GT vs MT vs D2C vs Marketplaces: Where Indian FMCG Brands Really Win (and Lose)

In the fast-moving world of FMCG (Fast-Moving Consumer Goods) in India, the product alone is not enough. Even the most popular brands can struggle if their distribution channels are not optimized. The channels through which products reach consumers, be it General Trade (GT), Modern Trade (MT), Direct-to-Consumer (D2C), or online Marketplaces, can make or break growth.

A smart channel strategy ensures products reach the right consumers at the right time, while maximizing margins and minimizing operational inefficiencies. For Indian FMCG brands navigating a diverse retail landscape, understanding each channel’s strengths and weaknesses is critical to long-term success.

Overview of GT, MT, D2C, and Marketplaces

General Trade (GT): This traditional network includes small kirana stores, local wholesalers, and mom-and-pop outlets. GT is still the backbone of FMCG sales in India, offering unmatched reach, especially in tier 2 and tier 3 cities.

Modern Trade (MT): Supermarkets, hypermarkets, and organized retail chains represent MT. While limited in reach compared to GT, MT allows better visibility, brand experience, and controlled pricing.

Direct-to-Consumer (D2C): FMCG brands are increasingly selling directly via websites, mobile apps, or subscription models. D2C enables better margins, deeper customer insights, and stronger brand loyalty.

Marketplaces: E-commerce platforms like Amazon, Flipkart, and BigBasket allow brands to reach millions of online consumers quickly. Marketplaces offer convenience and data insights but come with intense competition and operational challenges.

GT Channel Analysis: Pros, Cons, and Best Practices

General Trade (GT) remains the backbone of India’s FMCG distribution network, especially for brands targeting tier 2, tier 3 cities, and rural markets. It encompasses traditional retail formats such as kirana stores, small neighborhood shops, local wholesalers, and mom-and-pop outlets. Despite the rise of modern trade and online channels, GT continues to drive the majority of FMCG sales volume in India. However, operating effectively in GT requires careful planning, execution, and technology adoption.

Pros:

-

Vast penetration in small towns and rural areas ensures products reach even remote consumers effectively.

-

Strong relationships with local retailers build trust and enable insights into demand and competitor activity.

-

Flexible credit and stocking arrangements help small retailers maintain inventory without cash flow pressure constraints.

Cons:

-

Low visibility and poor merchandising control reduce brand presence and affect sales in crowded outlets.

-

Limited data for sales tracking causes stock-outs, overstocking, and inaccurate demand forecasting decisions.

-

High operational costs result from fragmented distribution, large territories, and extensive human resource requirements.

Best Practices:

-

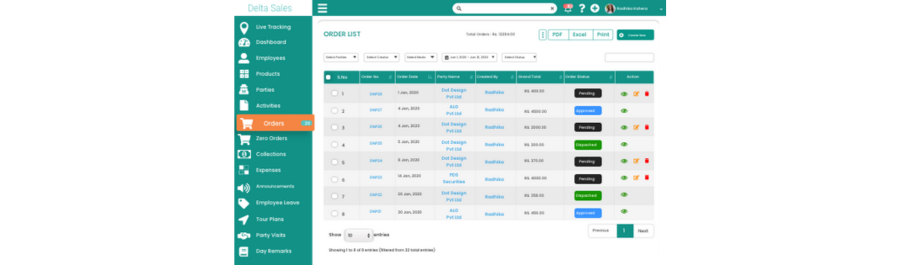

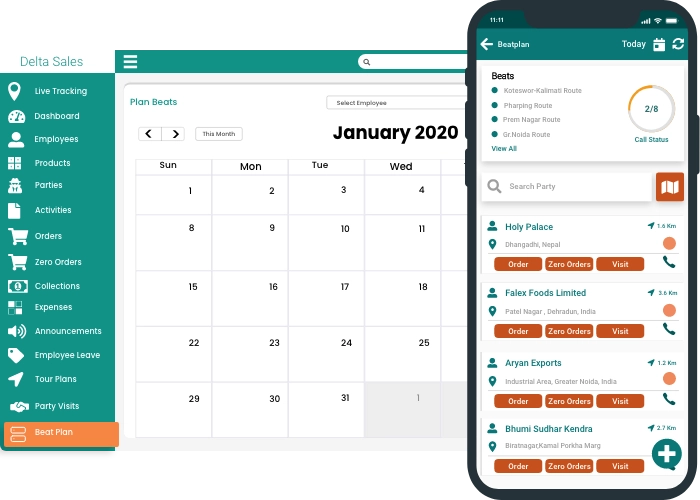

Use technology to track GT sales, stock levels, and distributor activity in real-time efficiently.

-

Conduct regular retailer engagement programs, workshops, and loyalty incentives to strengthen trust and execution.

-

Incentivize distributors for timely, accurate product delivery and reporting to optimize GT channel performance.

MT Channel Analysis: Opportunities, Risks, and Examples

Modern Trade (MT) includes supermarkets, hypermarkets, and organized retail, offering structured visibility but limited reach in smaller towns.

Opportunities:

-

Better shelf visibility and promotional support enhance brand recognition and influence consumer purchasing decisions effectively.

-

Ability to execute brand campaigns effectively allows consistent messaging and stronger engagement with target customers.

-

Organized data collection provides accurate sales, inventory, and customer insights for improved decision-making efficiency.

Risks:

-

High entry costs and stringent compliance make expansion expensive and operationally challenging for smaller brands.

-

Limited reach in smaller towns reduces potential consumer base and restricts market penetration significantly.

-

Price competition with other brands may reduce profitability and require continuous promotional or discount strategies.

D2C Channel Analysis: Direct Engagement and Customer Loyalty

Direct-to-Consumer (D2C) allows brands to sell directly via websites or apps, building loyalty and insights.

Advantages:

-

Direct relationships with consumers provide valuable feedback, engagement, and a better understanding of preferences.

-

Higher margins are possible as no intermediaries take a share, increasing overall profitability for brands.

-

Ability to run subscription and loyalty programs strengthens retention and encourages repeat purchases effectively.

Challenges:

-

Requires investment in digital infrastructure, including websites, apps, and e-commerce platforms for smooth operation.

-

Marketing costs can be high to acquire, convert, and retain consumers through digital campaigns efficiently.

-

Logistics and delivery management can be complex, especially for perishable products or nationwide distribution

Marketplaces Channel Analysis: Digital Sales and Operational Hurdles

Online marketplaces allow FMCG brands to reach millions of consumers digitally, but operational challenges remain significant.

Advantages:

-

Massive reach with minimal physical infrastructure enables brands to access urban and semi-urban consumers quickly.

-

Data-driven insights on consumer behavior help optimize product placement, promotions, and inventory decisions effectively.

-

Quick go-to-market for new products allows rapid testing, launch, and scaling without heavy offline investment.

Challenges:

-

High competition and price wars among brands can reduce visibility and pressure profit margins significantly.

-

Commission fees charged by platforms reduce overall margins, impacting profitability despite high sales volumes.

-

Dependence on marketplace policies and fulfillment systems limits brand control over customer experience and operations.

Comparative Analysis: Sales, Margins, and Reach

In the General Trade (GT) channel, brands enjoy very high nationwide reach, making it one of the most powerful distribution networks. Its biggest strength lies in ubiquity and strong retailer relationships built over time. However, margins are typically medium to low, and the channel presents challenges such as low visibility, fragmented operations, and difficulty in tracking real-time performance.

The Modern Trade (MT) channel offers medium reach, primarily concentrated in urban areas. It provides better brand display opportunities and access to more organized sales data, which supports structured growth. Margins are generally medium, but the reach is limited compared to GT, and operational costs are relatively high.

With Direct-to-Consumer (D2C), brands gain targeted and highly scalable reach, especially in digital-first markets. This channel typically delivers high margins and allows direct engagement with customers, helping brands build stronger relationships and collect valuable insights. However, it requires consistent digital investment and comes with logistics and fulfillment challenges.

Lastly, Marketplaces provide high reach in urban markets and enable quick digital scaling. They offer useful data insights and relatively medium margins. That said, brands face intense competition and must operate within platform policies, creating dependency and limiting control over pricing and customer relationships.

Common Mistakes Indian FMCG Brands Make in Each Channel

Even strong FMCG brands risk lost growth opportunities if they fail to execute channel-specific strategies properly.

-

Ignoring smaller retailers or failing to track stock levels results in lost sales, reduced market reach, and missed growth opportunities.

-

Treating shelf space as a one-time effort and neglecting regular promotions lowers visibility and limits ongoing consumer engagement.

-

Underestimating marketing costs and customer acquisition challenges can slow growth and weaken long-term direct consumer relationships.

-

Relying solely on marketplaces for growth without investing in branding, storytelling, or loyalty programs reduces sustainable digital success.

Actionable Strategies for Optimizing Your Channel Mix

Optimizing channel performance requires a structured approach, combining analytics, technology, targeted marketing, and continuous monitoring to maximize growth and efficiency.

1. Data-Driven Decisions:

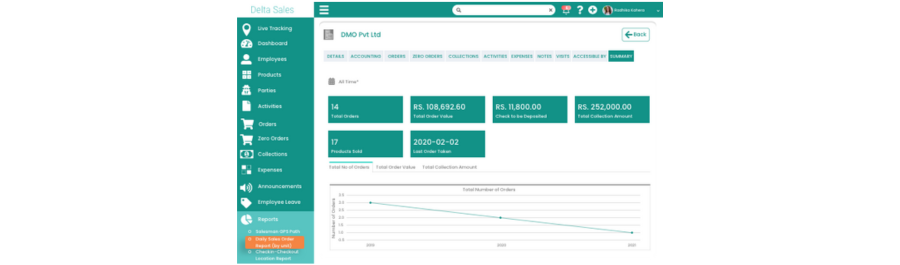

Use sales, inventory, and distribution analytics to identify top-performing channels, uncover gaps, and make informed strategic decisions for growth.

2. Segment Your Audience:

Map consumer preferences to the right channels, use GT for mass-market penetration, MT for visibility, D2C for premium engagement effectively.

3. Leverage Technology:

Implement tools like route planning, stock tracking, and automated reporting to streamline operations and improve GT and MT execution efficiency.

4. Channel-Specific Marketing:

Customize marketing campaigns for each channel, balancing brand-building, promotions, and digital engagement to maximize consumer impact and loyalty.

5. Continuous Monitoring:

Track key performance indicators such as sales, margins, distribution reach, and stock levels regularly to adjust channel strategy promptly.

Future Trends in FMCG Distribution and Consumer Behavior

-

Digital Integration: General Trade is increasingly adopting digital solutions, including mobile apps, e-invoicing, and real-time tracking, improving efficiency and execution accuracy.

-

Hybrid Models: Brands will strategically combine GT, MT, D2C, and Marketplaces to create a cohesive multi-channel distribution network for maximum reach.

-

Consumer-Centric Strategies: Personalized offerings, subscription models, and loyalty programs will enhance customer engagement, retention, and long-term brand loyalty effectively.

-

Data-Driven Execution: Predictive analytics will optimize inventory, route planning, and promotional activities, reducing stock-outs and improving overall operational efficiency.

Final Thoughts

No single channel alone guarantees success in India’s diverse FMCG landscape. GT ensures widespread reach, MT boosts visibility, D2C strengthens loyalty, and marketplaces unlock rapid digital scale. Brands that strategically combine these channels, leverage technology, and monitor performance in real time can drive sustainable growth, higher margins, and stronger customer engagement.

Start mapping your channel mix today and implement smart tools to optimize sales, execution, and consumer reach across GT, MT, D2C, and marketplaces.