How to Scale an FMCG Brand in India Without Burning Cash

Scaling an FMCG brand in India is one of the most exciting opportunities for businesses today, but it can also drain your capital if done incorrectly.

India’s FMCG market is expected to continue strong growth, driven by rural consumption, urban demand, and expanding retail penetration. According to the India Brand Equity Foundation (IBEF), the Indian FMCG sector is one of the largest contributors to the country’s GDP and employment generation.

The opportunity is massive. But here’s the truth: Most FMCG brands fail not because of weak products; they fail because of poor execution, uncontrolled distribution, and rising operational costs.

If you want to scale your FMCG brand in India without burning cash, you need a structured FMCG growth strategy.

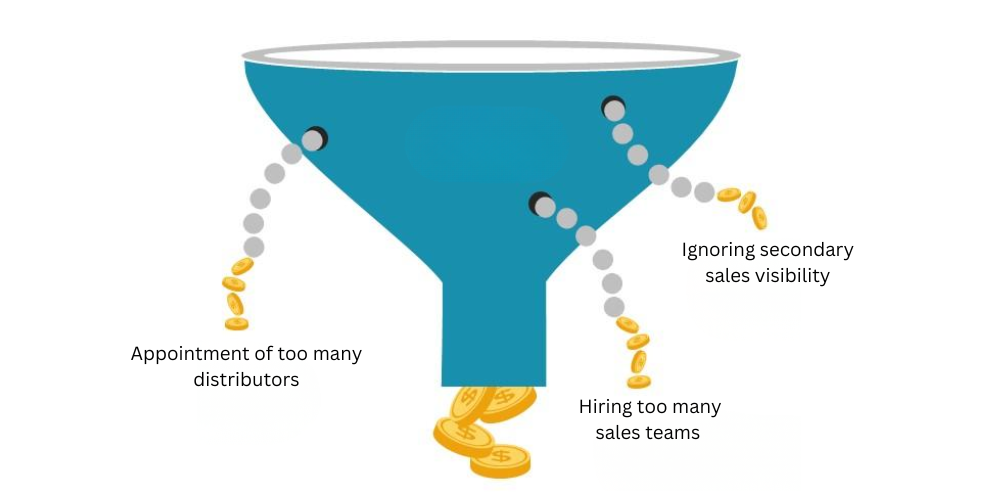

Why Most FMCG Brands Burn Cash During Expansion

Scaling an FMCG brand in India seems exciting, but many companies lose money during expansion because they focus only on growth numbers rather than operational efficiency. Without proper planning, tracking, and validation, expenses grow faster than revenue, and profits shrink. The following are the main reasons why cash burns during expansion:

-

Appoint too many distributors at once: Hiring multiple distributors simultaneously can create confusion and inefficiency. Some distributors may not perform well, while others may overstock. This uneven distribution ties up cash in inventory that isn’t selling.

-

Enter multiple states without data validation: Expanding into new states without researching demand, competition, or market potential is risky. Companies often spend heavily in regions where sales may be low, causing unnecessary losses.

-

Hire large field sales teams without productivity tracking: Adding more sales representatives seems like growth, but without proper monitoring, their productivity can be low. High salaries, travel costs, and incentives quickly increase expenses without guaranteed results.

-

Offer heavy trade discounts to push primary sales: Giving large discounts to distributors or retailers may temporarily boost sales, but it lowers profit margins. Over time, it also trains distributors to expect consistent incentives, resulting in a long-term cost burden.

-

Ignore secondary sales visibility: Primary sales figures (to distributors) do not always accurately reflect what reaches retailers or end users. Without tracking secondary sales, brands risk stock piling up, expiring, or going unsold, resulting in cash burn without actual market growth.

Revenue increases. But working capital gets blocked, margins shrink, and leakage increases. Scaling without systems creates chaos.

1. Strengthen FMCG Distribution Before Expanding

FMCG distribution in India is not uniform; each region behaves differently. Metro cities, Tier 2 towns, Tier 3 cities, and rural areas all have distinct consumer habits, purchase frequency, and demand patterns. Expanding too quickly without improving distribution in your current territories frequently results in inefficiency, stock imbalances, and wasted resources.

Before moving into new regions, focus on these key aspects:

-

Increasing numeric distribution: This means increasing the number of outlets where your product is available. Higher numeric distribution ensures that your brand reaches more customers, creating visibility and potential sales before you invest in expansion.

-

Improving weighted distribution: Weighted distribution measures the sales performance of your products in outlets, not just the number of outlets covered. Focus on placing your products in high-performing stores or chains to maximize sales rather than spreading them thin across low-performing outlets.

-

Monitoring SKU-wise sales velocity: Track how quickly each SKU (product variant) sells in different outlets. Some SKUs may perform better in urban areas, while others are popular in rural markets. Understanding this helps in stock planning, reducing inventory piling, and meeting actual consumer demand.

-

Ensuring consistent secondary sales movement: Secondary sales refer to products that move from distributors to retailers rather than from the company to distributors (primary sales). Consistent secondary movement prevents overstocking, reduces waste, and frees up working capital.

Deep penetration in one region is more profitable than shallow presence in five states. Scaling depth first ensures stable cash flow.

2. Reduce Field Sales Leakage with FMCG Sales Automation

Field sales is one of the largest expenses in FMCG operations. Fuel costs, salaries, daily allowances, and incentives. Without monitoring, productivity drops significantly. Manual reporting methods like Excel sheets and WhatsApp updates create blind spots.

Implementing a sales force automation software helps you:

-

Track real-time sales rep location: SFA software allows managers to see where each sales representative is at any moment. This ensures reps are following their assigned routes, reduces absenteeism, and prevents fake reporting. It also helps in quick decision-making if a rep needs support in a particular area.

-

Monitor outlet coverage: It provides a clear view of which outlets are visited and how often. Managers can identify unvisited or low-frequency outlets, optimize routes, and ensure maximum market penetration without increasing manpower.

-

Capture orders digitally: Reps can record orders directly in the system via mobile devices, eliminating the need for paper-based reporting. This reduces errors, speeds up order processing, and ensures accurate inventory and sales tracking.

-

Improve strike rate: Strike rate measures the number of productive visits vs. total visits. SFA software helps identify underperforming reps or territories, allowing managers to increase efficiency and ensure each field visit generates real sales.

-

Analyze sales performance: SFA systems provide detailed analytics on individual rep performance, SKU sales, and territory results. These insights help managers make informed decisions, optimize coverage, plan incentives, and improve overall sales productivity.

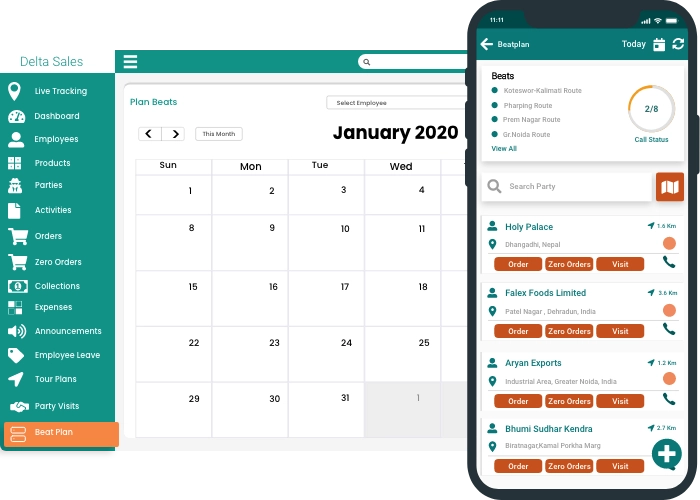

3. Optimize Routes with Beat Planning Software

Many FMCG companies believe that adding more salespeople will boost sales. However, inefficient route planning is often the root cause of the problem. Without structured routes or "beats," field sales teams spend more time traveling than selling, increasing costs and lowering productivity. Implementing Beat Planning software ensures that sales reps follow optimized routes, which improves efficiency and outlet coverage.

Without structured beats:

-

Sales reps waste travel time

-

Fuel costs increase

-

Outlet visits become inconsistent

-

Daily productivity decreases

A beat planning software helps FMCG brands plan sales reps’ daily routes in a way that maximizes productivity and reduces costs. Instead of reps deciding their own paths, the software ensures every visit counts.

-

Create geo-optimized routes: The software determines the most efficient route for each sales rep based on outlet location, reducing unnecessary travel. This ensures that representatives travel the shortest distance possible to cover all assigned outlets.

-

Increase productive calls per day: Sales representatives can visit more outlets during the same working hours by optimizing their routes. More outlet visits translate into more opportunities for order capture, relationship building, and in-store promotions. This directly increases the number of productive calls per day, resulting in higher sales without the need to hire additional staff.

-

Reduce travel time: Inefficient routes waste time every day. Beat Planning Software reduces travel time by calculating the shortest and fastest routes between outlets. Less time spent on the road allows reps to spend more time interacting with customers, training retailers, and promoting products. It also reduces fuel consumption and vehicle maintenance costs, which increases profitability.

-

Improve coverage efficiency: The software ensures consistent coverage of all outlets in a given territory. No outlets are overlooked, and high-priority outlets get the attention they deserve. This improves brand visibility, strengthens relationships with retailers, and provides accurate data on regional sales performance. Coverage efficiency ensures that every field visit contributes significantly to growth.

4. Implement a Strong Distributor Management System (DMS)

A Distributor Management System (DMS) is essential for FMCG companies to keep control of their supply chain. While primary sales (from company to distributor) are important, true market performance is determined by secondary sales: what actually reaches retailers and end users.

An advanced Distributor Management System provides:

-

Real-time inventory tracking: Brands can use DMS to instantly monitor stock levels in distributor warehouses. This prevents overstocking, stockouts, and expired products. Knowing inventory in real time allows for more efficient production and logistics planning.

-

Secondary sales visibility: Secondary sales are products that pass from distributors to retailers. Tracking these sales provides a clear picture of true market demand, allowing brands to avoid making assumptions based solely on primary sales. It ensures that stock reaches the correct outlets at the appropriate time.

-

Scheme performance tracking: FMCG brands frequently offer trade promotions and schemes to distributors and retailers. DMS tracks the effectiveness of these schemes, indicating which promotions drive actual sales and which do not. This helps to optimize trade spending and increase ROI.

-

Outstanding management: DMS provides insight into distributors' outstanding payments and credit limits. Timely receivable tracking prevents cash flow issues, lowers financial risk, and ensures that money is collected on time.

5. Focus on Retail Execution for Sustainable FMCG Growth

In FMCG, real brand growth occurs at the retail level. Selling products to distributors isn't enough; the ultimate goal is to make products available, visible, and appealing to consumers at the point of sale. Strong retail execution has a direct impact on sales, brand loyalty, and repeat purchases.

Here’s how effective retail execution helps:

-

On-shelf availability: Ensuring that products are consistently available on the shelves helps to prevent lost sales. Even if distributors have stock, if products do not arrive at retail counters on time, customers will be unable to purchase them.

-

Visibility at retail counters: In crowded retail environments, simply being on the shelf is insufficient. Products must stand out through strategic placement, eye-catching displays, and branding initiatives. High visibility improves brand recall and encourages impulse purchases, which directly increases revenue.

-

Planogram compliance: Planograms are guidelines for displaying products on shelves, including their placement, arrangement, and spacing. Ensuring planogram compliance improves shopper experience, increases product visibility, and leads to higher sales per outlet.

-

Competitor tracking: Monitoring competitor products, promotions, and pricing in retail stores enables brands to remain competitive and make informed decisions. Understanding competitor activity allows you to adjust promotions, optimize pricing strategies, and maintain a dominant market position.

-

Scheme communication: Trade promotions and discount schemes are only effective if they are communicated clearly to retailers and salespeople. Ensure that schemes are properly understood and executed to maximize their impact, drive incremental sales, and avoid confusion or missed opportunities.

Using advanced retail execution software ensures that your products are not just distributed but properly placed and promoted.

6. Use Data-Driven FMCG Growth Strategy

Expanding an FMCG brand without analyzing data is akin to driving blindfolded. A data-driven growth strategy ensures that all decisions are supported by facts rather than assumptions, allowing brands to scale efficiently and profitably. Before entering a new state or market, it is critical to assess your current operations and identify potential gaps.

Here are the key questions every FMCG brand should ask:

-

What is my current distribution percentage?

Understanding how many outlets your products currently have is critical. Expanding into a new region without fully covering your existing territories can result in missed sales opportunities and inefficient use of resources. Full coverage of current markets provides a solid foundation for profitable growth.

-

Is my sales team fully optimized?

Evaluate whether your field sales team is operating at peak efficiency. Are the routes optimized? Are your visits productive? Are targets consistently met? Ensuring that your sales team is fully optimized reduces the need to hire additional staff and increases ROI per sales representative.

-

What is my cost per outlet visit?

Analyze the costs associated with each outlet visit, including travel, incentives, and time. High costs without proportional sales indicate inefficiency. Route planning, digital order capture, and automation can all help to reduce the cost per outlet visit, making expansion much more profitable.

-

What is my repeat order frequency?

Tracking how frequently retailers reorder your products provides insight into actual demand. Low repeat orders indicate inefficiencies in retail execution, distribution, and product acceptance. Improve repeat order frequency to ensure inventory moves quickly and working capital is not tied up unnecessarily.

7. Reduce Overdependence on Trade Schemes

Many FMCG brands use trade promotions and discounts to increase short-term sales. While these promotions can temporarily boost orders, relying too heavily on discounts can reduce profitability and distort real market demand. Smart brands prioritize operational efficiency and field performance over excessive incentive spending.

Here’s why overdependence on trade schemes is risky:

-

Reduce profitability

-

Train retailers to wait for offers

-

Distort demand forecasting

Instead of increasing discounts, improve:

-

Outlet visit frequency: Increasing the number of visits to each outlet ensures that products are constantly stocked, shelves are replenished, and promotions are actively carried out. Frequent visits also enable sales representatives to interact with retailers, understand their challenges, and resolve issues in real time. This strengthens retailer relationships and generates consistent sales without relying on additional discounts.

-

Sales rep productivity: Improving your field team's productivity is more effective than increasing schemes. Sales reps can use tools like Sales Force Automation and Beat Planning Software to make more meaningful visits, prioritize high-potential outlets, and ensure that every interaction leads to actual sales. Increased productivity reduces the need for artificial sales incentives.

-

In-store visibility: Products must stand out on crowded retail shelves. Improving in-store visibility through strategic placement, eye-catching displays, and planogram compliance captures consumer attention and encourages purchases. Effective visibility boosts sales organically, making trade discounts less important in driving growth.

-

Secondary sales tracking: Monitoring the movement of products from distributors to retailers provides a clear view of real market demand. Brands can identify slow-moving SKUs, prevent stockpile-ups, and plan replenishments accurately. With better visibility into secondary sales, companies can reduce over-reliance on trade schemes to push products artificially.

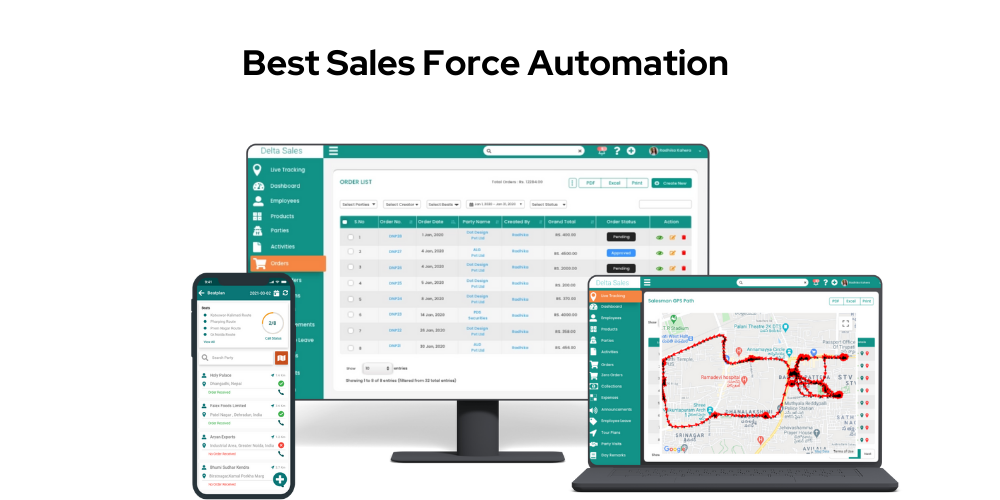

How Delta Sales App Helps Scale FMCG Brands Profitably

Scaling an FMCG brand in India does not have to entail hiring more employees or expanding trade programs. The Delta Sales App offers a unified platform for brands to optimize existing resources, boost field productivity, and improve sales visibility. By combining multiple tools into a single solution, businesses can grow efficiently and profitably without depleting cash.

It combines:

-

Real-time field tracking

Managers can monitor the location and activity of sales reps live, ensuring routes are followed, outlet visits are completed, and any issues are resolved promptly. This accountability boosts performance and helps brands identify high- and low-performing areas instantly.

![]()

-

Sales Force Automation Software

The Sales Force Automation (SFA) module helps track your sales reps in real-time, monitor outlet coverage, and digitally capture orders. This ensures every field visit is productive and accountable, reducing revenue leakage. By providing instant insights into sales performance, SFA enables managers to take timely action and improve overall team efficiency.

-

Distributor Management System

A strong Distributor Management System (DMS) gives complete visibility into distributor inventory, secondary sales, and payment status. Brands can avoid overstocking, manage cash flow efficiently, and ensure products reach retailers on time. By tracking distributor performance and scheme effectiveness, companies can make data-driven decisions that reduce unnecessary trade spending.

-

Beat Planning Software

Beat Planning ensures that sales reps follow geo-optimized routes, increasing productive calls per day while reducing travel time and fuel costs. With better coverage efficiency, no outlet is missed, and every territory is monitored systematically. This improves field productivity without adding extra manpower.

-

Retail Execution Software

Retail execution is where real growth happens. The Delta Sales App helps maintain on-shelf availability, planogram compliance, competitor tracking, and proper scheme execution. By improving in-store visibility and engagement, brands increase consumer purchases organically without relying on aggressive discounting.

-

Secondary sales monitoring

Secondary sales tracking, or the movement of products from distributors to retailers, provides an accurate picture of real market demand. Brands can plan inventory, optimize replenishments, and avoid wasting working capital on unprofitable products.

Conclusion

Scaling an FMCG brand in India doesn’t have to mean burning cash on additional manpower or excessive trade discounts. By focusing on operational efficiency, data-driven strategies, and technology-enabled solutions, brands can optimize distribution, increase field sales productivity, and ensure consistent retail execution. Tools like Sales Force Automation, Distributor Management, Beat Planning, and Retail Execution software provide real-time insights, improve outlet coverage, and strengthen secondary sales tracking, all of which drive sustainable growth and profitability.

Ready to scale your FMCG brand efficiently and profitably? Book a demo with the Delta Sales App today and see how our all-in-one platform can help you optimize resources, improve visibility, and grow without burning cash.