Why Syncing Your SFA with Accounting Software is a Game Changer

Running your sales and finance teams on separate systems creates friction. Your sales reps celebrate a closed deal in Salesforce, but your accounting team must wait for a manual hand-off to generate an invoice. This gap is more than just inefficient; it's a breeding ground for data entry errors, late payments, and a hazy picture of your company's true financial health. You are constantly looking in the rearview mirror rather than seeing the road ahead. A proper accounting integration with Salesforce bridges this gap, resulting in a single, trustworthy source of truth. It automates the flow of information, ensuring that when a deal is won, your books immediately reflect it, giving you the real-time clarity needed to make smarter, faster business decisions.

Syncing your SFA with accounting software closes these gaps, resulting in a seamless workflow that connects sales and finance. This integration is a game changer, allowing businesses to reduce errors, increase cash flow, and make more informed, data-driven decisions.

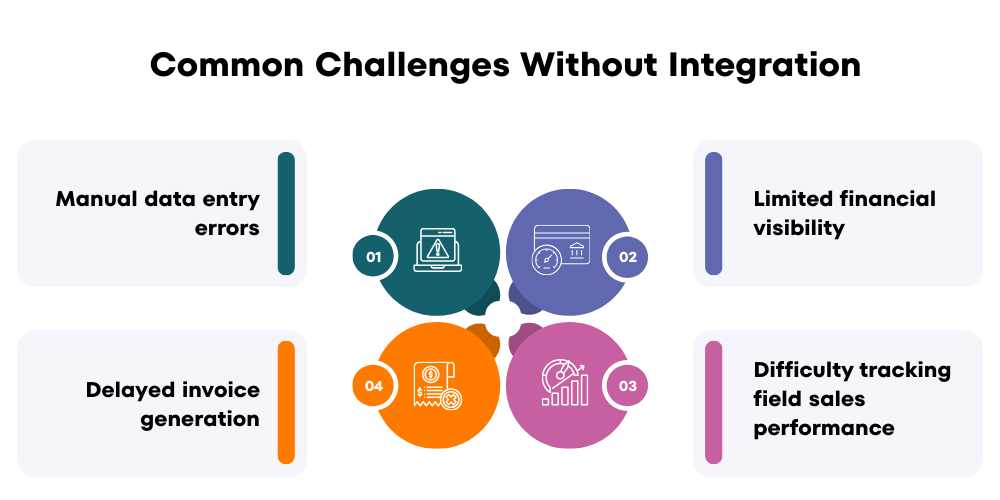

Common Challenges Without Integration

Before integrating systems, organizations often struggle with:

Manual data entry errors

Field sales representatives frequently record orders in the SFA during customer visits, but finance teams must re-enter the data into the accounting system. Every time data is typed twice, there is a chance of error: wrong quantities, incorrect pricing, or misapplied discounts. These errors can result in inaccurate invoices, miscalculated commissions, and dissatisfied customers. Correcting these errors not only takes time but also delays revenue recognition, resulting in unnecessary operational inefficiencies.

Delayed invoice generation

When sales and finance systems are disconnected, creating invoices becomes a manual process that is prone to errors and delays. Any inaccuracies in the data necessitate additional verification, slowing down the billing process. Customers receive invoices late, which in turn delays payments and negatively impacts cash flow. For businesses that rely on timely collections, these delays can create significant financial strain.

Limited financial visibility

Managers frequently use spreadsheets or static reports to analyze revenue, outstanding payments, and overall profitability. Because this data is frequently outdated or incomplete, it can lead to poor decision-making. Leadership may struggle to determine which accounts have outstanding payments, which products are performing well, and which sales territories require attention. This lack of real-time insights impedes strategic planning and may result in missed opportunities.

Difficulty tracking field sales performance

Disconnected systems make it difficult to accurately track field sales performance. Sales representatives may appear productive in the SFA, but if orders are not properly invoiced or payments are not tracked, the true financial impact of their efforts remains unknown. Managers are left with an incomplete picture of revenue and sales efficiency, making it difficult to optimize territories, routes, and customer engagement strategies.

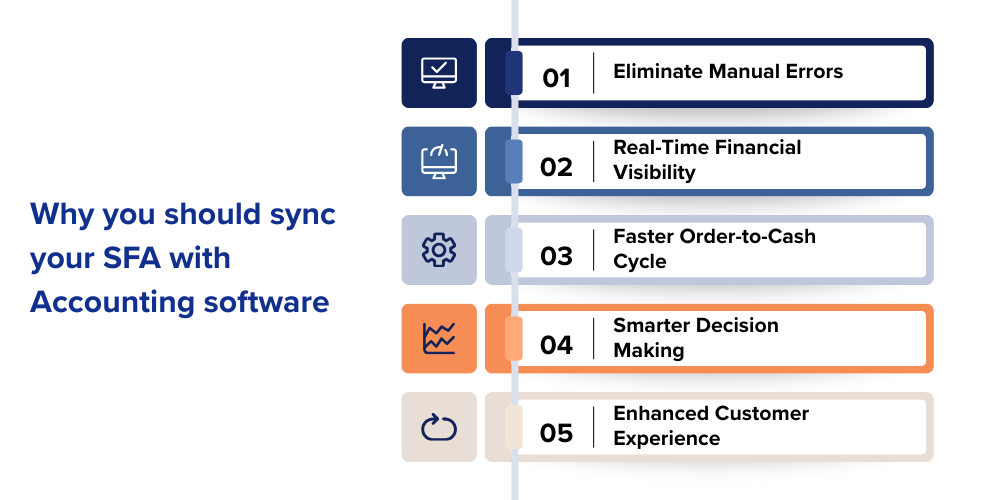

Why You Should Sync Your SFA with Accounting Software

Syncing your SFA with accounting software connects sales activities to financial processes. It ensures that orders, invoices, and payments flow seamlessly between teams, reducing errors, speeding up cash collections, and providing businesses with real-time visibility into revenue and performance.

Eliminate Manual Errors

When sales and accounting systems are not linked, the same data is entered multiple times, which increases the likelihood of errors. Syncing your SFA with accounting software ensures that sales orders, pricing, and customer information flow seamlessly between systems. This reduces invoice errors, incorrect discounts, and commission mismatches, saving time and avoiding revenue loss.

Real-Time Financial Visibility

Integration provides sales and finance teams with instant access to current financial data. Managers can view outstanding invoices, revenue by territory, and payment status in real time rather than relying on out-of-date spreadsheets. This visibility enables teams to respond quickly to pending collections and make informed financial decisions.

Faster Order-to-Cash Cycle

A synchronized SFA and accounting system speeds up the entire process, from order placement to payment collection. Orders captured in the field generate automatic invoices and payment tracking, reducing delays. This faster order-to-cash cycle boosts cash flow and ensures revenue realization sooner.

Smarter Decision Making

Businesses benefit from having sales and financial data combined in one system, which provides a single source of truth. Managers can assess profitability by customer, product, or territory and adjust their strategies accordingly. Accurate, real-time insights enable more timely, data-driven decisions that align sales efforts with business objectives.

Enhanced Customer Experience

When systems are synchronized, customers benefit from faster order processing, more accurate invoices, and fewer billing issues. Sales representatives have instant access to payment history and order details, allowing them to quickly resolve queries. This smoother experience fosters trust, increases satisfaction, and encourages repeat business.

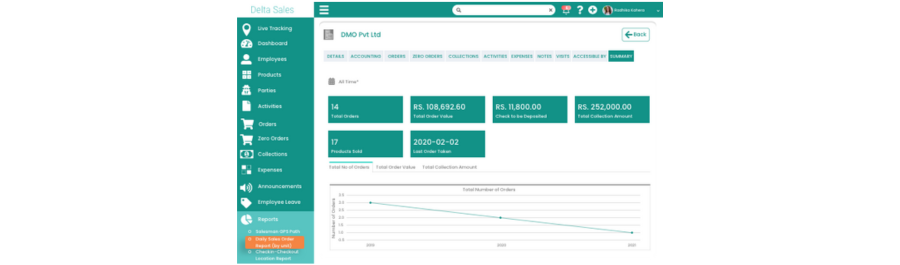

How Delta Sales App Solves This

DeltaSales App bridges the gap between field sales and finance, allowing both teams to collaborate seamlessly with accurate, real-time data. Here is how it accomplishes this:

Real-time sync between SFA and accounting software

DeltaSales ensures that all orders captured in the field are immediately synced with your accounting system. This eliminates manual data entry, reduces errors, and ensures that finance teams have the most current information for invoicing and reporting.

Automated reporting for orders, invoices, and payments

The app generates automatic reports on sales orders, invoices, and payment status. This saves time, improves accuracy, and gives sales and finance teams immediate visibility into revenue, pending payments, and collections performance.

Analytics dashboards for smarter decisions

DeltaSales offers simple dashboards that combine sales and financial data in one view. Managers can monitor territory performance, profitability, and customer trends to make data-driven decisions that increase efficiency and revenue.

Mobile access for field reps

Field sales teams can access all relevant information on the go, including pending invoices and customer history. Mobile access enables reps to make informed decisions during visits, follow up on unpaid orders promptly, and improve overall customer service.

Tips For Businesses Considering Integration

To get the most value from syncing your SFA with accounting software, focus on three key strategies that ensure smooth adoption and measurable results:

Choose compatible software

Before integrating your SFA with accounting software, make sure the two systems are fully compatible. Compatibility ensures that data flows smoothly between sales and finance, reducing errors, delays, and additional manual work. Choosing the right software from the start ensures a smooth, efficient integration.

Train field teams

Even the best integration will not produce results if your sales team does not understand how to use it properly. Provide proper training so that field representatives understand how synced features work, how to access real-time data, and how to act on system insights. Well-trained teams maximize the benefits of your integration.

Monitor ROI

Dashboards and reports can help you track the impact of your integrations. Measure cash flow improvements, manual labor reductions, faster invoicing, and team productivity. Monitoring ROI allows you to better understand the value of the integration, identify areas for improvement, and ensure that your investment is producing measurable business results.

How To Measure Your Integration’s Success

The impact of syncing your SFA with accounting software is measured in sales, finance, and operations. When manual work is reduced, invoices are generated faster, data accuracy improves, and managers have real-time visibility into revenue and performance, the integration provides real business value rather than just system connectivity.

Reduced Manual Work

A successful integration significantly reduces the amount of time sales and finance teams spend doing manual data entry and reconciliation. Orders, invoices, and payment details are automatically transferred between systems, allowing teams to focus on selling, analysis, and strategic tasks rather than administrative tasks.Faster Invoice and Payment Cycles

When sales data syncs with accounting software immediately, invoices are generated without delay. Shorter billing cycles and faster customer payments show that the integration is increasing cash flow and revenue realization.Improved Data Accuracy

Fewer invoice disputes, pricing mismatches, and commission errors indicate that sales and accounting systems are in sync. Accurate, consistent data across both teams fosters internal trust while reducing time spent correcting errors.Real-Time Visibility for Managers

A successful integration generates live dashboards for sales performance, outstanding invoices, and revenue trends. Managers can make faster, more informed decisions because the sales and finance teams use the same real-time data.Higher Team Productivity

Sales representatives spend less time tracking down payment updates, and finance teams spend less time resolving sales data issues. This increased focus across teams results in higher productivity and overall operation efficiency.

Conclusion

Integrating Sales Force Automation (SFA) with accounting software is no longer a technical upgrade; it is a business-critical strategy for today's field sales teams. Integrating your SFA with accounting software transforms the way field sales teams operate. Businesses that sync orders, invoices, and payments in real time reduce errors, increase cash flow, and gain actionable insights to make better decisions.

DeltaSales App provides businesses with a seamless connection between sales and finance, allowing field teams to access mobile data, automate reporting, create analytics dashboards, and sync in real time. The end result is smarter operations, faster cash flow, and measurable ROI for your sales and finance departments.

Ready to increase productivity and revenue? Discover the power of real-time integration with the Delta Sales App today.