Best Practices for FMCG Retail Execution

In today’s highly competitive FMCG market, success is determined at the retail shelf. Regardless of strong marketing or product quality, true impact comes from FMCG Retail Execution, how effectively products are placed, displayed, and sold in stores. Customers demand availability and convenience, retailers expect accurate orders and quick replenishment, and companies seek data-driven performance and efficiency. To meet these expectations, leading FMCG brands are reimagining field operations, retail visibility, merchandising processes, and supply chain coordination.

This guide outlines essential best practices for stronger execution and explains why digital solutions like FMCG Sales Automation are now critical for real-time control and consistent growth.

Understanding the Importance of FMCG Retail Execution

The retail shelf is the ultimate battleground for FMCG brands. Effective retail execution ensures that your product is not only available but also visible, correctly priced, well-stocked, and promoted in alignment with your brand strategy. Strong execution:

-

Improves sales velocity and off-take

-

Enhances brand recall

-

Reduces stock-outs and lost sales

-

Strengthens retailer relationships

-

Improves territory-level planning and market coverage

However, achieving consistent retail excellence across multiple distributors, territories, and field teams is challenging without a structured strategy, proper training, and technology-driven insights.

Key Pillars of Effective FMCG Retail Execution

FMCG retail execution is built on core pillars that ensure accuracy and consistency across markets. These pillars guide field teams, distributors, and retail partners toward a unified execution model.

-1766310218.png)

-

Product Availability: Ensuring optimal stock levels across outlets prevents lost sales and keeps products consistently accessible to customers. Tracking Primary vs. Secondary Sales, monitoring expiry dates, and using real-time inventory visibility help brands avoid both stock-outs and excess stock.

-

In-Store Branding & Promotions: Effective branding and promotions engage shoppers, boost impulse purchases, and highlight value during competitive buying moments. Timely setup, compliance tracking, and data-driven evaluation ensure promotional campaigns deliver measurable sales uplift and consistent retail execution.

-

Order Taking & Replenishment Efficiency: Accurate and timely order collection drives smooth replenishment and prevents stock gaps across retail outlets. Using FMCG Sales Automation reduces errors, improves distributor coordination, accelerates delivery cycles, and ensures reliable SKU availability.

-

Retailer Relationship Management: Strong retailer relationships secure better visibility, faster product acceptance, and higher support for promotions and launches. Consistent communication, transparency, and service help build trust, leading to long-term collaboration and stronger market influence.

Role of Field Sales Teams in Strong Retail Execution

Field sales teams are the backbone of FMCG retail execution. Their daily activities determine the on-ground performance of the brand.

Key responsibilities include:

-

Checking stock levels: Field teams verify product quantities, identify low or missing SKUs, and ensure timely replenishment. This prevents stock-outs and maintains consistent availability across all stores.

-

Executing merchandising standards: They ensure shelves follow planograms, displays are neat, and POSM is placed correctly. Consistent merchandising strengthens brand visibility and improves shopper engagement.

-

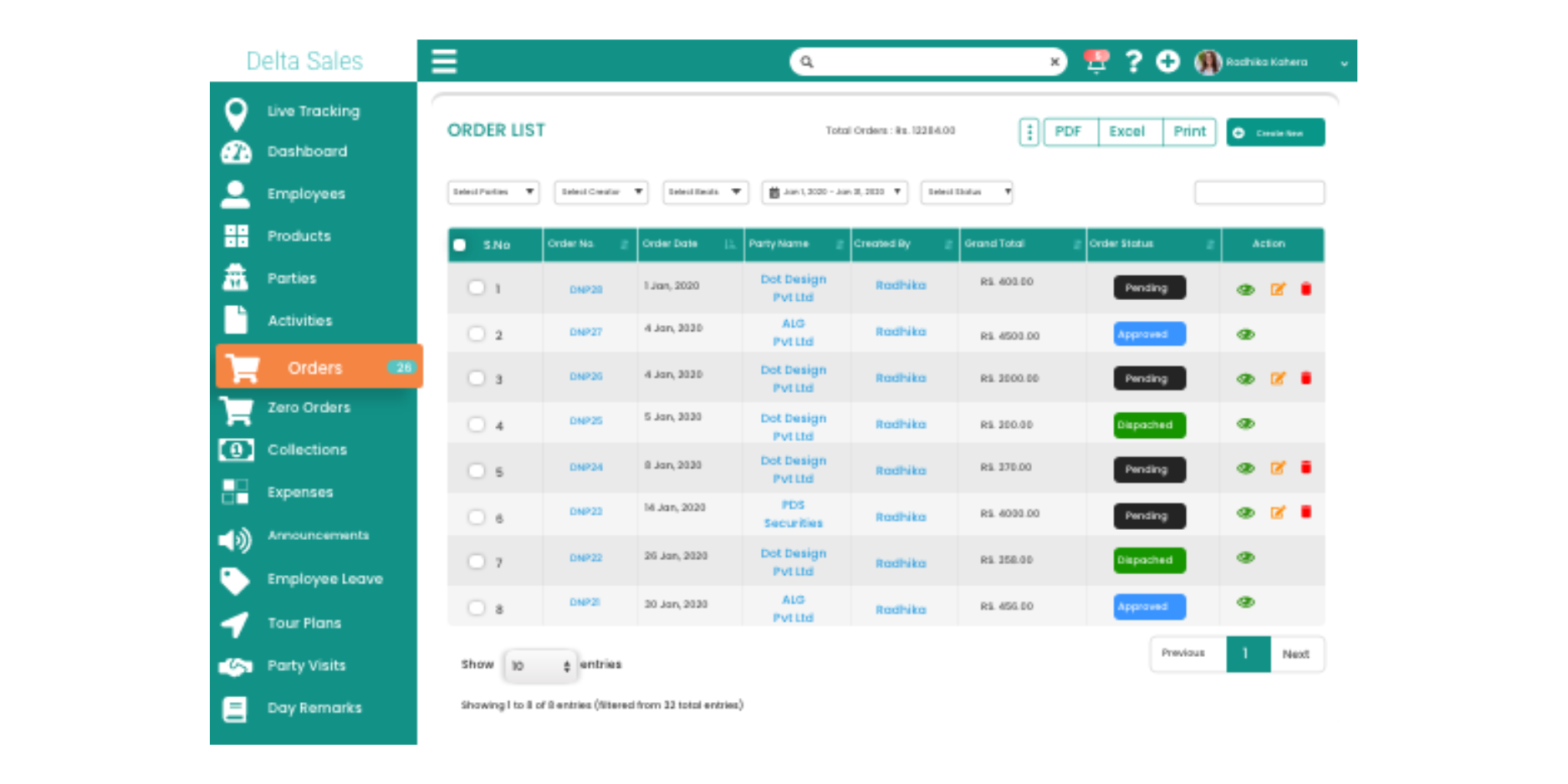

Taking accurate orders: Accurate order capture ensures distributors receive correct SKU and quantity requirements. This reduces delays, prevents errors, and supports uninterrupted product flow.

-

Launching new product placements: Field teams introduce new SKUs to retailers and ensure proper visibility and stocking. Effective placement drives faster acceptance and stronger initial sales momentum.

-

Tracking distributor performance: They monitor distributor stock, delivery timelines, and overall service quality. This ensures smooth supply chain flow and consistent product availability at retail outlets.

To support field teams, organizations must invest in training, performance measurement, and digital assistance.

Leveraging Digital Tools for Modern FMCG Execution

Digital transformation has become a necessity for FMCG operations. Modern brands are increasingly adopting FMCG Sales Automation systems, mobile apps, and real-time dashboards to streamline execution.

Real-Time Market Visibility

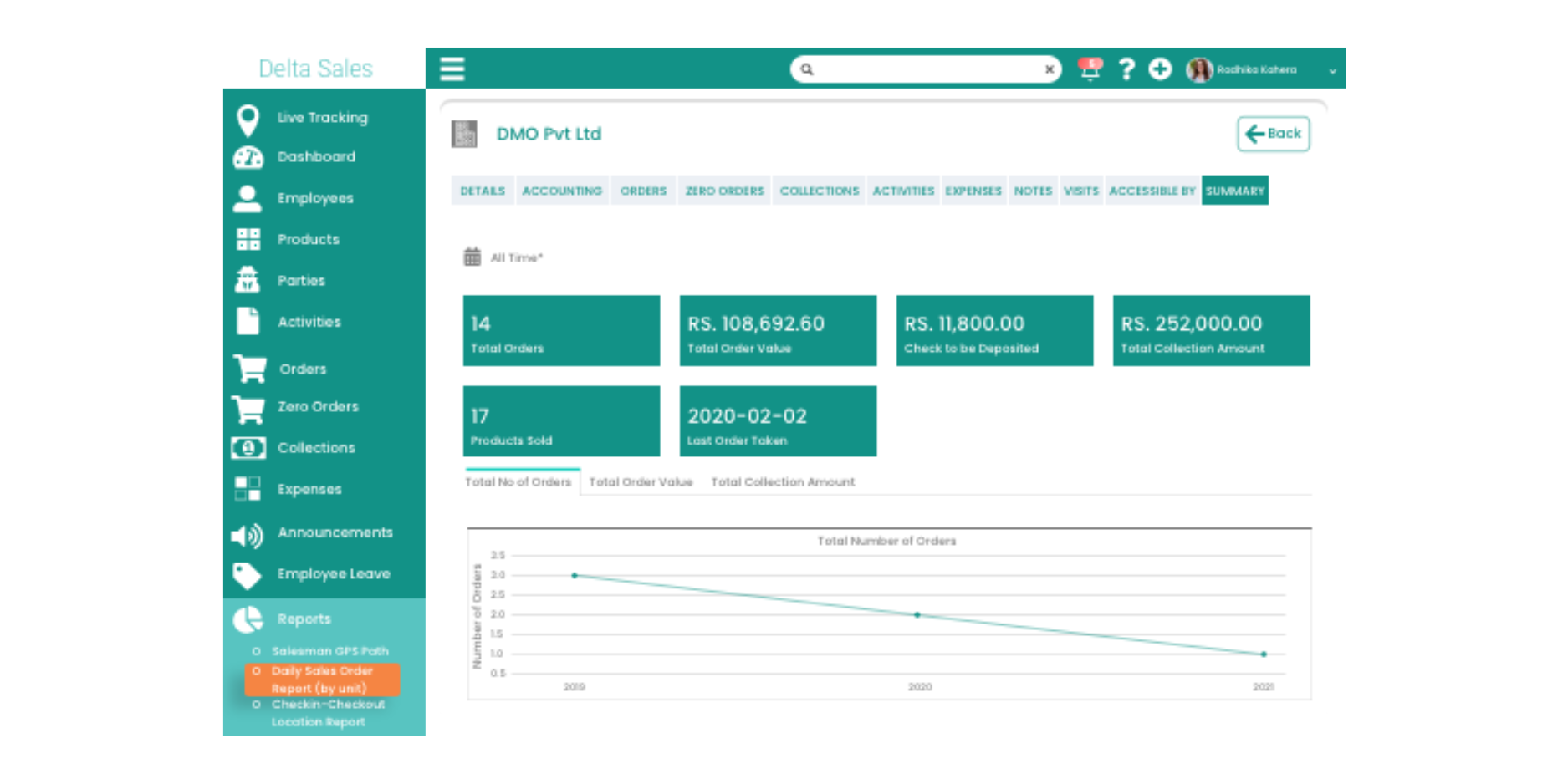

Digital systems offer live insights into stock levels, order flow, route performance, and daily field activities. With immediate access to market data, managers can quickly identify execution gaps and take corrective action.

-

Live inventory management: Inventory management helps identify shortages instantly and prevents lost sales opportunities. It ensures every outlet maintains the required product quantity without delays.

-

Route and beat-level insights: Beat insights reveal how effectively field teams cover outlets and manage visits. This optimizes route planning and ensures consistent market coverage.

-

Real-time order flow: Live order tracking helps brands monitor demand patterns and distributor response time. It ensures smooth replenishment and minimizes delivery delays.

-

Daily activity reports: Automated reports show field performance, visit outcomes, and task completion. This ensures transparency and strengthens performance monitoring.

-

Competitor activity updates: Instant updates on competitor actions help brands adjust pricing, promotions, or visibility. This maintains competitiveness and protects market share.

Smart Route & Beat Planning

Automated route planning maximizes productivity by ensuring efficient travel paths and disciplined outlet coverage. Better beat planning increases visit consistency, reduces costs, and strengthens retail execution.

-

Higher outlet coverage: Optimized beats ensure more outlets are visited daily without increasing workload. This maximizes market presence and boosts sales potential.

-

Optimized travel routes: Smart routing reduces travel distance and time for field representatives. It improves efficiency and allows more productive store interactions.

-

Reduced fuel consumption: Shorter, optimized routes decrease transportation expenses significantly. This leads to cost savings and eco-friendly operations.

-

Increased productive time: Less travel means more time spent on retail execution tasks. This enhances sell-out efficiency and overall field performance.

-

Stronger visit discipline: System-driven schedules ensure consistent store visits and timely follow-ups. This strengthens execution reliability and retailer confidence.

Data-Driven Sales Insights

Data analytics empowers brands with predictive insights that improve decision-making and market performance. When combined with Primary vs. Secondary Sales, companies gain deeper visibility into demand and distribution efficiency.

-

Outlet-wise performance: Outlet-level analysis highlights high-potential stores and underperforming locations. It helps optimize coverage and resource allocation.

-

Sales trends by SKU: SKU trends reveal which products are driving growth or declining. This supports smarter production, inventory, and promotional planning.

-

Beat-wise order patterns: Tracking order cycles by beat shows buying frequency and consumption behavior. It helps refine beat strategies for maximum output.

-

Retailer buying capacity: Understanding each retailer’s purchasing capability improves order planning. It prevents overstocking and ensures realistic sales targets.

-

Distributor stock movement: Monitoring distributor stock rotation ensures healthy inventory flow. It reduces expiry risks and boosts availability.

Strengthening Distribution & Supply Chain Alignment

Even perfect field execution fails without strong distributor alignment. The supply chain must be synchronized with retail demand.

Accurate Forecasting

Accurate forecasting enables brands to plan production, inventory, and distribution based on real market demand. Secondary sales insights, seasonal patterns, and outlet-level trends help minimize wastage and ensure continuous product availability.

-

Seasonal trends: Understanding seasonal demand shifts helps brands prepare inventory for peak and off-peak periods. This reduces the risk of stock-outs during high seasons and excess stock during low demand.

-

Territory-wise consumption: Each region consumes differently, making localized forecasting essential. Territory-specific insights improve distributor stocking and market responsiveness.

-

Outlet-wise growth potential: Outlet-level data helps identify high-growth stores that require more stock and support. This ensures resources are allocated to the most profitable locations.

-

Distributor stock movement: Monitoring distributor inventory turnover ensures healthy stock rotation. It helps avoid expiry issues, dead stock, and inconsistent market supply.

Optimal Distributor Stock Levels

Balanced distributor inventory ensures continuous product availability without locking excess capital. Effective stock planning improves retail coverage, reduces wastage, and enhances distributor confidence.

-

Maintaining balanced inventory levels: Distributors must stock enough to meet demand without holding unnecessary excess. Balanced levels ensure efficient cash flow and uninterrupted supply.

-

Preventing both overstocking and understocking: Overstock leads to expiry and losses, while understock causes missed sales. Effective monitoring keeps inventory levels aligned with real consumption.

-

Ensuring timely replenishments: Regular restocking prevents gaps and keeps retailers consistently supplied. Timely deliveries maintain brand reliability and retailer satisfaction.

-

Assigning realistic sales targets: Targets must align with distributor capability and local demand trends. Realistic goals motivate performance and reduce channel pressure.

-

Training distributor salesmen: Well-trained salesmen improve order collection, retailer service, and product push. This boosts market penetration and enhances overall execution quality.

Reducing Supply Chain Gaps

A friction-free supply chain eliminates delays and ensures predictable availability at retail shelves. Digitization, real-time tracking, and streamlined communication minimize errors and strengthen execution.

-

Digitize order processing: Digital orders reduce manual mistakes and accelerate distributor response time. It ensures smooth coordination between field teams and warehouses.

-

Monitor distributor delivery timelines: Tracking delivery schedules helps identify bottlenecks and improve service reliability. Timely deliveries enhance retailer trust and execution consistency.

-

Track the movement of vans or delivery personnel: Real-time van tracking offers visibility into delivery routes and timelines. It helps improve efficiency, reduce delays, and optimize logistics.

-

Ensure proper warehouse-to-distributor coordination: Seamless coordination ensures stock flows steadily from warehouses to distributors. This minimizes supply disruptions and maintains smooth market operations.

Ensuring Out-of-Stock (OOS) Prevention

Out-of-stock situations directly reduce sales and damage retailer trust. Some best OOS prevention practices include:

-

Real-time stock tracking: Real-time stock tracking helps brands instantly identify low inventory levels at the distributor or retailer level. It enables timely replenishment, prevents sudden shortages, and ensures that high-demand products remain consistently available on shelves.

-

Automated replenishment alerts: Automated alerts notify teams when stock reaches minimum levels, preventing delays in refilling shelves. This system ensures timely order placement, smoother supply flow, and continuous product availability across key outlets.

-

Tracking distributor fill rates: Monitoring fill rates helps brands understand how efficiently distributors supply orders. Low fill rates indicate gaps in stock or delivery processes, enabling companies to take corrective action before OOS issues arise.

-

Monitoring high-demand SKUs: High-demand products require closer tracking due to faster movement. Constant oversight ensures they are always available, preventing revenue loss and avoiding customer dissatisfaction resulting from empty shelves.

-

Analyzing OOS patterns by outlet, beat, or region: Studying OOS trends across specific outlets, routes, or territories helps identify recurring issues. This analysis supports targeted interventions, optimized stock allocation, and improved execution in areas with higher product movement.

Using Competition Insights for Better Execution

Understanding competitor moves helps brands refine their own strategies. Field teams must collect:

-

Competitor pricing: Tracking competitor pricing helps brands understand market positioning and identify opportunities to adjust their own price strategy. It enables better discount planning, protects margins, and ensures the brand stays competitive in every outlet.

-

New product launches: Monitoring competitor product launches provides insights into emerging trends and evolving customer preferences. This allows brands to prepare counter-strategies, strengthen their own product offerings, and prevent competitors from gaining early market advantage.

-

Promotional activities: Understanding competitor promotions helps brands evaluate market dynamics and create more compelling offers. It ensures timely response with discounts, schemes, or retailer incentives that protect market share and keep customers engaged.

-

Shelf share data: Tracking how much shelf space competitors occupy helps brands assess their visibility and execution strength. This insight supports better negotiations with retailers and improved merchandising strategies to increase product visibility.

-

Retailer feedback on competitors: Retailer opinions reveal strengths and weaknesses of competing brands. This feedback helps companies improve service quality, adjust product offerings, and build stronger relationships, enabling better execution and positioning at the retail level.

Driving Growth Through New Product Introductions (NPI)

A strong NPI process ensures that new products reach markets quickly and gain early traction. Best practices include:

-

Educating retailers and field teams: Training retailers and field teams ensures they understand product features, benefits, and selling points. This knowledge boosts confidence, improves product recommendations, and helps the new product gain faster acceptance in the market.

-

Planning targeted promotions: Launching focused promotional campaigns helps create initial buzz and attract customer interest. Targeted schemes, discounts, and visibility initiatives accelerate product trials, encourage shelf movement, and strengthen early-stage sales performance.

-

Ensuring initial stock availability: Adequate stock at distributors and retail outlets prevents early stock-outs and supports smooth product rollout. Strong availability builds credibility, meets initial demand, and ensures the new product gains consistent market presence from day one.

-

Monitoring early sales performance: Tracking the first weeks of sales helps identify product acceptance, demand variations, and territory-level opportunities. Early monitoring allows quick adjustments in supply, promotions, or communication, ensuring the product remains on a growth path.

-

Tracking feedback and challenges: Gathering insights from retailers, field teams, and consumers highlights issues like pricing, packaging, or taste. Addressing these challenges early helps refine the product experience and increases its chances of long-term success.

Final Thoughts

In today’s environment, consistency is impossible without digital tools. Automation platforms offering order management, retail audits, route planning, and real-time analytics empower teams to execute at scale with accuracy. As competition grows and customer expectations evolve, adopting technologies like FMCG Sales Automation becomes essential for sustainable success.

Solutions like Delta Sales App help brands streamline end-to-end field operations, strengthen retail visibility, improve distributor coordination, and elevate on-ground execution quality. Companies that combine people, processes, and technology achieve execution excellence creating a strong foundation for FMCG growth across every market segment.

Ready to transform your FMCG retail execution? Book a Free Demo with Delta Sales App and experience smarter, faster, and more efficient field execution.