7 Mistakes First-Time FMCG Founders Make While Expanding Distribution

Expanding FMCG distribution is one of the biggest growth opportunities for first-time founders, but it’s also one of the most challenging. Many promising FMCG startups fail not because of weak products or lack of demand, but because they underestimate the complexities of distribution, field operations, and retail execution.

Scaling distribution isn’t just about shipping products to more outlets; it’s about ensuring every product reaches the right retailer at the right time, maximizing visibility, and maintaining operational efficiency. From choosing the right distributors to tracking secondary sales and optimizing sales routes, each decision impacts profitability and long-term growth.

In this article, we explore the 7 most common mistakes first-time FMCG founders make when expanding distribution globally, along with actionable strategies to avoid them and scale your brand efficiently.

Mistake 1: Rushing Into Too Many Markets at Once

Many first-time founders aim for rapid growth, launching products in multiple regions simultaneously. While ambition is good, over-expansion can dilute resources. Each market has unique consumer behavior, regulations, and competition.

Why it’s risky:

-

Operational oversight becomes difficult

-

Working capital gets tied up in multiple regions

-

Risk of unsold inventory increases

How to avoid it:

-

Expand geographically in phases.

Start by launching your FMCG products in one or two high-potential regions. Phased geographic expansion allows founders to test distribution strategies, optimize inventory, and understand consumer behavior before scaling further.

-

Leverage Market Research:

Use FMCG market analysis, consumer insights, and data from trusted sources like consumer packaged goods industry insights to identify areas with high demand, low competition, or strategic growth potential.

-

Track Key Performance Metrics:

Monitor outlet coverage, SKU-specific sales velocity, and distributor performance. Data-driven tracking ensures early detection of operational gaps and avoids cash flow problems.

Mistake 2: Ignoring Distributor Selection and Management

Distributors are the foundation of every FMCG operation. Selecting the wrong distributor or failing to manage them effectively can lead to stock imbalances, late deliveries, lost sales, and insufficient market coverage. For first-time FMCG entrepreneurs, these mistakes frequently result in unnecessary cash burn, dissatisfied retailers, and missed growth opportunities.

Common errors:

-

Appointing multiple distributors without performance checks

-

Relying solely on primary sales data without monitoring secondary sales

-

Poor communication of schemes or promotional plans

Solution:

-

Use a Distributor Management System (DMS)

Use a distribution management system to track inventory levels, monitor secondary sales, and assess scheme performance in real time. This reduces errors, increases distributor accountability, and ensures that stock flows efficiently.

-

Evaluate Distributors Before Appointment

Consider the coverage area, delivery reliability, market knowledge, and past performance. Selecting the right partners ensures that your products are consistently distributed to the appropriate outlets.

-

Maintain strong relationships

Conduct regular reviews, establish clear KPIs, and communicate expectations effectively. Incentivize performance based on measurable outcomes, such as secondary sales and outlet coverage.

Mistake 3: Underestimating Field Sales Complexity

Many first-time FMCG entrepreneurs believe that simply hiring a larger sales team will result in increased revenue. However, without structured route planning, clear coverage targets, and performance monitoring, field teams can become expensive, inefficient, and underproductive. Ineffective field sales management can result in missed opportunities, wasted resources, and unnecessary cash burn.

Impacts:

-

High travel costs and fuel expenses

-

Uneven outlet visits

-

Low strike rate (productive visits vs total visits)

Solution:

-

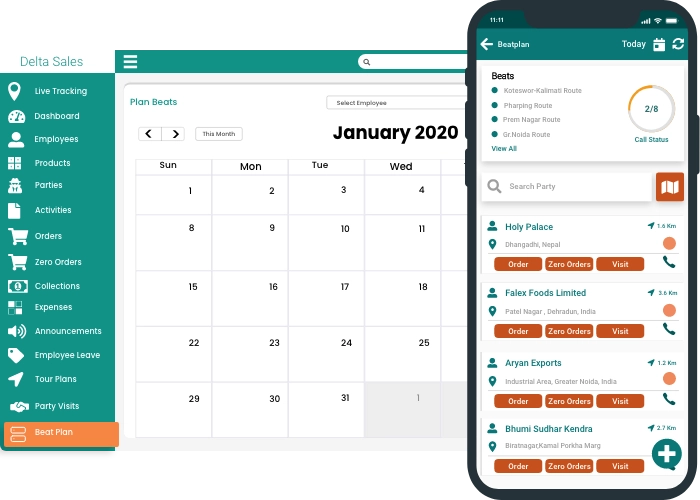

Implement Beat Planning Software:

Use Beat Planning software to generate geo-optimized daily routes, ensuring that each sales rep visits the appropriate outlets efficiently. This reduces travel time, broadens coverage, and boosts FMCG field sales productivity.

-

Leverage Sales Force Automation (SFA):

Monitor real-time sales rep location, digitally capture orders, and track outlet visits to ensure that each field call is productive and accountable.

-

Regularly Analyze Performance Metrics:

Track strike rate, conversion per visit, and territory performance. Identify underperforming reps or areas and provide coaching or corrective actions to improve outcomes.

Mistake 4: Over-Reliance on Trade Promotions

For first-time FMCG entrepreneurs, offering excessive trade discounts or promotional schemes may appear to be a quick way to increase orders and sales. However, relying too heavily on promotions can reduce profit margins, distort demand forecasting, and have a negative impact on retailer behavior. Retailers may delay purchases while waiting for the next offer, which can create cash flow challenges and render your growth strategy unsustainable.

Key Risks Include:

-

Reduced profitability

-

Retailer dependency

-

Distorted market insights

How to prevent

-

Focus on Operational Efficiency:

Focus on improving sales rep productivity, consistent outlet coverage, and in-store visibility rather than relying solely on discounts. Structured field operations ensure every visit generates real sales. Tools like retail execution software help maintain on-shelf availability, planogram compliance, and proper execution of trade schemes.

-

Monitor Secondary Sales:

Track products moving from distributors to retailers to understand actual market demand. This data-driven approach ensures inventory is optimized, and promotions are applied only where they drive incremental sales.

-

Reduce Dependency Gradually:

Instead of offering constant discounts, use promotions strategically to maintain strong retailer engagement and repeat purchases. Over time, this reduces reliance on trade schemes while maintaining market penetration.

Mistake 5: Not Tracking Secondary Sales

First-time FMCG founders often make the mistake of evaluating performance based solely on primary sales data (company → distributor). While primary sales indicate what is delivered to distributors, true market performance is determined by secondary sales, or the actual movement of products from distributors to retailers. Ignoring this data can result in overestimating demand, overstocking or stockouts, and lost sales opportunities.

Consequences:

-

Overestimating market demand

-

Overstocking or stockouts

-

Lost sales opportunities

Solution:

-

Implement Secondary Sales Monitoring:

Use tools like Secondary Sales tracking to monitor product movement from distributors to retailers in real time. This ensures your stock aligns with actual consumer demand and prevents inventory inefficiencies.

-

Align Incentives with Real Performance:

Reward sales reps and distributors based on secondary sales achievement, not just primary orders. This encourages focus on retail execution and actual revenue generation.

-

Analyze SKU-Level Performance:

Keep track of which SKUs are performing well in retail and which are slow to move. Utilize this information to optimize production, distribution, and marketing strategies.

Mistake 6: Weak Retail Execution

Getting products into distributor warehouses is only half of the battle for FMCG distribution. What truly drives revenue is how those products perform in the retail environment. If your product is not visible, incorrectly placed, or unavailable when customers are ready to buy, expansion efforts will fail, regardless of how strong your primary sales appear.

Many first-time FMCG entrepreneurs believe that once billing is completed, sales will naturally follow. However, retail execution determines sell-through rather than just sell-in. Poor shelf placement, low shelf share, noncompliance with planograms, and inconsistency in promotion execution can all significantly reduce secondary sales and brand recall.

When retail execution is weak, brands often face:

-

Products pushed to the bottom shelf or hidden behind competitors

-

Stock available in storage but not displayed on shelves

-

Inconsistent pricing or incorrect promotional communication

-

Missed visibility opportunities during high-footfall periods

Over time, this leads to lower off-take, slow-moving inventory, and unnecessary pressure to increase trade discounts.

How to Avoid This Mistake

-

Ensure On-Shelf Availability at Key Outlets

On-shelf availability is one of the most critical retail execution KPIs in FMCG. Regular outlet audits and field tracking ensure that products are not just delivered but actually displayed and ready for purchase. -

Follow Planograms for Consistent Product Placement

Planogram compliance improves brand visibility and increases purchase probability. When products are placed at eye level or in high-traffic areas, impulse buying increases significantly. -

Monitor Competitor Activity and Shelf Share

Retail shelves are competitive spaces. Tracking competitor pricing, scheme offers, and new product placements allows brands to react quickly and protect market share. -

Communicate Trade Promotions Clearly to Retailers

Even well-designed trade schemes fail when they are not communicated properly. Ensure retailers understand offer mechanics, margins, and timelines to maximize execution effectiveness.

To streamline these processes, brands can leverage Retail Execution Software to monitor in-store visibility, planogram compliance, outlet audits, and competitor tracking in real time. This helps founders maintain consistent retail standards across multiple regions without increasing manual supervision.

Mistake 7: Scaling Without Data-Driven Decisions

One of the most common mistakes first-time FMCG founders make during distribution expansion is relying too heavily on instinct instead of analytics. While entrepreneurial intuition is valuable, scaling an FMCG business requires structured decision-making backed by real-time data. Without a data-driven growth strategy, companies often misallocate budgets, expand into underperforming markets, overstock slow-moving SKUs, or hire additional manpower without measurable ROI.

Even minor inefficiencies in the FMCG industry can quickly multiply as distribution grows. Entering new markets without first determining outlet productivity, repeat purchase behavior, or cost per visit can significantly increase operational costs while decreasing margins. Sustainable FMCG growth requires visibility across distribution, field sales, and retail execution, not guesswork.

How to Adopt a Data-Driven FMCG Growth Strategy

-

Track Distribution Coverage and Cost Metrics

Measure numeric distribution, weighted distribution, cost per outlet visit, and repeat order frequency. These KPIs reveal whether your expansion is profitable or simply increasing primary sales without real market penetration. -

Use Analytics Dashboards to Identify High-Performing Markets and SKUs

Instead of pushing every SKU equally, analyze SKU-wise sales velocity, secondary sales movement, and regional demand patterns. This allows you to allocate inventory and marketing budgets more effectively. -

Monitor Sales Productivity and Inventory Turnover

Track strike rate, productive calls per day, sales rep performance, and distributor inventory turnover. If productivity drops, optimize routes or coverage before increasing headcount.

Leveraging advanced analytics & reporting tools helps founders consolidate field data, secondary sales insights, and distributor performance metrics into actionable dashboards. This ensures expansion decisions are backed by real-time intelligence rather than assumptions.

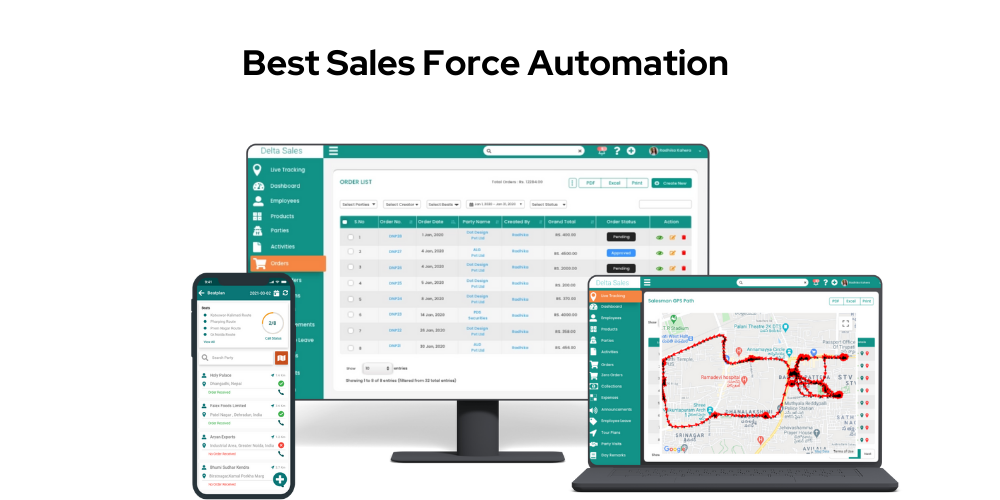

How Delta Sales App Helps First-Time FMCG Founders Scale Distribution the Right Way

Expanding FMCG distribution without the proper systems frequently results in the same mistakes mentioned above: uncontrolled distributor appointments, low field productivity, poor retail execution, and poor secondary sales visibility. Delta Sales App offers an integrated, data-driven platform that enables first-time FMCG founders to build structured, scalable, and profitable distribution networks from the start.

Instead of relying on manual reports or disconnected tools, founders get complete visibility across their entire sales ecosystem.

-

Sales Force Automation (SFA)

SFA ensures real-time tracking of field sales teams, outlet coverage monitoring, digital order capture, and performance analytics. This improves strike rate, reduces revenue leakage, and ensures every field visit contributes to measurable growth.

-

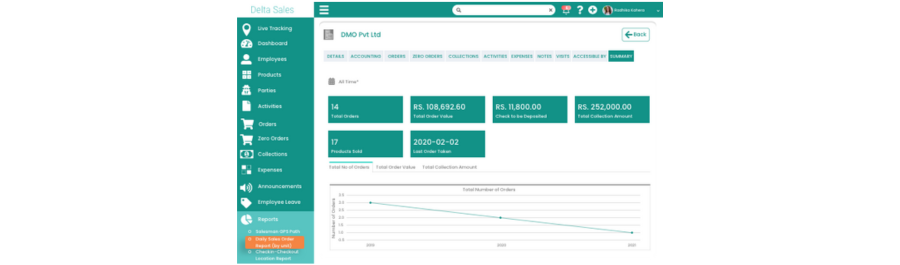

Distributor Management System (DMS)

DMS provides full visibility into inventory levels, secondary sales movement, outstanding payments, and scheme performance. Founders can make informed decisions, prevent overstocking, and maintain healthier working capital cycles.

-

Beat Planning Software

Delta Sales App optimizes route planning with geo-mapped territories, increasing productive calls per day while reducing travel time and fuel costs. This boosts field productivity without increasing headcount.

-

Retail Execution Software

Delta Sales App’s retail execution improves on-shelf availability, planogram compliance, competitor tracking, and in-store visibility, ensuring that products are sold at the retail level rather than just to distributors.

-

Analytics & Reporting Dashboards

The app consolidates distribution metrics, SKU-wise performance, cost per outlet visit, repeat order frequency, and sales productivity into actionable insights. Founders can scale into new territories confidently, backed by real data instead of assumptions.

Delta Sales App serves as a structured growth engine for first-time FMCG founders, assisting them in avoiding costly expansion mistakes while establishing a solid, long-term distribution foundation.

Conclusion

Expanding FMCG distribution is not just about entering new markets; it’s about building systems that support sustainable, profitable growth. First-time FMCG founders often burn cash not because their product lacks potential, but because distribution, field sales, retail execution, and secondary sales are not properly structured. Avoiding these seven mistakes can significantly reduce operational inefficiencies, protect margins, and improve long-term scalability.

Ready to scale your FMCG brand the right way?

Stop guessing and start growing with real-time visibility, smarter distribution, and data-driven execution. Book a demo with the Delta Sales App today and build profitable expansion with confidence.