces dependency on borrowing

-

Controlled retailer credit: Prevents cash blockage

-

Fast stock rotation: Converts inventory into cash quickly

Healthy working capital keeps distribution sustainable.

17. Margin vs. markup?

These terms are often confused but mean different things.

-

Margin:

Profit ÷ Selling Price

→ Shows profitability from revenue perspective -

Markup:

Profit ÷ Cost Price

→ Shows pricing increase over cost

Understanding both helps distributors price products correctly.

18. Why is cash flow more important than margins?

High margins look attractive but mean little without timely collections.

Why cash flow matters more:

-

Pays suppliers and salaries on time

-

Supports daily operations

-

Prevents borrowing and interest costs

In FMCG, cash-in-hand beats profit-on-paper.

19. How do incentives work?

Incentives motivate distributors, salesmen, and retailers to push sales.

Common incentive types include:

-

Volume slabs: Higher rewards for higher sales

-

Visibility bonuses: Better shelf placement or displays

-

Product-wise incentives: Focus on priority or slow SKUs

Well-designed incentives drive both sales and execution quality.

20. What causes financial losses?

Financial losses usually come from operational gaps, not pricing alone.

Major loss drivers include:

-

Bad credit: Non-recovery of retailer dues

-

Expiry losses: Poor stock planning or rotation

-

Sales leakage: Untracked or fake transactions

-

Low stock turnover: Capital stuck in inventory

-

Wrong brand or SKU selection: Poor market demand fit

Preventing losses requires discipline across sales, inventory, and finance.

21. How do distributors scale?

Distributors scale by expanding reach, capacity, and portfolio while maintaining operational control.

Key ways distributors scale:

-

More beats: Adding new routes to cover additional areas

-

More retailers: Onboarding new outlets to increase sales base

-

More brands: Expanding product portfolio to improve revenue per outlet

-

More vehicles: Faster deliveries and wider daily coverage

Successful scaling balances growth with cash flow and service quality.

22. What influences territory expansion?

Territory expansion decisions are data-driven and geography-dependent.

Major influencing factors include:

-

Population size: Higher population means higher consumption potential

-

Retailer density: More shops increase sales opportunities

-

Logistics feasibility: Distance, road connectivity, delivery time

-

Competitive intensity: Existing brand presence and distributor strength

Poor territory planning leads to high costs and low efficiency.

23. How do FMCG companies enter new markets?

Entering a new market requires local adaptation and execution discipline.

Common entry strategies include:

-

Appointing local distributors: Leverages local market knowledge

-

Introductory promotions: Encourages trial and adoption

-

Sampling activities: Builds product trust

-

Localized pricing: Matches regional affordability

Execution quality matters more than advertising in early stages.

24. Why do some FMCG brands grow fast?

Fast-growing FMCG brands align demand creation with strong execution.

Key growth drivers are:

-

Strong brand positioning: Clear value proposition

-

High consumer demand: Solving a real need

-

Wide distribution reach: Availability across outlets

-

Aggressive marketing: Consistent visibility and promotions

Growth accelerates when brand pull meets distribution push.

25. What is trade marketing?

Trade marketing focuses on influencing retailers and distributors rather than end consumers.

Its objectives include:

-

Improving shelf visibility

-

Encouraging range stocking

-

Motivating retailers to recommend products

-

Supporting distributor sell-in and sell-out

Trade marketing bridges the gap between brand strategy and retail execution.

26. What are brand activations?

Brand activations are on-ground activities that drive trial and awareness.

Common activation formats include:

-

Product sampling: Encourages first-time usage

-

Roadshows: Increases local visibility

-

In-store demos: Converts walk-in consumers

-

Promotional events: Boosts short-term sales

Activations are especially effective during launches and festivals.

27. Why do new products fail?

Most new FMCG product failures occur due to execution gaps, not product quality.

Primary failure reasons include:

-

Weak consumer demand: No real need or differentiation

-

High pricing: Mismatch with target market affordability

-

Limited distribution: Poor availability at retail

-

Insufficient marketing: Low awareness and trial

A strong go-to-market strategy is critical for success.

28. How do distributors choose brands?

Distributors evaluate brands based on profitability, demand, and company support.

Key selection criteria include:

-

Market demand: Pull from retailers and consumers

-

Margin structure: Sustainable profitability

-

Company support: Schemes, marketing, logistics

-

Product range: Ability to sell multiple SKUs

-

Brand reputation: Trust and long-term potential

Distributors prefer brands that grow with them.

29. What is the future of FMCG distribution?

The FMCG distribution model is rapidly evolving due to technology and competition.

Key future trends include:

-

Digitalization: Paperless sales and reporting

-

Automation: Faster order processing and billing

-

Improved logistics: Shorter delivery cycles

-

AI-based forecasting: Smarter inventory and demand planning

Efficiency, speed, and data accuracy will define future leaders.

30. What skills matter most in FMCG?

Success in FMCG depends on a blend of commercial, operational, and people skills.

Most critical skills include:

-

Sales management: Driving targets and execution

-

Negotiation: Managing retailers and distributors

-

Operations control: Inventory, logistics, and processes

-

Financial understanding: Margins, cash flow, credit

-

Relationship building: Long-term trade partnerships

FMCG rewards professionals who combine discipline with market understanding.

Conclusion

The FMCG industry values speed, availability, discipline, and execution excellence. From understanding fundamental FMCG concepts to mastering distribution, sales force management, inventory control, credit discipline, and growth strategy, success depends on how consistently these principles are executed in daily operations.

Visibility, control, and data-driven decision-making are now the real drivers of growth, not just effort. Manual processes, delayed reporting, and guesswork create operational leakages that modern FMCG businesses can no longer afford.

Adopting the right sales automation platform is essential to strengthen distributor performance, improve retail execution, reduce revenue leakage, and scale operations with confidence.

Delta Sales App empowers FMCG companies and distributors with real-time visibility into field sales, outlet coverage, secondary sales, and team productivity - while keeping operations simple, transparent, and fully under control.